U.S. - CHINA TRADE WAR

REUTERS - Any trade war with the United States will only bring disaster to the world economy, Chinese Commerce Minister Zhong Shan said on Sunday, as Beijing stepped up its criticism on proposed metals tariffs by Washington amid fears it could shatter global growth.

After pressure from allies, the United States has opened the way for more exemptions from tariffs of 25 percent on steel imports and 10 percent on aluminum that U.S. President Donald Trump set last week.

On Saturday, the European Union and Japan urged the United States to grant them exemptions from metal import tariffs, with Tokyo calling for "calm-headed behavior."

But the target of Trump's ire is China, whose capacity expansions have helped add to global surpluses of steel. China has repeatedly vowed to defend its "legitimate rights and interests" if targeted by U.S. trade actions.

Zhong, speaking on the sidelines of China's annual session of parliament, said China does not want a trade war and will not initiate one.

"There are no winners in a trade war," Zhong said. "It will only bring disaster to China and the United States and the world."

China can handle any challenges and will resolutely protect its interests, but the two countries will continue to talk, he said.

"Nobody wants to fight a trade war, and everyone knows fighting one harms others and does not benefit oneself."

Trump's announcement on tariffs underlined concerns about rising U.S. protectionism, which has sparked bouts of turmoil in global financial markets over the past year as investors feared a damaging trade spat will shatter a synchronized uptick in world growth.

China's metals industry issued the country's most explicit threat yet in the row, urging on Friday for the government to retaliate by targeting U.S. coal - a sector that is central to Trump's political base and his election pledge to restore American industries and blue-collar jobs.

The U.S. is the world's biggest importer of steel, purchasing 35 million tonnes of raw material in 2017. Of those imports, South Korea, Japan, China and India accounted for 6.6 million tonnes.

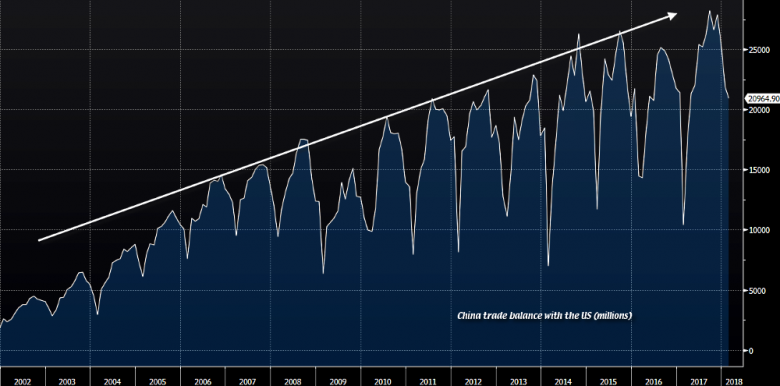

Trade tensions between China and United States have risen since Trump took office. China accounts for only a small fraction of U.S. steel imports, but its massive industrial expansion has helped create a global glut of steel that has driven down prices.

The dispute has fueled concerns that soybeans, the United States' most valuable export to the world's second largest economy, might be caught up in the trade actions after Beijing launched a probe into imports of U.S. sorghum, a grain used in animal feed and liquor.

PROTECTING AMERICAN JOBS

Zhong said U.S. official trade deficit figures had been over-estimated by about 20 percent, and in any case would be a lot lower if the United States relaxed export restrictions on some high-tech goods.

He also reiterated a previous pledge that China would lower import tariffs on consumer goods including automobiles, as part of an effort to boost domestic consumption.

Trump believes the tariffs will safeguard American jobs, though many economists say the impact of price increases for users of steel and aluminum, such as the auto and oil industries, will destroy more jobs than curbs on imports create.

Nonetheless, there is growing bipartisan consensus in Washington, and support within some segments of the U.S. business community, for the U.S. government to counter what are seen as Beijing's predatory industrial policies and market restrictions on foreign firms.

Trump's administration has said the United States mistakenly supported China's membership in the World Trade Organization in 2001 on terms that have failed to force Beijing to open its economy.

Diplomatic and U.S. business sources say the United States has frozen a formal mechanism for talks on commercial disputes with China because it is not satisfied Beijing has met its promises to ease market restrictions.

-----

Earlier:

2018, February, 27, 13:50:00

U.S. - CHINA OIL RECORDPLATTS - China's crude oil imports from the US hit a new record high at 2.01 million mt or 474,450 b/d in January, General Administration of Customs data showed Monday.

|

2018, February, 27, 13:40:00

CHINA'S LNG IMPORTS UP BY 46%EIA - China surpassed South Korea to become the world’s second-largest importer of liquefied natural gas (LNG) in 2017, according to data from IHS Markit and official Chinese government statistics. Chinese imports of LNG averaged 5 billion cubic feet per day (Bcf/d) in 2017, exceeded only by Japanese imports of 11 Bcf/d. Imports of LNG by China, driven by government policies designed to reduce air pollution, increased by 1.6 Bcf/d (46%) in 2017, with monthly imports reaching 7.8 Bcf/d in December.

|

2018, February, 12, 07:30:00

U.S. LNG FOR CHINAFT - The 25-year deal with China National Petroleum Corporation means Cheniere has pulled ahead in the race to develop a new wave of US LNG export projects to come on stream in the 2020s.

|

2018, February, 7, 08:10:00

CHINA: THE WORLD'S LARGESTEIA - China surpassed the United States in annual gross crude oil imports in 2017, importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d for the United States. China had become the world’s largest net importer (imports minus exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic oil production were the major factors contributing to the recent increase in China’s crude oil imports.

|

2018, February, 2, 12:15:00

CHINA'S OIL INVESTMENT UPBLOOMBERG - The Beijing-based explorer sees capital expenditures at 70 billion to 80 billion yuan ($11.1 billion to $12.7 billion) for 2018, it said in a statement to the Hong Kong stock exchange Thursday. That’s an increase of as much as 60 percent from the previous year, which came in under target. It also raised its production estimate to between 470 million and 480 million barrels of oil equivalent, poised for the the first increase in three years.

|

2018, January, 17, 23:40:00

CHINA'S OIL DEMAND UP 4.6%PLATTS - China's apparent oil demand is expected to rise 4.6% year on year to hit 600 million mt (12.05 million b/d) in 2018, with net crude imports to increase 7.7% to 451 million mt, according to a report released Tuesday by state-owned China National Petroleum Corp.'s Economics and Technology Research Institute.

|

2018, January, 3, 15:55:00

RUSSIA - CHINA OIL FRIENDSHIPBLOOMBERG - After a glut sparked the biggest price crash in a generation and starved Russia of oil revenues, the nation sought to boost market share in the world’s top importer. It’s now supplanted Saudi Arabia as the top exporter to China, even as the two producers lead efforts to shrink the global oversupply by curbing output. A pipeline that transports crude from the East Siberia-Pacific Ocean system has helped its mission to increase volumes. |