NEW CHINA'S OIL

EIA - As Asia-Pacific oil demand continues to grow, some market participants believe the region needs an oil price benchmark based on local supply and demand conditions. Last month marked the beginning of trading for the new Shanghai crude oil futures contract in China. For the Shanghai contract to become an accepted regional benchmark, it will have to attract a wide variety of market participants, and its usage for price discovery must be established.

Although North America and Europe each have a widely traded oil futures contract—West Texas Intermediate (WTI) and Brent, respectively—the Asian market has yet to develop a widely traded benchmark contract. Even though some might consider the Dubai Mercantile Exchange's Oman futures contract to be representative of the Asian crude oil market, its daily traded volume and open interest (number of contracts outstanding) have remained at low levels since its inception in 2007, indicating it is not actively used among market participants.

The Asia and Oceania region represented more than 35% of global petroleum and other liquid fuels demand in 2017, an increase from the 30% of petroleum demand the region represented in 2008. Many countries in the region are dependent on crude oil imports to meet domestic demand. Imports to a select group of Asia-Pacific crude oil importing countries averaged a record-high 24 million barrels per day (b/d) in January 2018 (Figure 1). As the crude oil trade in the region grows, a benchmark futures price that reflects local supply and demand conditions could benefit market participants in managing price risk.

A benchmark crude is a widely and actively traded crude whose qualities are well understood by market participants. Prices for other crudes can be determined by adding or subtracting an agreed upon differential between the two crudes. The differential takes into account a number of factors, including quality characteristics such as API gravity or sulfur content, transportation costs from production areas to refineries, and regional and global supply and demand conditions.

Perhaps the most significant difference between the Shanghai crude oil futures contract and WTI, Brent, and Oman benchmarks is that the Shanghai crude oil futures contract is priced in Chinese yuan (CNY) per barrel (¥/b). The other futures contracts are priced in United States dollars (USD) per barrel ($/b), as is essentially every other crude oil transaction in the world. The Shanghai contract's settlement in ¥/b introduces an element of currency risk that oil traders previously did not have to consider. Based on the September 2018 contract's April 24 closing price of 440.9 ¥/b and the April 24 USD/CNY exchange rate of 6.31 ¥/$, the Shanghai crude oil futures price settled at an equivalent of $69.91/b (Figure 2). The September 2018 contracts for WTI, Brent, and Oman closed at $66.62/b, $72.01/b, and $68.85/b, respectively. The USD/CNY exchange rate has appreciated 8% during the past year, from 6.88 ¥/$ on April 24, 2017.

Similar to the other futures contracts, several crude oil streams are eligible for delivery against the Shanghai contract, comprising seven different oils primarily produced in the Middle East. All are medium in API gravity and sour in terms of sulfur content. The Oman futures contract also represents medium and sour crude oils, whereas Brent and WTI underlie light and sweet crude oils. Unlike the other contracts, Shanghai futures represent a crude oil for delivery in a demand center distant from where the crude oil is produced. The other contracts are priced near production areas. As a result, the Shanghai futures prices could reflect delivery costs that are more volatile than contracts based near production areas.

After one month of trading, the Shanghai futures contract for September 2018 delivery already has more open interest and trading volume than the Oman contract for September delivery. The Shanghai futures contract's open interest is smaller than that for Brent and WTI, but trading volume has been high compared with the number of contracts outstanding, indicating a high amount of trading turnover (Figure 3).

To attract international companies, China's finance ministry has waived income tax on commissions earned by foreign investors for three years. Although this initiative could attract the market participants needed to facilitate trading in the contract, China's central bank still maintains international capital restrictions, which could reduce interest for some companies. Soon after the launch, the trading company for Sinopec—Asia's largest refiner—agreed to a one-year deal to purchase crude oil from a European oil company priced against the new contract.

China has had success in developing futures contracts in other commodities. The Shanghai futures contract may become a widely accepted benchmark depending on how much traders use it in crude oil price discovery.

-----

Earlier:

2018, April, 25, 10:10:00

RUSSIA - CHINA OIL MAXIMUMREUTERS - Russia was China’s largest crude oil supplier in March, data showed on Tuesday, retaining the lead spot for a 13th consecutive month.

|

2018, April, 16, 09:30:00

SOUTHEAST ASIA: ENHANCING POTENTIALWBG - Growth in developing East Asia and Pacific (EAP) is expected to remain strong and reach 6.3 percent in 2018, according to the latest World Bank economic report on the region. Prospects for a continued broad-based global recovery and robust domestic demand underpin this positive outlook. Still, emerging risks to stability and sustained growth require close attention.

|

2018, April, 4, 09:20:00

SOUTH CHINA SEA TENSIONBLOOMBERG - Vietnam’s state-owned oil company said South China Sea tensions will hurt oil and gas exploration and efforts to attract foreign investment to offshore fields.

|

2018, March, 28, 11:05:00

SAUDIS OIL FOR CHINA: +20%PLATTS - China's crude oil imports from Saudi Arabia in February rose 19.5% month on month to 1.21 million b/d, or 4.64 million mt, making it the second-largest supplier, data released by the General Administration of Customs on Tuesday showed.

|

2018, March, 28, 11:00:00

CHINA - PHILIPPINES COOPERATIONOGJ - The governments of China and the Philippines say they’re moving toward cooperative offshore oil and gas exploration.

|

2018, February, 27, 13:50:00

U.S. - CHINA OIL RECORDPLATTS - China's crude oil imports from the US hit a new record high at 2.01 million mt or 474,450 b/d in January, General Administration of Customs data showed Monday.

|

2018, February, 7, 08:10:00

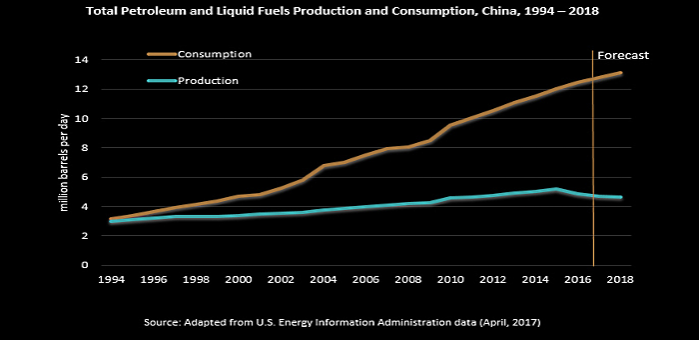

CHINA: THE WORLD'S LARGESTEIA - China surpassed the United States in annual gross crude oil imports in 2017, importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d for the United States. China had become the world’s largest net importer (imports minus exports) of total petroleum and other liquid fuels in 2013. New refinery capacity and strategic inventory stockpiling combined with declining domestic oil production were the major factors contributing to the recent increase in China’s crude oil imports. |