OIL PRICE: ABOVE $72 AGAIN

REUTERS - Oil prices rose on Wednesday, lifted by a reported decline in U.S. crude inventories and by the ongoing risk of supply disruptions.

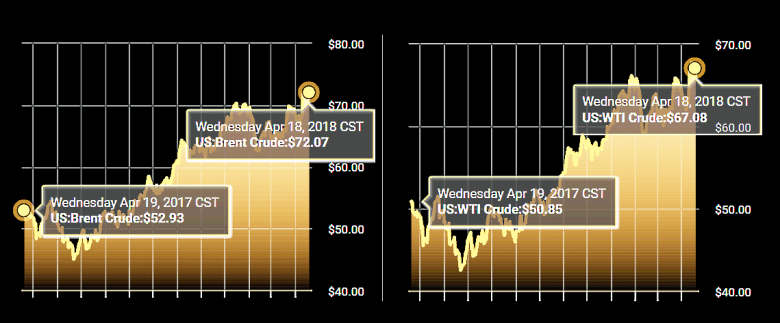

Brent crude oil futures LCOc1 were at $72.07 per barrel at 0659 GMT, up 49 cents, or 0.7 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 49 cents, or 0.7 percent, at $67.01 a barrel.

In the United States, crude inventories fell by 1 million barrels last week, to 428 million barrels, according to a weekly report by the American Petroleum Institute (API) on Tuesday.

Official weekly U.S. data will be published by the Energy Information Administration (EIA) on Wednesday.

Outside the United States, oil markets have been receiving general support due to a sense that there are high risks of supply disruptions, including a potentially spreading conflict in the Middle East, renewed U.S. sanctions against Iran and falling output as a result of political and economic crisis in Venezuela.

"Oil prices are holding near three-year highs (reached earlier in April) for the time being, and with inventories back in line with normal levels, the supply glut of the last few years appears to be over," said William O'Loughlin, investment analyst at Australia's Rivkin Securities.

Beyond voluntary supply restrictions aimed at propping up prices led by the producer cartel of the Organization of the Petroleum Exporting Countries (OPEC) since 2017, O'Loughlin said falling output in Venezuela due to its political and economic turmoil was supporting prices.

"OPEC production is currently lower than expected as a result of large declines in Venezuelan output caused by a deterioration in the economic situation there," he said.

The lower OPEC supplies come as demand is healthy, with China's refineries processing a record 12.1 million barrels per day (bpd) of crude oil in March.

Dutch bank ING said in a note to clients that Brent had risen back above $70 per barrel in April "due to geopolitical risks along with some fundamentally bullish developments in the market".

It raised its average 2018 price forecast for Brent to $66.50 a barrel from $60.25, and its 2018 WTI forecast to $62.50 per barrel from $57.75.

For next year, however, ING expects lower prices due to rising U.S. crude output, which has jumped by a quarter since mid-2016 to over 10.5 million bpd.

The structure of the Brent and WTI forward price curve also points to a tighter market this year than in 2019.

The premium for June 2018 over June 2019 prices for Brent and WTI is $5.50 and $6 per barrel respectively, creating a market structure known as backwardation in which it is attractive to sell crude immediately instead of keeping it in storage for later sale.

-----

Earlier:

2018, April, 16, 09:50:00

OIL PRICE: NOT ABOVE $72REUTERS - Oil prices slipped with Brent crude futures LCOc1 off 66 cents at $71.92 a barrel, while U.S. crude CLc1 fell 56 cents to $66.83 a barrel.

|

2018, April, 13, 18:10:00

OIL PRICE: ABOVE $72REUTERS - Recovering from earlier losses, Brent crude LCOc1 was up 28 cents at $72.30 a barrel by 1301 GMT and set for a weekly gain of almost 8 percent, or about $5.U.S. crude for May delivery CLc1 rose 28 cents to $67.35, up more than 8 percent, or about $5, for the week.

|

2018, April, 11, 13:40:00

OIL PRICE: ABOVE $71REUTERS - Brent crude has gained 5.7 percent this week, rising to $71.34 a barrel on Tuesday, the highest since late 2014, although the price has since fallen back and was $70.98 a barrel by 0907 GMT LCOc1, down 6 cents.U.S. crude futures CLc1 were at $65.55 a barrel, up 4 cents on the day. |

2018, April, 11, 13:35:00

RUSSIA - OPEC UNLIMITEDPLATTS - Maintaining a long-term oil management alliance with Russia and other allies will allow OPEC producers to react more quickly to changing fundamentals and stabilize the market,

|

2018, April, 11, 13:30:00

INDIA WANTS $50BLOOMBERG - “We are a very price-sensitive consumer,’’ Pradhan said on Tuesday. “From Indian consumers’ point of view, I will be more than happy if the price is around $50 a barrel.’

|

2018, April, 11, 13:25:00

OIL PRICE 2018-19: $63EIA - Brent crude oil spot prices averaged $66 per barrel (b) in March. EIA forecasts Brent spot prices will average about $63/b in both 2018 and 2019. EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI futures and options contract values for July 2018 delivery that traded during the five-day period ending April 5, 2018, suggest a range of $52/b to $78/b encompasses the market expectation for July 2018 WTI prices at the 95% confidence level.

|

2018, April, 9, 11:45:00

OIL PRICE: NOT ABOVE $68 AGAINREUTERS - U.S. WTI crude futures CLc1 were at $62.31 a barrel at 0643 GMT, up 25 cents, or 0.4 percent, from their previous settlement. Brent crude futures LCOc1 were at $67.42 per barrel, up 31 cents, or 0.5 percent.

|