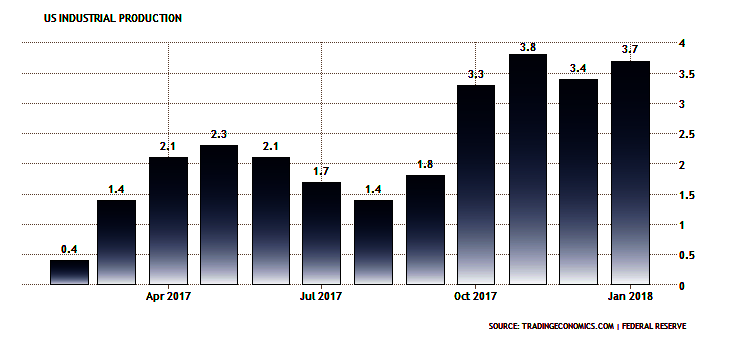

U.S. INDUSTRIAL PRODUCTION DOWN 0.1%

FRB - Industrial production edged down 0.1 percent in January following four consecutive monthly increases. Manufacturing production was unchanged in January. Mining output fell 1.0 percent, with all of its major component industries recording declines, while the index for utilities moved up 0.6 percent. At 107.2 percent of its 2012 average, total industrial production was 3.7 percent higher in January than it was a year earlier. Capacity utilization for the industrial sector fell 0.2 percentage point in January to 77.5 percent, a rate that is 2.3 percentage points below its long-run (1972–2017) average.

Market Groups

In January, the output of consumer goods moved up 0.3 percent; much of the gain reflected an increase of 1.0 percent for consumer energy products. The output of durable consumer goods rose about 1/2 percent, while the output of non-energy nondurables was unchanged. Business equipment registered a gain of 0.9 percent mostly as a result of advances of 1.0 percent or more posted by information processing equipment and by industrial and other equipment. The index for defense and space equipment slipped 0.2 percent after having increased in six of the previous seven months. The output of construction supplies dropped 1.4 percent, while the index for business supplies fell back 0.2 percent. The production of materials moved down 0.3 percent, with consumer parts and paper materials posting drops that were greater than 1 percent.

Industry Groups

Manufacturing output was unchanged in January for a second consecutive month; the index has increased 1.8 percent over the past 12 months. Major manufacturing industries recorded a broad mix of gains and losses in January. The production of durables moved up 0.2 percent, and the index for nondurables was unchanged. The output of other manufacturing (publishing and logging) fell 1.4 percent.

In January, the output of mining declined 1.0 percent for a second consecutive monthly loss. Even so, the mining index for January was 8.8 percent higher than its year-earlier level because of strength in the oil and natural gas sector.

Capacity utilization for manufacturing was unchanged in January at 76.2 percent, a rate that is 2.1 percentage points below its long-run average. The operating rate for durables, at 76.1 percent, was less than 1 percentage point below its long-run average, whereas the rates for nondurables and for other manufacturing (publishing and logging), at 77.4 percent and 60.1 percent, respectively, were further below their long-run averages of about 80 percent for each. Utilization for mining fell 1.4 percentage points to 84.2 percent, but the rate for utilities rose 0.3 percentage point to 81.1 percent. Capacity utilization rates for both mining and utilities remained below their long-run averages.

Note: Preliminary Estimates of Industrial Capacity

The data in this release include preliminary estimates of industrial capacity for 2018. Measured from fourth quarter to fourth quarter, total industrial capacity is projected to rise 2.3 percent this year after increasing 1.1 percent in 2017. Manufacturing capacity is expected to advance 1.5 percent in 2018, somewhat faster than the 0.7 percent pace in 2017. Capacity in the mining sector is estimated to rise 6.3 percent in 2018 following a smaller increase of 2.7 percent in 2017. Capacity at electric and natural gas utilities is projected to increase 2.5 percent in 2018 after moving up 0.7 percent in 2017.

-----

Earlier:

2018, February, 14, 09:45:00

U.S. NUCLEAR WILL UPWNN - The USA has extended production tax credits for advanced nuclear power plants under a budget bill signed into law by President Donald Trump. The nuclear production tax credit is seen as an essential component for the completion of US plants already under construction and for first-of-a-kind small modular reactor (SMR) construction.

|

2018, February, 14, 09:30:00

U.S. OIL +110 TBD, GAS + 832 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 110,000 b/d month-over-month in March to 6,756 million b/d, gas production to increase 832 million cubic feet/day to 64,941 million cubic feet/day .

|

2018, February, 12, 07:25:00

U.S. SALES 100 MBPLATTS - Congress early Friday approved a two-year budget agreement which mandates the sale of 100 million barrels of crude oil from the Strategic Petroleum Reserve within a decade and authorizes sales of another $350 million of government-owned crude this fiscal year.

|

2018, February, 7, 07:40:00

U.S. DEFICIT UP TO $53.1 BLNBEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $53.1 billion in December, up $2.7 billion from $50.4 billion in November, revised. December exports were $203.4 billion, $3.5 billion more than November exports. December imports were $256.5 billion, $6.2 billion more than November imports.

|

2018, February, 2, 12:10:00

U.S. FEDERAL FUNDS RATE 1.25 - 1.5%U.S. FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

|

2018, January, 29, 08:40:00

U.S. PETROLEUM DELIVERIES: 20.7 MBDAPI - Total petroleum deliveries in December rose to 20.7 million barrels per day. This was the strongest December monthly demand in the last decade.

|

2018, January, 29, 08:20:00

U.S. GDP UP 2.6%BEA - Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2017 (table 1), according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent. |