OIL PRICE: ABOVE $74 ANEW

REUTERS - Oil prices dipped on Monday after a rising rig count in the United States pointed to higher production there, but markets held near their highest in over three years and remained set for a second straight month of gains.

Oil prices were supported by supply concerns amid prospects that the United States could reimpose sanctions on Iran, while OPEC-led producers continue to withhold output.

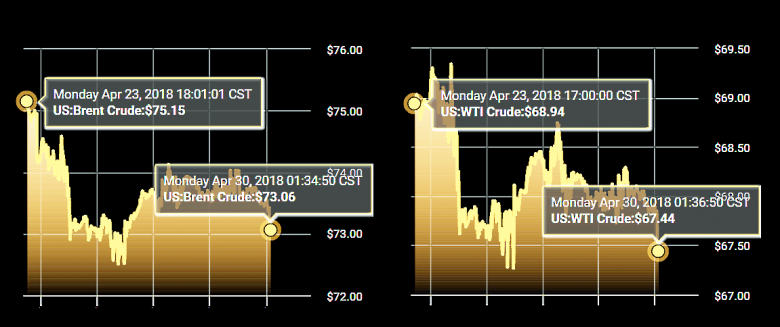

Brent crude futures LCOc1, the international benchmark, had dipped 50 cents, or 0.7 percent, to $74.14 a barrel by 0633 GMT. Prices climbed as high as $75.47 last week, levels not seen since November, 2014.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $67.82 a barrel, down 28 cents, or about 0.4 percent, from their last settlement.

"Oil prices are hanging tight as the market remains fundamentally optimistic with declining stockpile levels and on prospective sanctions on Iran," Benjamin Lu, commodities analyst at Singapore-based broker Phillip Futures, said in a note.

U.S. drillers added five oil rigs in the week to April 27, bringing the total count to 825, the highest level since March 2015, General Electric's Baker Hughes energy services firm said.

Crude production in the United States has soared more than 25 percent since mid-2016 to a record 10.59 million barrels per day (bpd). Only Russia currently produces more, at around 11 million bpd.

Meanwhile, Brent prices have gained nearly 6 percent this month, buoyed by expectations the United States will renew sanctions against Iran.

U.S. President Donald Trump has until May 12 to decide whether to restore the sanctions on Iran that were lifted after an agreement over its disputed nuclear program.

"Things are not quite the same as in the previous decade, when Iran was regarded as a menace and a threat. Over the last three-four years Iran has behaved itself - according to everybody," said Sukrit Vijayakar, director of energy consultancy Trifecta.

"It's only Trump who wants to back out of the deal, but he wants to back out of so many deals ... If you keep saying about backing out, you lose credibility as a state. Everyone is feeling the pinch of OPEC cuts anyway," Vijayakar added.

Re-imposed sanctions on Iran, OPEC's third-largest producer, would probably result in a reduction of Iranian oil exports, tightening global supplies even more.

Further backing oil prices are declining output in Venezuela, OPEC's biggest producer in Latin America, and Angola, Africa's second-largest exporter.

-----

Earlier:

2018, April, 27, 11:20:00

OIL PRICE: ABOVE $74 YETREUTERS - Global benchmark Brent crude futures LCOc1 were down 27 cents, or 0.4 percent, at $74.47 a barrel by 0644 GMT, after rising 1 percent on Thursday. U.S. West Texas Intermediate (WTI) crude CLc1 fell 19 cents, or 0.3 percent, to $68 a barrel. The contract gained 0.2 percent the previous session. |

2018, April, 27, 11:15:00

БАЛАНС МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак, говоря о перспективах соглашения о балансировке рынка, отметил, что участники рассматривают несколько вариантов дальнейшего сотрудничества. «Главная задача – не создать условия для дисбаланса на рынке», - заключил Министр. |

2018, April, 27, 10:50:00

NEW CHINA'S OILEIA - As Asia-Pacific oil demand continues to grow, some market participants believe the region needs an oil price benchmark based on local supply and demand conditions. Last month marked the beginning of trading for the new Shanghai crude oil futures contract in China. For the Shanghai contract to become an accepted regional benchmark, it will have to attract a wide variety of market participants, and its usage for price discovery must be established. |

2018, April, 25, 10:20:00

OIL PRICE: NOT ABOVE $74 AGAINREUTERS - Brent crude oil futures LCOc1 were at $73.89 per barrel at 0455 GMT, up 3 cents from their last close but around $1.60 below the November-2014 high of $75.47 a barrel reached the previous day. U.S. West Texas Intermediate (WTI) futures were flat at $67.7 63 per barrel, but off the late-2014 highs of $69.56 a barrel marked earlier in April. |

2018, April, 23, 14:50:00

РОССИЯ - ОПЕК: 149%МИНЭНЕРГО РОССИИ - страны ОПЕК и государства, не входящие в ОПЕК, выполнили соглашение по добровольной корректировке объемов добычи нефти на 149%, что является самым высоким показателем в истории соглашения. |

2018, April, 20, 09:30:00

OIL PRICE: NOT ABOVE $74REUTERS - Brent crude oil futures LCOc1 were at $73.79 per barrel at 0440 GMT, up 1 cent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 down 2 cents at $68.40 a barrel.

|

2018, April, 20, 09:20:00

OIL STOCKS & PRICES UPFT - Oil prices hit their highest level since 2014 on Thursday, moving above $74 a barrel and lifting energy companies to the top of global stock indices. |