GLOBAL TIGHT OIL INVESTMENT

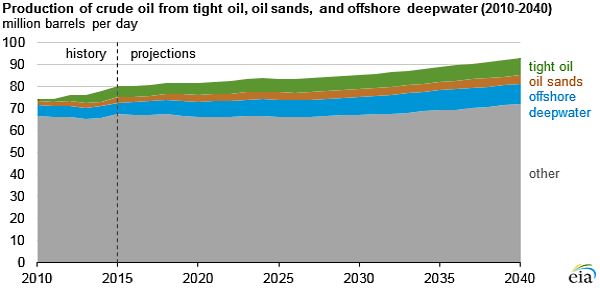

EIA - Upstream investment in crude oil and liquids production is highly sensitive to crude oil prices, particularly production of higher-cost resources from tight rock formations, oil sands, and offshore deepwater. Increasing crude oil prices lead to more investment, driving production growth in these higher-cost resources. By 2040, EIA projects that the combined production from tight oil, oil sands, and offshore deepwater will reach 21 million barrels per day (b/d) and will account for almost a quarter of the world's total crude oil production.

From 2010 to 2014, global investment in tight oil, oil sands, and offshore deepwater development increased from 20% to 30% of total upstream investment. Over that same period, combined production from these resources increased by 4 million b/d, reaching 12.2 million b/d and accounting for 16% of total global crude oil production. Following the decline in crude oil prices in 2014–2015, global upstream investment in these resources decreased from $280 billion in 2014 to $126 billion dollars in 2016.

Brent global benchmark crude oil price will increase throughout the projection period but will remain lower than prices during 2010–2014 in real dollar terms. For this reason, future investment growth in higher-cost resources is expected to be lower than in recent history. Global production of tight oil will increase by 3.3 million b/d, offshore deepwater by 2.7 million b/d, and oil sands by 1.4 million b/d between 2017 and 2040. Total production increases from these sources makes up nearly half of the long-term global liquids supply growth through 2040.

EIA expects a large share of global upstream capital investment to be concentrated in tight oil resources in the United States. Tight oil projects in the United States tend to have shorter payback periods because of lower service costs, high operator efficiency, exploitable resources that can be accessed through new technological advances, and a stable regulatory framework.

IEO2017 projects that investment in tight oil plays outside of the United States will be lower than investment in plays in the United States through 2025. Development of tight oil can be hindered by a lack of infrastructure and of experience in developing tight oil resources and by competing oil resources that can be produced at a lower cost than tight oil. After 2030, as oil prices continue to increase, more investment in these resources is expected to result in increased production.

Total global investment in the development of new offshore deepwater and oil sands projects to be limited through 2027. These resources are generally more expensive to develop, take longer to reach full production, and require additional infrastructure, which limits investment in projects other than those already in development. However, higher or lower oil prices would likely affect the allocation and distribution of upstream investments across various resource types and their geographic locations.

-----

Earlier:

2018, March, 7, 14:25:00

OIL NEED $20 TLNSAUDI ARAMCO - our industry needs more than 20 trillion dollars over the next quarter century to meet rising demand for oil and gas (including in ageing infrastructure).

|

2018, February, 16, 23:20:00

ADNOC INVESTMENT $109 BLNAOG - ADNOC announced that it has launched the implementation phase of its new in-country value (ICV) strategy, aimed at increasing the company’s ICV contribution and strengthening its relationship with the UAE’s private sector.

|

2018, February, 7, 08:15:00

GAZPROM'S ANNUAL INVESTMENT: $17.5 BLNREUTERS - Gazprom expects its average annual investment until 2035 to be capped at 1 trillion rubles ($17.5 billion).

|

2018, February, 5, 07:42:00

MEXICO'S OIL INVESTMENT $100 BLNFT - Mexico secured almost $100bn in investment in its most successful oil tender to date as Anglo-Dutch oil major Royal Dutch Shell positioned itself as the biggest player in deepwater exploration and new companies including Qatar Petroleum burst on to the scene.

|

2018, January, 15, 10:00:00

FOSSIL FUELS DIVESTMENT $5 BLNRBF - New York City Mayor Bill de Blasio and Comptroller Scott Stringer announced plans to divest the city’s five pension funds of approximately $5 billion in fossil fuel investments in an effort to safeguard the retirement plans of the city’s employees from the threat of underperforming assets. The total size of the retirement funds, $189 billion, makes New York City the largest American municipality to divest to date.

|

2017, December, 27, 12:15:00

INDONESIA'S INVESTMENT UP BY 21%PLATTS - Indonesia's state-owned Pertamina plans to spend $3.324 billion on its upstream business in 2018, a 21.16% jump year on year.

|

2017, December, 13, 12:15:00

WBG: NO OIL&GAS FINANCEWBG - The World Bank Group will no longer finance upstream oil and gas, after 2019. |