RESPONSIBILITY TO THE MARKET

REUTERS - The oil industry's biggest names gather this week at CERAWeek, the largest energy industry get-together in the Americas, at a time when U.S. shale production is booming, global demand is rising and crude prices are at a sweet spot for both big U.S. producers and OPEC.

Last year's decision by the Organization of the Petroleum Exporting Countries to restrain output has drained the global glut that occupied much of the conversation at 2017's gathering. With oil prices LCOc1 up about 15 percent since oil ministers and top executives convened here last year, fears have receded for a slugfest of OPEC vs. U.S. shale.

Rising prices have U.S. shale producers pumping more, sending total U.S. output to an all-time record above 10 million barrels per day. This year, the United States could surpass Russia as the world's largest oil producer.

OPEC, meanwhile, has shown no signs of moving to produce more, with output from members at a 10-month low. The cartel's leaders have even expressed interest in keeping some production curbs in place through 2019.

Oil ministers and their advisers will use the conference to put shale under a microscope, said Dan Yergin, vice chairman of conference organizer IHS Markit (INFO.O) and a Pulitzer Prize-winning oil historian.

"OPEC is still really struggling to understand:'What is this new oil business called shale?'" said Yergin."This conference is a field trip for OPEC to a different reality in oil."

They have scheduled dinners with shale executives and financiers for the second time in two years, underscoring the maturation of a relationship between big petrostates and a once-upstart industry that weathered OPEC's best efforts to bury it under a supply glut from 2014 to 2016.

Shale has emerged stronger from that period with the Permian Basin, the largest U.S. oilfield, now producing nearly 3 million barrels of oil per day, triple that of 2009. Presentations will look at shale's rising role in global markets and the potential for future North American production and export growth.

"The Permian is just now coming into its own," said Randy Foutch, chief executive officer of shale producer Laredo Petroleum Inc (LPI.N), which plans to boost output 10 percent this year."We no longer have to find oil and gas. We've found it, and will pump it."

OPEC says it wants to encourage moderation by shale companies as well as its own members. Shale firms often use hedges, or financial contracts that lock in a price for future production, to guarantee profits. These contracts protect them should prices slip.

"We all should look with responsibility to the market in order to keep the balance in the market as much as we can so as not to harm investors," said Ali Nazar, Iraq's national representative to OPEC.

OPEC views shale as a monolith rather than a collection of independent companies, and hopes executives will say they will keep U.S. output under 10 million barrels per day. But the organization also recognizes shale producers would be violating U.S. antitrust law if they agreed to collective pricing or output pacts, one OPEC source told Reuters.

The U.S. Energy Information Administration said on Tuesday it expects domestic oil production to surpass 11 million barrels per day late this year.

ELECTRIC CARS & BIG DATA

Global oil industry players are also concerned about threats from renewable energy technologies and rapid changes to the automobile industry. Majors including BP Plc (BP.L) have forecast that gasoline use will decline as electric vehicle usage grows.

General Motors Co (GM.N) Chief Executive Officer Mary Barra, in her first visit to the oil conference, is expected to detail plans by the largest U.S. automaker to launch 20 new electric vehicles by 2023.

Exxon Mobil Corp (XOM.N) and others have said they expect rising petrochemical and aviation fuel demand to offset a drop in demand for liquid fuels such as gasoline.

The oil industry is also funding research into big-data, cloud computing and applying new technology to its operations to cut costs and boost production. In a sign of that convergence, the head of Alphabet Inc's (GOOGL.O) Google Cloud division also will attend the conference.

"The U.S. shale industry has turned out to be amazingly innovative and it's like open-source software, with everyone experimenting and learning from one another," said Yergin.

-----

Earlier:

2018, February, 27, 14:00:00

OPEC - RUSSIA COOPERATIONPLATTS - "I think we are seeing more cooperation, and my hope is that this group of OPEC and non-OPEC will incentivize the adequate investments among themselves to ensure we have adequate supply in the market," he said. "My worry is not an oversupply. My worry is an undersupply. Everyone is expecting that we will have more demand coming in the future."

|

2018, February, 27, 13:55:00

U.S. OIL PRIODUCTION UP TO 10.2 MBDAPI - U.S. crude production rose to 10.2 million barrels per day (MBD) in January – the highest monthly output on record, according to API’s monthly statistical report. This was an increase of 1.1 percent versus December and 15.1 percent from January 2017.

|

2018, February, 14, 10:15:00

РОССИЯ - ОПЕК: 2/3 СОГЛАШЕНИЯМИНЭНЕРГО РОССИИ - Принимая декларацию о сотрудничестве в рамках ОПЕК+, мы не ставили своей целью ограничить добычу нефти на какой-то определенный срок, к примеру, на полгода, год или два. Нашей задачей было убрать излишки нефти с рынка. На текущий момент мы видим, что эта цель достигнута на две трети.

|

2018, February, 14, 10:05:00

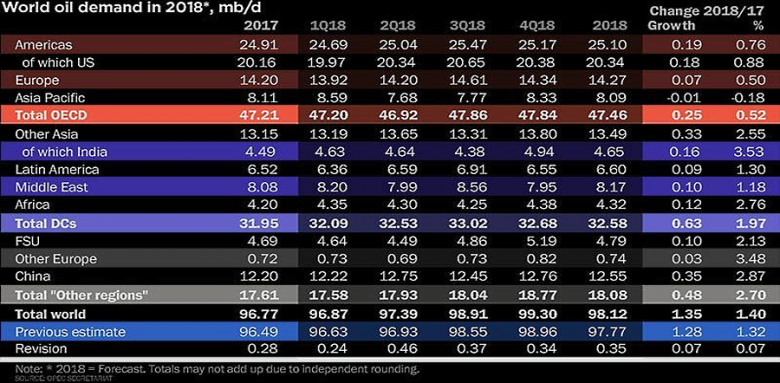

IEA: OIL DEMAND GROWTH 1.6 MBDIEA - Our demand growth estimate for 2017 remains strong at 1.6 mb/d, reinforced by November data for the US. For 2018, the more positive global economic picture published by the International Monetary Fund is a key factor in raising our growth outlook to 1.4 mb/d. It was thought that the significant increase in the dollar price of crude oil since the middle of 2017 would dampen growth, and this might be the case to some extent, but the impact of higher prices has been partly offset in some countries by currency appreciations.

|

2018, February, 14, 10:00:00

OPEC'S OIL DEMAND: 32.86 MBDPLATTS - As a result, demand for OPEC crude will average 32.86 million b/d in 2018, the organization calculated.

|

2018, February, 14, 09:55:00

БОЛЬШЕ ДЕНЕГ ДЛЯ РОССИИМИНЭНЕРГО РОССИИ - Говоря о сделке по сокращению добычи нефти, Александр Новак отметил, что благодаря венским соглашениям федеральный бюджет получил дополнительный поступления. «За счет этого соглашения мы получили за период 2016-2017 годы в федеральный бюджет примерно 1,7 триллиона рублей, наши компании получили 700 миллиардов рублей. То есть почти 2,5 триллиона рублей – эффект, достигнутый за два года», - сказал глава энергетического ведомства.

|

2018, February, 14, 09:30:00

U.S. OIL +110 TBD, GAS + 832 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 110,000 b/d month-over-month in March to 6,756 million b/d, gas production to increase 832 million cubic feet/day to 64,941 million cubic feet/day . |