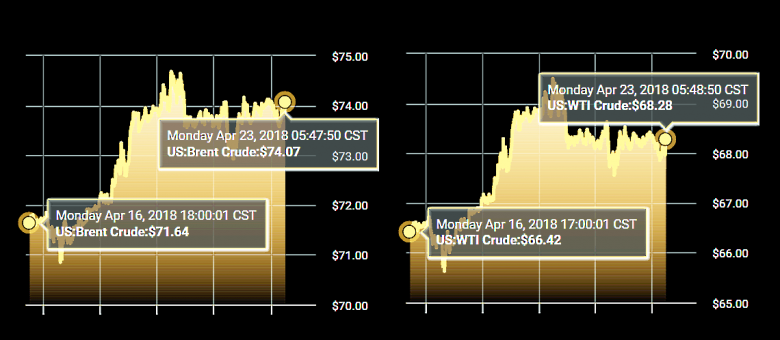

OIL PRICE: NOT ABOVE $74 YET

REUTERS - Oil eased on Monday on rising U.S. borrowing costs and the prospect of further output rises after another increase in the weekly rig count, although the overall picture for crude remained bullish.

Brent crude futures were down 49 cents at $73.57 a barrel by 0911 GMT, while U.S. West Texas Intermediate (WTI) crude futures fell 51 cents to $67.89 a barrel.

"Underlying sentiment is bullish ... we've got an important decision from (U.S. President Donald) Trump coming up in May and we have OPEC potentially trying to 'overtighten' the market," Saxo Bank senior manager Ole Hansen said.

"(Fund managers) need a continuous flow of bullish news for their position to be maintained and this week, it's not a matter of just watching the oil market."

Broader financial markets were under pressure from the rise in U.S. government yields toward 3 percent, a level that in the past has triggered aggressive sell-offs in stocks, bonds and commodities.

"Whether a break above 3 percent will have an impact on currencies remains to be seen, but to have an overall rising cost of finance at a time when Saudi Arabia is aiming at $100, something is going to give. Last time we were at $100 interest rates were rock-bottom and that wasn't a concern to anyone. This time around, it's a different story," Hansen said.

Despite slipping on Monday, the oil market remains well supported, especially by strong demand in Asia.

Prices have risen by 25 percent in the last year thanks to supply cuts led by the Organization of the Petroleum Exporting Countries (OPEC) that were introduced in 2017 to prop up the market.

"Added price pressure comes from U.S. sanctions against the key oil exporting nations of Venezuela, Russia and Iran," said J.P. Morgan Asset Management Global Market Strategist Kerry Craig. He was referring to action the U.S. government has taken on Russian companies and individuals, as well as on potential new measures against struggling Venezuela and especially OPEC-member Iran.

"Stay long oil," J.P. Morgan said in a separate note.

The United States has until May 12 to decide whether it will leave a nuclear deal with Iran and impose new sanctions against Tehran, including potentially on its oil exports, which would further tighten global supplies.

That said, U.S. drilling activity is now at its highest in three years and a rising weekly rig count points to further increases in U.S. crude production, which is already up by a quarter since mid-2016 to a record 10.54 million barrels per day (bpd).

Only Russia produces more, at almost 11 million bpd.

-----

Earlier:

2018, April, 20, 09:30:00

OIL PRICE: NOT ABOVE $74REUTERS - Brent crude oil futures LCOc1 were at $73.79 per barrel at 0440 GMT, up 1 cent from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 down 2 cents at $68.40 a barrel.

|

2018, April, 20, 09:20:00

OIL STOCKS & PRICES UPFT - Oil prices hit their highest level since 2014 on Thursday, moving above $74 a barrel and lifting energy companies to the top of global stock indices.

|

2018, April, 18, 13:14:00

OIL PRICE: ABOVE $72 AGAINREUTERS - Brent crude oil futures LCOc1 were at $72.07 per barrel at 0659 GMT, up 49 cents, or 0.7 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 49 cents, or 0.7 percent, at $67.01 a barrel. |

2018, April, 18, 13:12:00

RUSSIA - OPEC DIMENSIONPLATTS - Russia is committed to its OPEC pact with Saudi Arabia and will continue supplying Europe energy despite tensions with the West after US-led strikes on Bashar al-Assad's Syrian regime, said Vladimir Putin's spokesman. |

2018, April, 13, 18:10:00

OIL PRICE: ABOVE $72REUTERS - Recovering from earlier losses, Brent crude LCOc1 was up 28 cents at $72.30 a barrel by 1301 GMT and set for a weekly gain of almost 8 percent, or about $5.U.S. crude for May delivery CLc1 rose 28 cents to $67.35, up more than 8 percent, or about $5, for the week.

|

2018, April, 11, 13:40:00

OIL PRICE: ABOVE $71REUTERS - Brent crude has gained 5.7 percent this week, rising to $71.34 a barrel on Tuesday, the highest since late 2014, although the price has since fallen back and was $70.98 a barrel by 0907 GMT LCOc1, down 6 cents.U.S. crude futures CLc1 were at $65.55 a barrel, up 4 cents on the day. |

2018, April, 11, 13:35:00

RUSSIA - OPEC UNLIMITEDPLATTS - Maintaining a long-term oil management alliance with Russia and other allies will allow OPEC producers to react more quickly to changing fundamentals and stabilize the market, |