OIL PRICES 2018 - 19: $62

EIA - SHORT-TERM ENERGY OUTLOOK

Prices

North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI contract values for May 2018 delivery traded during the five-day period ending March 1, 2018, suggest a range of $51/b to $76/b encompasses the market expectation for June 2018 WTI prices at the 95% confidence level.

In February, the U.S. benchmark Henry Hub natural gas spot price averaged $2.66 per million British thermal units (MMBtu), down $1.03/MMBtu from January. Winter weather moderated in February after extremely cold temperatures in much of the country during the first half of January. U.S. heating degree days were an estimated 17% lower than the 10-year average for February, which contributed to lower consumption and prices.

EIA expects natural gas prices to moderate in the coming months, based on a forecast of record natural gas production levels. EIA expects Henry Hub spot prices to average $2.72/MMBtu in March and $2.99/MMBtu for all of 2018. In 2019, EIA forecasts prices will average $3.07/MMBtu. NYMEX contract values for June 2018 delivery that traded during the five-day period ending March 1, 2018, suggest that a range of $2.16/MMBtu to $3.49/MMBtu encompasses the market expectation for June Henry Hub natural gas prices at the 95% confidence level.

Global Liquid Fuels

North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI contract values for May 2018 delivery traded during the five-day period ending March 1, 2018, suggest a range of $51/b to $76/b encompasses the market expectation for June 2018 WTI prices at the 95% confidence level.

EIA estimates that U.S. crude oil production averaged 10.3 million barrels per day (b/d) in February, up 230,000 b/d from the January level, when there were some well freeze-offs in the Permian and Bakken. EIA has reported that total U.S. crude oil production averaged 9.3 million b/d in 2017, ending the year with production of 9.9 million b/d in December. EIA projects that U.S. crude oil production will average 10.7 million b/d in 2018, which would mark the highest annual average U.S. crude oil production level, surpassing the previous record of 9.6 million b/d set in 1970. EIA forecasts that 2019 crude oil production will average 11.3 million b/d.

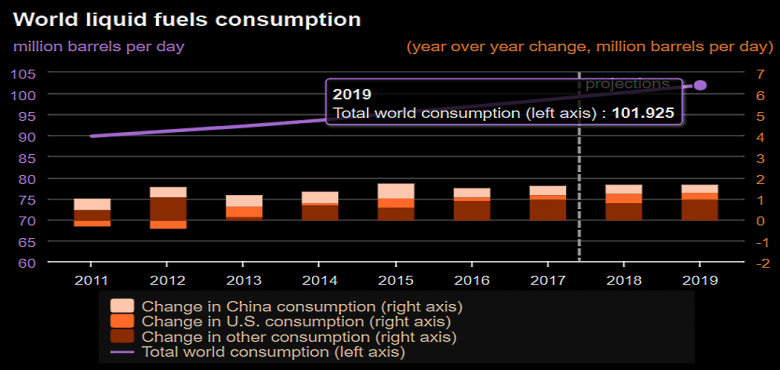

EIA estimates that inventories of global petroleum and other liquid fuels declined by 0.6 million b/d in 2017. In this forecast, global inventories grow by about 0.4 million b/d in 2018 and by another 0.3 million b/d in 2019.

Natural Gas

EIA estimates that U.S. dry natural gas production averaged 73.6 billion cubic feet per day (Bcf/d) in 2017. EIA forecasts that natural gas production will average 81.7 Bcf/d in 2018, establishing a new record. That level would be 8.1 Bcf/d higher than the 2017 level and the highest annual average growth on record. EIA expects natural gas production will also increase in 2019, with forecast growth of 1.0 Bcf/d.

In February, the U.S. benchmark Henry Hub natural gas spot price averaged $2.66 per million British thermal units (MMBtu), down $1.03/MMBtu from January. Winter weather moderated in February after extremely cold temperatures in much of the country during the first half of January. U.S. heating degree days were an estimated 17% lower than the 10-year average for February, which contributed to lower consumption and prices.

EIA expects natural gas prices to moderate in the coming months, based on a forecast of record natural gas production levels. EIA expects Henry Hub spot prices to average $2.72/MMBtu in March and $2.99/MMBtu for all of 2018. In 2019, EIA forecasts prices will average $3.07/MMBtu. NYMEX contract values for June 2018 delivery that traded during the five-day period ending March 1, 2018, suggest that a range of $2.16/MMBtu to $3.49/MMBtu encompasses the market expectation for June Henry Hub natural gas prices at the 95% confidence level.

-----

Earlier:

2018, March, 4, 11:15:00

U.S. GAS WILL UP BY 40%EIA - EIA expects a 40% increase in natural gas consumed in the U.S. industrial sector, from 9.8 quadrillion British thermal units (Btu) in 2017 to 13.7 quadrillion Btu in 2050.

|

2018, February, 27, 13:45:00

GLOBAL LNG DEMAND UP TO 293 MTSHELL - The global liquefied natural gas (LNG) market has continued to defy expectations of many market observers, with demand growing by 29 million tonnes to 293 million tonnes in 2017, according to Shell’s annual LNG Outlook. Such strong growth in demand is consistent with Shell’s first LNG Outlook, published in 2017. Based on current demand projections, Shell sees potential for a supply shortage developing in mid-2020s, unless new LNG production project commitments are made soon.

|

2018, February, 16, 23:35:00

ФУНДАМЕНТАЛЬНЫЕ ПРЕОБРАЗОВАНИЯ РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак поделился своим видением будущего углеводородной энергетики: «Она обладает огромным потенциалом цифровизации своих процессов, гибкой подстройки под нужды потребителей. Доля углеводородов, безусловно, будет снижаться, но с учетом роста населения, автопарка, спроса на энергию, абсолютное потребление продолжит расти. Если мы хотим надежно обеспечить мир энергией, нам придется найти разумный баланс между традиционной и новой энергетикой».

|

2018, February, 14, 10:05:00

IEA: OIL DEMAND GROWTH 1.6 MBDIEA - Our demand growth estimate for 2017 remains strong at 1.6 mb/d, reinforced by November data for the US. For 2018, the more positive global economic picture published by the International Monetary Fund is a key factor in raising our growth outlook to 1.4 mb/d. It was thought that the significant increase in the dollar price of crude oil since the middle of 2017 would dampen growth, and this might be the case to some extent, but the impact of higher prices has been partly offset in some countries by currency appreciations.

|

2018, February, 5, 07:45:00

EXXON ENERGY OUTLOOK - 2040EXXONMOBIL - Despite efficiency gains, global energy demand will likely increase nearly 25 percent. Nearly all growth will be in non-OECD countries (e.g. China, India), where demand will likely increase about 40 percent, or about the same amount of energy used in the Americas today.

|

2018, January, 26, 12:35:00

СПРОС НА НЕФТЬ: 100 МЛН.МИНЭНЕРГО РОССИИ - «На сегодня 100 млн баррелей в сутки - общемировой спрос на нефть, а сланцевая нефть- это всего 5,7 млн барр в сутки. Это лишь один из способов удовлетворения спроса рынка».

|

2018, January, 26, 12:30:00

РЫНОК БУДЕТ СБАЛАНСИРОВАНМИНЭНЕРГО РОССИИ - «Надеюсь, что к концу 2018 года рынок сбалансируется. Действия ОПЕК+ показали, что в будущем мы можем применять подобные механизмы. При этом мы настроены не только продолжать сотрудничество в рамках сокращения, но и проводить раз в полгода или год совместные консультации стран — участниц сделки с привлечением других государств». |

-----

Earlier: