BAHRAIN'S NEW OIL

ГАЗПРОМ - в Москве состоялась рабочая встреча Председателя Правления ПАО «Газпром» Алексея Миллера и Чрезвычайного и Полномочного Посла Австрийской Республики в Российской Федерации Йоханнеса Айгнера.

На встрече была дана высокая оценка сотрудничеству сторон в газовой сфере. В частности, отмечено, что «Газпром» обеспечивает надежные поставки газа на австрийский рынок. В последние годы республика демонстрирует повышенный спрос на российский газ. По предварительным данным, с 1 января по 24 апреля объем его экспорта в Австрию на 79,2% превзошел показатель аналогичного периода прошлого года. Потребителям поставлено 4,2 млрд куб. м газа.

Стороны также обсудили ход реализации проекта «Северный поток — 2». Алексей Миллер проинформировал Йоханнеса Айгнера о получении от Германии и Финляндии полных комплектов разрешений на сооружение газопровода. Отмечено, что процедуры получения разрешений идут по графику.

-----

В 2017 году «Газпром» установил исторический рекорд по объему экспорта в Австрию — 9,1 млрд куб. м газа, что на 50,3% (3 млрд куб. м) превышает показатель 2016 года (6,1 млрд куб. м) и на 33,7% (2,3 млрд куб. м) — объем поставок в 2005 году, когда был достигнут предыдущий рекорд (6,8 млрд куб. м).

Компания OMV — главный партнер «Газпрома» в Австрии. Компании взаимодействуют в сфере добычи, транспортировки и поставок газа.

«Северный поток — 2» — проект строительства газопровода мощностью 55 млрд куб. м газа в год из России в Германию по дну Балтийского моря.

-----

Раньше:

2018, April, 11, 13:00:00

ГАЗПРОМ - с 1 января по 8 апреля «Газпром» экспортировал в республику 3,7 млрд куб. м газа — на 77,2% больше, чем за аналогичный период прошлого года.

|

2018, February, 27, 14:10:00

ГАЗПРОМ - Растущий спрос сохраняется в Австрии и в начале 2018 года. По предварительным данным, с 1 января по 21 февраля «Газпром» поставил в республику 1,8 млрд куб. м газа — на 60,6% больше, чем за аналогичный период 2017 года (1,1 млрд куб. м).

|

2017, December, 25, 20:30:00

ГАЗПРОМ - еще в начале ноября Австрия превзошла исторический рекорд импорта российского газа, установленный по итогам 2005 года (6,8 млрд куб. м). С 1 января по 21 декабря 2017 года «Газпром», по предварительным данным, поставил в республику 8,25 млрд куб. м газа — на 2,4 млрд куб. м (40,7%) больше, чем за аналогичный период прошлого года.

|

2017, October, 18, 19:00:00

С 1 января по 15 октября этого года «Газпром» экспортировал в Австрию 6,4 млрд куб. м газа — на 48,3% или на 2,1 млрд куб. м больше, чем за девять с половиной месяцев 2016 года.

|

2016, December, 15, 18:45:00

Председатель Правления ПАО «Газпром» Алексей Миллер и Председатель Правления OMV AG Райнер Зеле подписали Базовое соглашение об обмене активами. Церемония состоялась в присутствии Министра финансов Австрии Ханса Йорга Шеллинга и заместителя Министра энергетики России Анатолия Яновского.

|

2016, October, 13, 18:40:00

Рост поставок в 2015 году по сравнению с 2014 годом составил 11,5%. С 1 января по 10 октября 2016 года экспорт российского газа в республику достиг 4,18 млрд куб. м, что на 23,8% больше показателя за аналогичный период прошлого года.

|

2016, February, 4, 19:25:00

Россия и Австрия достигли положительных результатов по вопросу строительства газопровода «Северный поток – 2». По мнению вице-канцлера Австрии, проект «Северный поток — 2», по которому российский газ будет поставляться в Германию по дну Балтийского моря, позволит надежнее обеспечивать Европу газом.

|

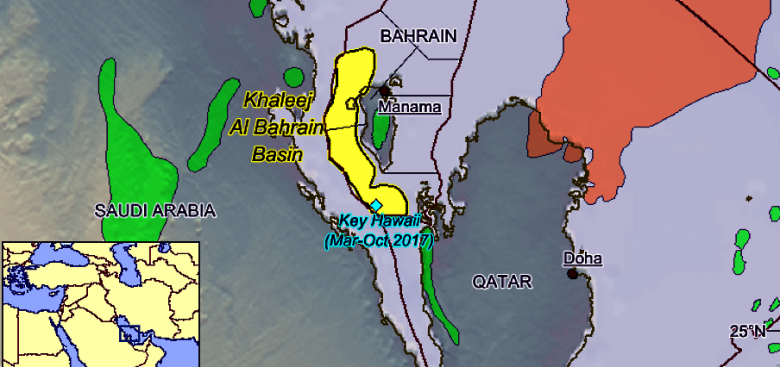

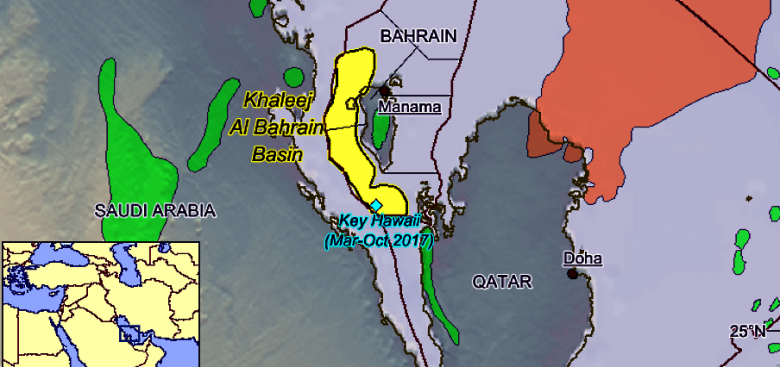

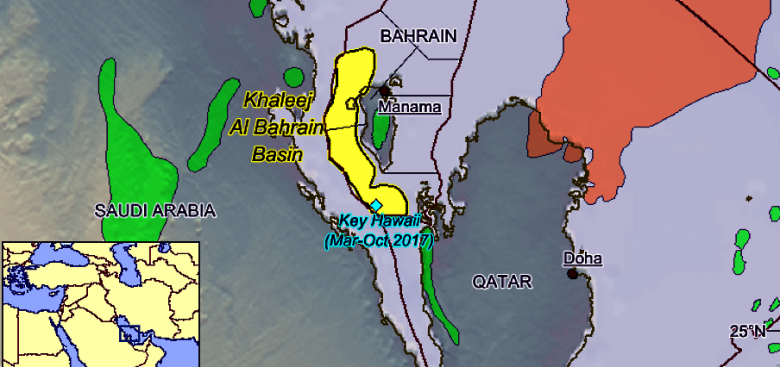

BAHRAIN'S NEW OIL

AOG - Bahrain is to consider a wide range of finance options to help support the extraction of its newly-discovered offshore shale reserves, according to Dawood Nassif, an advisor to the kingdom's oil minister and cited by The National.

"We're looking at all options, frankly, we might invite [international oil companies] or we might invest some. It's premature, however. We need time," Nassif told reporters in Abu Dhabi.

"In six months' time we'd be in a better position," he added.

Bahrain, recently announced that it had unearthed around 80 billion barrels of unconventional oil and up to 20 trillion cubic feet of tight gas off its west coast. The discovery could potentially transform the island state's reserves which currently total well under 200 million barrels.

Nassif, who is also on the board of the country's state-owned Bahrain Petroleum Company, re-iterated the field's recovery rate would not be known "for a few months to come".

Extraction of tight oil and gas is complex and recovery rates are notoriously low, with most experts suggesting that the usual yield is somewhere between 5-10%.

Bahrain is to work with US firm Halliburton to drill appraisal wells in the first instance. Currently, Bahrain is the smallest oil producer in the Arabian Gulf, generating around 50,000 barrels per day domestically, as well as holding a 50% share in the offshore Abu Safah field alongside Saudi Arabia.

-----

Earlier:

2018, April, 2, 09:15:00

REUTERS - The new tight oil and deep gas resource is expected to contain many times the amount of oil produced by Bahrain’s existing oilfields, as well as large amounts of gas, BNA reported.

|

2017, August, 28, 19:45:00

Bahrain’s fiscal and external vulnerabilities have increased in the wake of the oil price decline. Overall GDP grew 3 percent in 2016, supported by strong growth of 3.7 percent in the non-oil sector aided by the implementation of GCC-funded projects. Average inflation remained moderate at 2.8 percent. Bank deposit and private sector credit growth slowed. The banking sector remains well capitalized and liquid. Despite the implementation of significant fiscal adjustment, lower oil prices meant that the overall fiscal deficit reached nearly 18 percent of GDP and government debt rose to 82 percent of GDP. The current account deficit widened to 4.7 percent. International reserves have declined.

|

2016, May, 5, 18:50:00

Russian state-owned oil and gas giant Gazprom is currently working to create a liquefied natural gas (LNG) distribution hub in Bahrain. The hub will be meant to intake LNG from various sources, including Russia.

|

| |

| |

| |

| |

Tags:

BAHRAIN,

OIL