OPEC OIL PRICE: $66.85

OPEC - Oil Market Report feb 2018

Crude Oil Price Movements

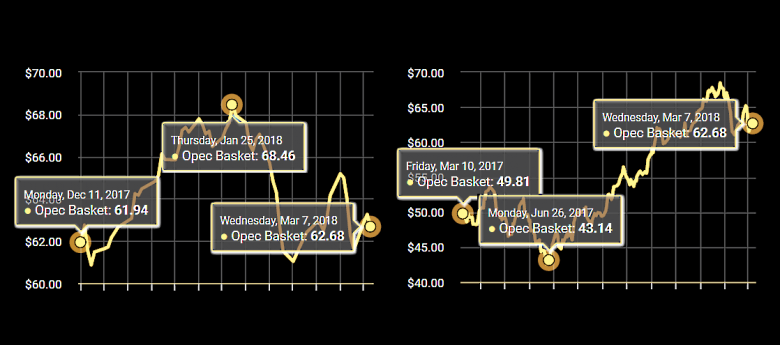

The OPEC Reference Basket increased for the fifth-straight month in January, gaining a sharp 7.7% to average $66.85/b, the highest monthly average since November 2014. Oil prices were supported by continuing efforts by OPEC and participating non-OPEC producers to balance the market and ten consecutive weeks of crude inventory draws amid healthy economic growth and improving oil demand.

ICE Brent was $4.99 higher at $69.08/b in January, while NYMEX WTI surged $5.71 to $63.66/b. The ICE Brent/NYMEX WTI spread narrowed 73¢ to $5.42/b. Hedge funds raised net long positions in ICE Brent and NYMEX WTI to 1.08 million contracts, a new all-time high record. The market structures for Brent, WTI and Dubai are in sustained backwardation. In the first week of February, crude oil futures lost around $6/b from the end of January amid an overall decline in equity markets and a slide in the US dollar as well as stronger-than-expected US supply and a build in US inventories.

World Economy

The global GDP growth forecast was revised up by 0.1 percentage points to 3.8% for both 2017 and 2018, mainly supported by advanced economies. US growth was revised up in 2018 to 2.7%, after growth of 2.3% in 2017. Growth in the Euro-zone was lifted to 2.5% in 2017 and 2.2% in 2018. Japan's growth forecast remains unchanged in both 2017 and 2018 at 1.8% and 1.6%, respectively. While China's 2017 growth was better than expected at 6.9%, the 2018 growth forecast remains unchanged at 6.5%. Also, India's GDP growth forecast remains unchanged at 7.2% in 2018, after growth of 6.5% in 2017.

World Oil Demand

World oil demand growth in 2017 is estimated to increase by 1.60 mb/d, representing an upward adjustment of some 30 tb/d compared to last month's projections, mainly to reflect the continuing better-than-expected data in OECD Europe in 3Q17. Total world oil demand stood at 97.01 mb/d in 2017. In 2018, world oil demand is foreseen to reach 98.60 mb/d, representing growth of 1.59 mb/d, 60 tb/d higher than the previous month's projections and mainly reflecting the positive economic outlook.

World Oil Supply

Non-OPEC supply in 2017 was revised up by 0.07 mb/d, mainly due to an upward revision in the OECD, to average 57.86 mb/d, representing growth of 0.86 mb/d. For 2018, non-OPEC supply forecast was revised up by 0.32 mb/d, to average 59.26 mb/d, representing growth of 1.40 mb/d, which was also revised up by 0.25 mb/d. Expectations for higher production in the US, UK and Brazil, as well as lesser declines in Mexico and China were the main reasons behind the upward adjustment. OPEC NGLs and nonconventional liquids' production averaged 6.31 mb/d in 2017, up by 0.17 mb/d y-o-y. OPEC NGLs are expected to grow by 0.18 mb/d to average 6.49 mb/d in 2018. In January 2018, OPEC crude oil production

decreased by 8 tb/d, according to secondary sources, to average 32.30 mb/d.

