OIL NEED $20 TLN

SAUDI ARAMCO - "Lifting the hood on the real future facing the petroleum industry"

HOUSTON, Texas, U.S., March 06, 2018

Remarks by Amin H. Nasser, Saudi Aramco President & CEO

Good morning Ladies and Gentlemen, and thank you Dan [Yergin] for that kind introduction.

Like all CEOs, I receive many invitations to address conferences.

Naturally, the first thing I ask is: "How will this help Saudi Aramco?"

The second is: "How will this help our industry?"

And the third is: "Will Dan Yergin be involved?!"

So CERA Week in Houston really hits the trifecta!!!

Let me also thank Dan for reminding us of that historic breakthrough 80 years ago this week.

It was only possible because of an incredible partnership between American geologist Max Steineke and his Bedouin guide, Khamis ibn Rimthan.

They always seemed to know where to go next, and what it would take to get there.

So this morning I want to be clear about what really lies ahead for our industry, and the actions we must take to secure that future.

Market Overview

Before that, let me briefly address the current oil market situation that is on everyone's mind.

Despite significant price volatility, with many forecasts of rising shale oil production, we remain confident that market fundamentals are healthy.

And despite recent volatility in the financial markets, the broad-based recovery in the global economy remains on track.

It is particularly encouraging to see expectations of stronger economic growth in the emerging and developing world because that is where most oil demand growth is expected to be.

Oil demand globally also remains healthy.

Major oil producers continue to show exceptional production restraint, while spare capacity is tight, and there are multiple downside geopolitical risks to supply.

So I am not unduly concerned about the recent volatility and expect the market to strengthen once the seasonal factors begin to fade.

Future Role of Oil

Let me now turn to the energy transition underway.

I am increasingly worried that it is being portrayed in ways that seriously threaten future energy security and the transition itself.

In particular, the future role of oil is widely misunderstood, and I want to tell the real, compelling story today.

Future Role of Oil: Transport

The hot topic in energy transition is the future role of oil in transport.

At the heart of it is the light duty road passenger vehicles segment that accounts for about 20% of global oil demand today.

Many wrongly believe that it is a simple matter of electric vehicles quickly and smoothly replacing the internal combustion engine.

Nor is it an "either/or" future, but far more complex.

Five Competing Technology Horses

In fact, there are five strong technology horses racing each other to become the powertrain of the future – advanced Internal Combustion engines; Hybrid Electric Vehicles (Both Series and Parallel); Plug-in Hybrid Vehicles; Pure Battery Electric Vehicles; and Hydrogen Fuel Cell Vehicles.

The first three are powered by an internal combustion engine.

And let us not forget that more than 99% of the passenger vehicles on the road today have an internal combustion engine and will be with us for a long time.

In fact, some of the most disruptive technologies are only just emerging, including highly advanced integrated engine-fuel systems like the ones our researchers are working hard on at Saudi Aramco in collaboration with car and truck engine manufacturers.

So, given the world's focus on climate change, there should be a global priority on improving the efficiency and lowering carbon emissions from internal combustion engines as well as fuels.

Especially when the other two horses in the race – Pure Battery Electric Vehicles and Hydrogen Fuel Cell Vehicles – still face a range of problems.

For example, battery electric vehicles will not deliver rapid and economical reductions in carbon emissions until the electricity fuel mix becomes sufficiently clean.

Even 25 years from now, coal will still comprise up to half that mix in vast markets like China and India.

Right now, with battery electric vehicles we are simply moving emissions from tailpipe to smoke stack.

Meanwhile, hydrogen fuel cell vehicles are very promising and may turn out to be the silver bullet for electrification challenges in terms of driving range, charging time, and charging infrastructure.

But they also face major challenges involving cost, durability, reliability, onboard hydrogen storage, safety, and public acceptance.

So the powertrain mix of the future is far from decided, and competition is real.

Large-Scale Deployment Challenges

There are also major hurdles before alternatives can be deployed at scale.

Affordability is one, as customers continue to place great importance on up-front costs, especially in developing nations.

Another is that it will become increasingly difficult for governments to subsidize such enormous numbers, although this is often glossed over.

And it will require massive infrastructure, which is particularly challenging in developing nations as they are least well-equipped and can least afford this in the face of other economic and social priorities.

Yet the majority of vehicle growth will be in those very same nations.

Other Macro Factors

Further adding to the complexity will be the extra two billion people on the planet by 2050.

A world economy three times its current size.

And a global middle class that will reach five billion by 2030 – with two-thirds of it in Asia driving consumption.

