ADNOC INVESTMENT PLAN: $45 BLN

AOG - The Abu Dhabi National Oil Company (ADNOC) has unveiled plans to invest $45bn alongside partners, over the next five years, to become a leading global downstream player.

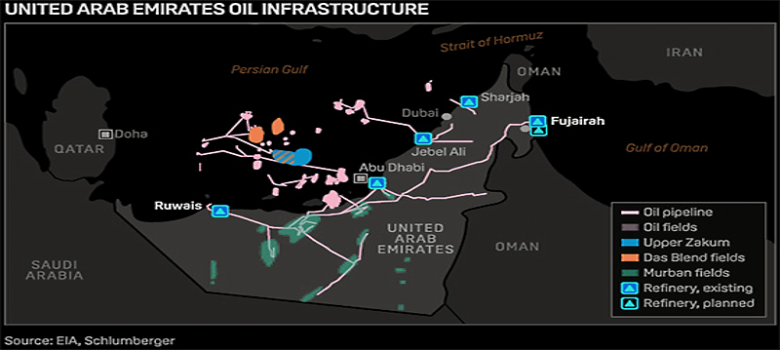

The plans were unveiled at the ADNOC Downstream Investment Forum in Abu Dhabi. The unprecedented investment programme will underpin a new downstream strategy to significantly expand ADNOC's refining and petrochemical operations at Ruwais in the UAE and undertake highly targeted overseas investments to secure greater market access.

Building on the existing strengths and competitive advantages of the Ruwais Industrial Complex, ADNOC will create the world's largest and most advanced integrated refining and petrochemicals complex. Through a combined programme of strategic partnerships and investment, ADNOC will increase its range and volume of downstream products, secure better access to growth markets around the world and create a manufacturing ecosystem in Ruwais that will significantly stimulate In-Country Value creation, private sector growth and employment. The strategy is expected to add more than 15,000 jobs by 2025 and contribute an additional 1% to gross domestic product per year.

Dr Sultan Ahmed Al Jaber, UAE Minister of State and ADNOC Group CEO, said: "Given the projected increase in demand for petrochemicals and higher value refined products, we are repositioning ADNOC to become a leading global downstream player. We will invest significantly in Ruwais and open up attractive partnership and co-investment opportunities along our extended value chain to create a powerful new downstream engine and springboard for growth that will benefit our country, our company and our partners.

"Importantly, the expansion plans for Ruwais will also support Abu Dhabi and the UAE's economic development and diversification, create high-skilled jobs and enhance the country's status as a globally attractive destination for energy investments", he added.

ADNOC's downstream investment plans are in line with its 2030 strategy of a more profitable upstream, more valuable downstream and sustainable, economic gas supply, underpinned by more proactive and adaptive marketing and trading.

Al Jaber also said: "The unique competitive advantages and world-scale of Ruwais, combined with a $45bn dollar investment plan and our ambitious smart growth strategy, create a unique opportunity for ADNOC to redefine the global refining and petrochemicals landscape. As in the past, our full potential will be accelerated through value-adding partnerships, so we are extending an invitation to both existing and new partners to join with us in building a world-leading refining and petrochemicals complex and manufacturing ecosystem here in Ruwais."

ADNOC's existing downstream portfolio comprises eight companies processing 10.5bn standard cubic feet of gas per day with a refining capacity of 922,000 barrels per day (bpd) of condensate and crude. They produce 40mn tonnes per year (mtpa) of refined products, and a range of other products, including granulated urea, liquefied petroleum gas, naphtha, gasoline, jet fuel, gas oil and base oils, fuel oil, and other petrochemical feedstock.

Plans are well advanced to expand the complex's refining capacity by more than 65%, or 600,000 bpd by 2025, through the addition of a third, new refinery, creating a total capacity of 1.5mn bpd.