Product Markets and Refining Operations

Product markets in the Atlantic Basin showed mixed performance in January as refining margins in the US turned around from the declining trend recorded in the previous month, showing some gains, mainly at the top of the barrel supported by cold weather-related refinery outages. Meanwhile, in Europe, product markets lost some ground with weakening seen at the bottom of the barrel due to supply-side pressure. In Asia, product markets weakened, with losses seen all across the barrel, except for the middle distillate complex, pressured by slower seasonal demand. Due to higher scheduled maintenance in February, product markets in the USGC are expected to receive some support on the back of lower product supplies.

Tanker Market

Dirty tanker spot freight rates experienced a general downward trend in January, which affected vessels of different classes on all reported routes. VLCC, Suezmax and Aframax average spot freight rates declined by 17%, 31% and 13% m-o-m, respectively. The decline was driven by low tonnage demand, limited inquiries and port maintenance as well as a prolonged tonnage list. Similarly, clean tanker spot freight rates were weak, mainly as fixtures to eastern destinations showed lower rates than in the previous month.

Stock Movements

Total OECD commercial oil stocks fell in December to stand at 2,888 mb. At this level, OECD commercial stocks were 109 mb above the latest five-year average. Crude and products stocks indicated a surplus of around 100 mb and 9 mb above the seasonal norm, respectively. In line with the existing overhang, the market is only expected to return to balance towards the end of this year. In terms of days of forward cover, OECD commercial stocks stood at 61.0 days in December, some 1.1 days higher than the latest five-year average.

Balance of Supply and Demand

Demand for OPEC crude in 2017 is estimated to stand at 32.8 mb/d, some 0.6 mb/d higher than the 2016 level. In 2018, demand for OPEC crude is forecast at 32.9 mb/d, slightly higher than the 2017 level.

-----

Earlier:

2018, March, 5, 11:30:00

RESPONSIBILITY TO THE MARKETREUTERS -“We all should look with responsibility to the market in order to keep the balance in the market as much as we can so as not to harm investors,” said Ali Nazar, Iraq’s national representative to OPEC.

|

2018, February, 27, 14:00:00

OPEC - RUSSIA COOPERATIONPLATTS - "I think we are seeing more cooperation, and my hope is that this group of OPEC and non-OPEC will incentivize the adequate investments among themselves to ensure we have adequate supply in the market," he said. "My worry is not an oversupply. My worry is an undersupply. Everyone is expecting that we will have more demand coming in the future."

|

2018, January, 22, 08:40:00

OPEC'S CONSTRUCTIVE ROLEOPEC - HH Sheikh Sabah praised all 24 participating countries, both OPEC and non-OPEC, for their joint efforts towards restoring much needed oil market stability, as well as keeping faith in the collaborative approach which is at the heart of the ‘Declaration of Cooperation’.

|

2017, December, 18, 12:35:00

INEVITABLE OIL CHANGESOPEC - Sustainable oil market stability is crucial to attract the level of investment necessary for future demand growth; In the longer term, oil will remain a vital and integral part of the energy mix; Global energy and oil demand will grow in the long term;

|

2017, December, 11, 09:40:00

OPEC WILL BACK BY 2040“Tight oil supplies are the wild card. They have reshaped the global outlook in recent years,” observed Ayed S. Al-Qahtani, who directs the research division at the OPEC Secretariat in Vienna. “US tight oil supplies will be the most important contributor but are expected to reach their peak around 2025.”

|

2017, December, 2, 18:54:00

OPEC CONFIRMEDOPEC - In agreeing to this decision, Member Countries confirmed their continued focus on a stable and balanced oil market, in the interests of both producers and consumers. Member Countries remain committed to being dependable and reliable suppliers of crude and products to global markets.

|

2017, November, 24, 09:20:00

OPEC WILL REDUCEREUTERS - The Organization of the Petroleum Exporting Countries, non-member Russia and nine other producers agreed to curb oil output by about 1.8 million barrels per day until March 2018. They are expected to extend the deal at a Nov. 30 meeting in Vienna. |