These macro factors will only grow demand for road passenger transport!

So, yes, battery electric vehicles will grow and have a welcome role to play in global mobility.

But given the competition and complexity of the transition, their impact on the 20% oil demand should not be exaggerated.

Future Role of Oil: Other Existing Sectors

And that still leaves the other 80%, where oil demand continues to grow.

In petrochemicals alone, oil use is expected to increase by almost 50%, while the number of air passengers each year is expected to almost double to 8 billion over the coming two decades.

Future Role of Oil: Non-Combustible / New Uses of Oil

And what about new outlets for our products?

I believe there are even more innovative ways to monetize each barrel, particularly in non-combustible and new uses.

For example, Saudi Aramco recently signed an agreement centered on a potential breakthrough technology that will directly convert up to 70 percent of a barrel of crude into petrochemicals.

This could transform the role of oil as a major petrochemical feedstock, substantially lighten the carbon footprint of oil consumption because of its non-combustible nature, and reduce costs by 30 percent.

And become a large and reliable outlet for our future oil production.

I also see huge potential in producing advanced materials for use in a wide range of high growth industries.

Just imagine a future where skyscrapers, cars (including electric ones!), and even our own pipelines are built with these advanced oil-based materials.

Looking further ahead, if we combine hydrogen from oil with carbon capture, utilization, and storage then green hydrogen comes within reach – not only for transport but also power and heat.

Summary of Real Energy Transition

My friends, this is the complex reality of the energy transition:

- alternatives will not be ready to shoulder the burden of supplying adequate and affordable energy for some time;

- penetration by alternatives will vary greatly between the developing and developed world;

- there will be fierce competition among various technologies.

- By contrast, there will be continued healthy demand for oil in most existing sectors;

- investment in R&D and innovation by individual companies will further lighten the carbon footprint of proven energy sources and technologies, boosted by collaborative efforts such as the 1 billion dollars of climate-related investments through the Oil and Gas Climate Initiative;

- and we will see many non-combustible and new uses of oil.

In other words, I am not losing any sleep over 'peak oil demandʼ or 'stranded resourcesʼ.

Oil and gas will continue to play a major role in a world where all energy sources will be required for the foreseeable future.

Call to Action: Getting the Industry Ready for that Future

But is the world ready for continued growth in oil and gas demand?

Frankly, that readiness is weakening day by day – fueled by irrational hopes of rapid switching, and a lack of realism about the valuable, long-term contribution our industry will make.

So as an industry, we need to move people from fasting on hope to feasting on reality.

We need to massively raise our game, and make a compelling case about oil's true role in the energy transition.

In particular, I believe we need bold action now in four key areas to ensure that those growing calls on our industry continue to be met.

First, we need to expand exploration.

Last year, only 7 billion barrels equivalent of oil and gas combined were discovered, which is among the lowest on record.

Second, we must not only meet the growth in oil demand but also offset a large natural decline in developed oil fields.

Even conservative estimates suggest about 20 million barrels per day of new capacity is required over the next five years.

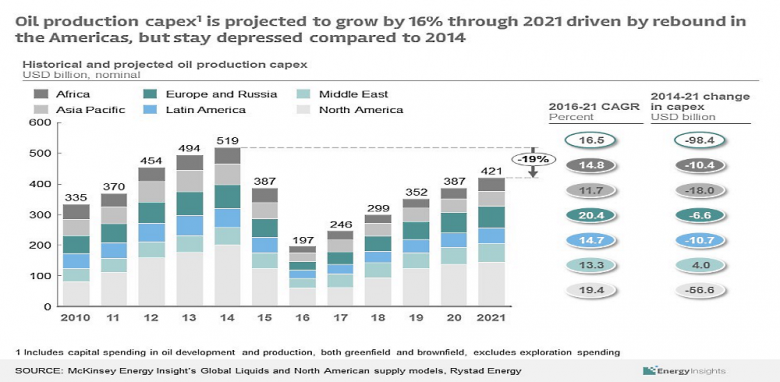

Third, our industry needs more than 20 trillion dollars over the next quarter century to meet rising demand for oil and gas (including in ageing infrastructure).

That is virtually the size of the U.S. economy!

And we have already lost 1 trillion dollars of investments since the downturn.

This staggering amount will only come if investors are convinced that oil will be allowed to compete on a level playing field, that oil is worth so much more, and that oil is here for the foreseeable future.

That is why we must push back on the idea that the world can do without proven and reliable sources.

