U.S. FEDERAL FUNDS RATE 1.25 - 1.5%

U.S. FRB - Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Gains in employment, household spending, and business fixed investment have been solid, and the unemployment rate has stayed low. On a 12-month basis, both overall inflation and inflation for items other than food and energy have continued to run below 2 percent. Market-based measures of inflation compensation have increased in recent months but remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

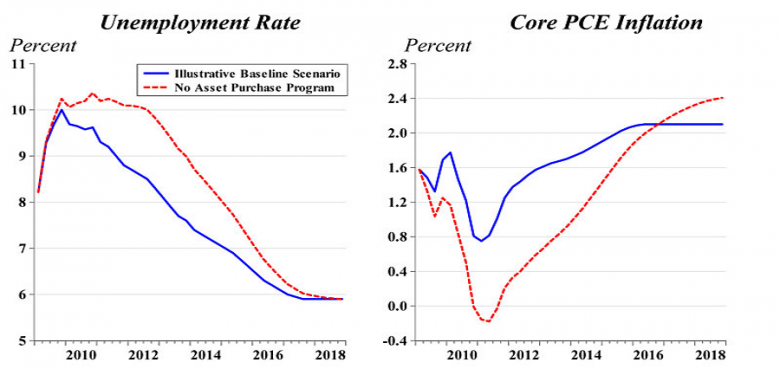

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12‑month basis is expected to move up this year and to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

-----

Earlier:

2018, January, 31, 11:05:00

U.S. - RUSSIA SANCTIONS ANEWREUTERS - U.S. Secretary of State Rex Tillerson said in Warsaw on Saturday that the United States sees Nord Stream 2 as a threat to Europe’s energy security.

|

2018, January, 31, 11:00:00

U.S. - RUSSIA SANCTIONSU.S.DT - The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) today designated 21 individuals and 9 entities under four Executive Orders (E.O.s) related to Russia and Ukraine, including three individuals and two entities related to Russia’s transfer of four turbines made by a Russian-German joint venture to Crimea.

|

2018, January, 31, 10:30:00

RUSSIAN GAS TO U.S.BLOOMBERG - The Gaselys carries liquefied natural gas originally produced in Siberia, according to vessel tracking data. The ship, poised to dock at Engie SA’s Everett import terminal, would be the first LNG shipment from anywhere other than Trinidad and Tobago in about three years.

|

2018, January, 29, 08:20:00

U.S. GDP UP 2.6%BEA - Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2017 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.

|

2018, January, 19, 12:25:00

U.S. SECURITIES INFLOW $33.8 BLNU.S.DT - The sum total in November of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a monthly net TIC inflow of $33.8 billion. Of this, net foreign private inflows were $49.7 billion, and net foreign official outflows were $15.9 billion.

|

2018, January, 19, 12:20:00

U.S. INDUSTRIAL PRODUCTION UP 0.9%U.S. FRB - Industrial production rose 0.9 percent in December even though manufacturing output only edged up 0.1 percent. Revisions to mining and utilities altered the pattern of growth for October and November, but the level of the overall index in November was little changed. For the fourth quarter as a whole, total industrial production jumped 8.2 percent at an annual rate after being held down in the third quarter by Hurricanes Harvey and Irma. At 107.5 percent of its 2012 average, the index has increased 3.6 percent since December 2016 for its largest calendar-year gain since 2010.

|

2018, January, 15, 10:00:00

FOSSIL FUELS DIVESTMENT $5 BLNRBF - New York City Mayor Bill de Blasio and Comptroller Scott Stringer announced plans to divest the city’s five pension funds of approximately $5 billion in fossil fuel investments in an effort to safeguard the retirement plans of the city’s employees from the threat of underperforming assets. The total size of the retirement funds, $189 billion, makes New York City the largest American municipality to divest to date. |