OIL PRICE: NOT ABOVE $68 AGAIN

REUTERS - Oil markets stabilized on Monday after slumping around 2 percent last Friday on concerns over an intensifying trade dispute between the United States and China, as well as increased U.S. drilling activity.

Markets on Monday were also eyeing the situation in Syria after reports - denied by the Pentagon - that U.S. forces had struck a major air base there.

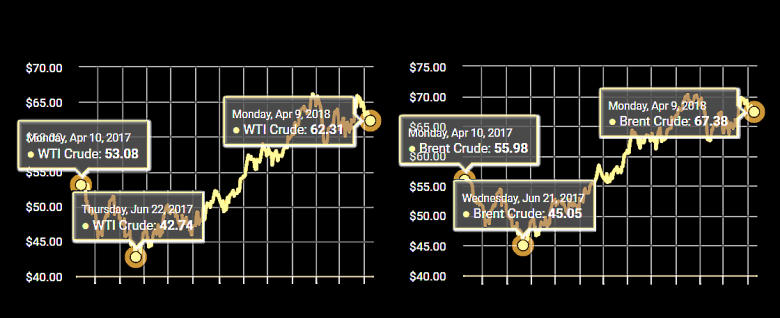

U.S. WTI crude futures CLc1 were at $62.31 a barrel at 0643 GMT, up 25 cents, or 0.4 percent, from their previous settlement.

Brent crude futures LCOc1 were at $67.42 per barrel, up 31 cents, or 0.5 percent.

Oil prices fell about 2 percent on Friday after U.S. President Donald Trump threatened new tariffs on China, reigniting fears of a trade war between the world's two largest economies that could hurt global growth.

"I hope that both sides understand the risks," said Greg McKenna, chief market strategist at futures brokerage AxiTrader.

With Chinese markets closed last Thursday and Friday, Shanghai crude futures ISCc1 played catch-up on Monday, dropping 0.2 percent to around 401.4 yuan ($63.73) per barrel.

"Oil prices have been susceptible to the brewing trade tensions between China and the U.S. ... However, fundamental support levels have been demonstrated with OPEC's suggestion on a production limit extension into 2019," said Singapore-based Phillip Futures.

Oil prices have generally been supported by healthy demand as well as by supply restraint led by the Organization of the Petroleum Exporting Countries (OPEC), which started in 2017 in order to rein in oversupply and prop up prices.

In physical oil markets, OPEC's number two producer Iraq said on Monday that it is keeping prices for its crude supplies in May steady.

In the United States, drillers added 11 rigs looking for new production in the week to April 6, bringing the total count to 808, the highest level since March 2015, General Electric's (GE.N) Baker Hughes energy services firm said on Friday.

-----

Earlier:

2018, April, 6, 18:35:00

OIL PRICE: NOT ABOVE $69REUTERS - Brent crude LCOc1 for June delivery briefly traded flat at 1322 GMT at $68.33 per barrel after falling as much as 66 cents earlier. U.S. West Texas Intermediate crude for May delivery CLc1 erased some of its previous losses, but was still down 15 cents at $63.39 a barrel.

|

2018, April, 4, 09:45:00

OIL PRICE: NOT ABOVE $68REUTERS - Oil prices slipped with Brent crude futures off 13 cents to $67.99 a barrel, while U.S. crude fell 11 cents to $63.40 a barrel.

|

2018, April, 4, 09:30:00

85% GLOBAL OIL DEALBLOOMBERG - The global deal to rein in oil output has removed “85 percent of the problem” of oversupply, and OPEC and allied producers are seeking ways to cooperate after the agreement ends, according to United Arab Emirates Energy Minister Suhail Al Mazrouei.

|

2018, April, 4, 09:25:00

RUSSIA EXECUTES THE AGREEMENTPLATTS - Russia is planning to fully comply with its commitment to cut oil output under the OPEC/non-OPEC deal this month, Russian energy minister Alexander Novak said Tuesday, the Prime news agency reported. |

2018, April, 2, 09:40:00

OIL PRICE: NOT ABOVE $70 YETREUTERS - U.S. WTI crude futures CLc1 were at $65.21 barrel at 0122 GMT, up 27 cents, or 0.4 percent, from their previous settlement. Brent crude futures LCOc1 were fetching $69.71 per barrel, up 37 cents, or 0.55 percent.

|

2018, April, 2, 09:25:00

LONG-TERM OPEC COOPERATIONSHANA - Leaders of the UAE, OPEC’s biggest producer Saudi Arabia and non-OPEC member Russia support extending energy cooperation beyond 2018. Cooperation on the part of a politically influential oil producer like Russia would add to the weight and influence of OPEC in global energy markets, both politically and in terms of decision-making.

|

2018, March, 30, 12:05:00

OIL PRICE: ABOVE $70 AGAINBLOOMBERG - West Texas Intermediate for May delivery gained 56 cents to settle at $64.94 a barrel on the New York Mercantile Exchange, with prices posting a third-straight quarterly gain, the longest streak since 2011. Brent for May settlement, which expires Thursday, added 74 cents to end the session at $70.27 a barrel on the London-based ICE Futures Europe exchange. The more-active June contract rose 58 cents to settle at $69.34. The global benchmark traded at a $5.33 premium to WTI. The European bourse, along with Nymex, will be closed for the Good Friday holiday.

|