We must challenge mistaken assumptions about the speed with which alternatives will penetrate markets.

And leave people in no doubt that misplaced notions of 'peak oil demandʼ and 'stranded resourcesʼ are direct threats to an orderly energy transition and energy security.

We also need an environment that encourages long-term investments, as we are seeing here in the United States, and in Saudi Arabia with our ambitious Vision 2030.

Fourth, we need to intensify our efforts to both enhance current technologies as well as create new, game-changing ones.

That requires us to devote more resources to longer term research, particularly low-to-no carbon products.

And it means regulators must be policy holistic and technology agnostic – let the market decide.

Saudi Aramco Response

At Saudi Aramco, we are addressing all four issues in our long-term strategy.

I will talk more about our performance, and our long-term plans for growth and value creation in the Q&A with Dan.

Ladies and Gentlemen, I hope that has lifted the hood on the real future facing our industry.

An industry at the heart of the much larger global economy that continues to reliably meet the energy demands of billions of people for decades to come, helping to meet society's lower carbon goals, and remaining at the cutting edge of technology.

Yes, we face huge challenges to get there.

But ours is the industry of Spindletop and Shale, of Manifa and Ghawar, of Steineke and Khamis.

As they knew 80 years ago, and as Americans and Saudis know today, going the extra mile together when others are starting to write us off is the best way of making our own history.

Thank you very much, and I wish you a great CERA Week ahead.

-----

Earlier:

2018, February, 16, 23:35:00

ФУНДАМЕНТАЛЬНЫЕ ПРЕОБРАЗОВАНИЯ РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак поделился своим видением будущего углеводородной энергетики: «Она обладает огромным потенциалом цифровизации своих процессов, гибкой подстройки под нужды потребителей. Доля углеводородов, безусловно, будет снижаться, но с учетом роста населения, автопарка, спроса на энергию, абсолютное потребление продолжит расти. Если мы хотим надежно обеспечить мир энергией, нам придется найти разумный баланс между традиционной и новой энергетикой».

|

2018, February, 5, 07:45:00

EXXON ENERGY OUTLOOK - 2040EXXONMOBIL - Despite efficiency gains, global energy demand will likely increase nearly 25 percent. Nearly all growth will be in non-OECD countries (e.g. China, India), where demand will likely increase about 40 percent, or about the same amount of energy used in the Americas today.

|

2018, January, 26, 12:35:00

СПРОС НА НЕФТЬ: 100 МЛН.МИНЭНЕРГО РОССИИ - «На сегодня 100 млн баррелей в сутки - общемировой спрос на нефть, а сланцевая нефть- это всего 5,7 млн барр в сутки. Это лишь один из способов удовлетворения спроса рынка».

|

2018, January, 26, 12:30:00

РЫНОК БУДЕТ СБАЛАНСИРОВАНМИНЭНЕРГО РОССИИ - «Надеюсь, что к концу 2018 года рынок сбалансируется. Действия ОПЕК+ показали, что в будущем мы можем применять подобные механизмы. При этом мы настроены не только продолжать сотрудничество в рамках сокращения, но и проводить раз в полгода или год совместные консультации стран — участниц сделки с привлечением других государств».

|

2018, January, 12, 13:00:00

ТРАНСФОРМАЦИЯ МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - На энергетическом рынке происходят существенные трансформации, появляются новые технологии, что в итоге приводит к изменению энергобаланса. В частности, за последние 10 лет добыча газа в мире выросла на 20% -- до 580 млрд м3, его доля в энергобалансе расширилась с 21 до 22%. При этом мировая торговля газом за тот же период увеличилась на 42%, или на 313 млрд м3.

|

2017, December, 15, 12:55:00

NUCLEAR - 2050: 25%WNN - According to the Foratom statement, World Nuclear Association Director General Agneta Rising said: "By 2050, nuclear energy must account for 25% of energy generation if we are to meet our climate targets. With nuclear making up 11% of generation in 2014, an extra 1000 GWe in nuclear capacity will need to be built by 2050. However, meeting this goal will not be easy."

|

2017, November, 27, 20:10:00

БОЛЬШИЕ ВОЗМОЖНОСТИ РОССИИМИНЭНЕРГО РОССИИ - «Совместно мы занимаем более 60% рынка газа. Наши общие запасы по последним оценкам составляют 70% от общемировых. По прогнозам к 2040 году глобальные потребности в газе увеличатся на почти на 60%, и данный показатель может быть еще пересмотрен в большую сторону, основываясь на глобальной климатической повестке». |