The $45bn investment programme will also see the entire Ruwais complex upgraded to increase its flexibility and integrated capabilities to produce greater volumes of higher-value petrochemicals and derivative products. It includes a plan to build one of the world's largest mixed feed crackers, trebling production capacity from 4.5 mtpa in 2016 to 14.4 mtpa by 2025.

ADNOC will also develop a new, large-scale, manufacturing ecosystem in Ruwais through the creation of new petrochemical Derivatives and Conversion Parks. The Ruwais Derivatives Park will be built on a six square kilometre area adjacent to, and fully integrated with, the larger Ruwais complex. The Ruwais Derivatives Park will act as a catalyst for the next stage of petrochemical transformation by inviting partners to invest and produce new products and solutions from the growing range of feedstocks that are available in Ruwais. This will enable the creation of numerous new petrochemical activities and value chains, in fields such as construction chemicals, oil and gas chemicals, surfactants and detergents.

Furthermore, the new Ruwais Conversion Park will take feedstock from both the Derivatives Park and other Ruwais assets to manufacture higher-value end products, including packaging materials, coatings, high voltage insulation and automotive composites. The Conversion Park, occupying another 3.6 square kilometres, will help create focused industry clusters, that can not only supply products and solutions using the derivatives and other facilities available, but will also utilise the proximity of an interconnected ecosystem to drive expertise, innovation and entrepreneurship.

Both the Ruwais Derivatives Park and Ruwais Conversion Park will act as a focal point for the global petrochemicals industry and will cement Ruwais's role as a key node in the global refining and petrochemical supply chain. Across both parks, in addition to supplying feedstocks, ADNOC will make available developed land, infrastructure, utilities and shared services at attractive rates to partners.

As part of the overall Ruwais area development, ADNOC will undertake the significant expansion and development of Ruwais City to meet the increase in demand for housing and other facilities resulting from the significant enlargement of the Ruwais Industrial Complex. Along with new homes, ADNOC is also constructing infrastructure and community enhancement projects for Ruwais City that include the expansion of the public transport system and numerous community and other facilities such as new healthcare facilities, secondary and tertiary educational facilities, a central park and recreation spaces, a new mall, new beach facilities and a traditional souq.

Significant interest in the new investment and downstream partnership opportunities has already been expressed and discussions are now taking place with global energy companies and domestic investors.

-----

Earlier:

2018, March, 23, 08:00:00

ADNOC - CNPC AGREEMENT: $1.175 BLNAOG - China National Petroleum Corporation (CNPC), the world’s third largest oil company, has been awarded stakes in two of Abu Dhabi’s offshore concession areas following the signing of agreements with Abu Dhabi National Oil Company (ADNOC). |

2018, March, 21, 12:05:00

ADNOC - TOTAL AGREEMENT: $1.45 BLNAOG - Total contributed a participation fee of $1.15bn to enter the Umm Shaif and Nasr concession and a fee of $300mn to enter the Lower Zakum concession. Both concessions are operated by ADNOC Offshore, a subsidiary of ADNOC, on behalf of all concession partners. |

2018, February, 16, 23:20:00

ADNOC INVESTMENT $109 BLNAOG - ADNOC announced that it has launched the implementation phase of its new in-country value (ICV) strategy, aimed at increasing the company’s ICV contribution and strengthening its relationship with the UAE’s private sector. |

2018, February, 12, 07:20:00

ADNOC'S INVESTMENT $3.1 BLNAOG - A $3.1bn project to introduce crude processing flexibility at the ADNOC-owned Ruwais oil refinery was announced. |

2018, February, 12, 07:15:00

UAE - INDIA'S CONCESSION: $600 MLNREUTERS - A consortium led by India’s Oil and Natural Gas Corp (ONGC) (ONGC.NS) has become the first group to win a stake in Abu Dhabi National Oil Co’s (ADNOC) 40-year offshore oil concession, a deal set to help the UAE expand its foothold in Asia. |

2018, January, 19, 12:10:00

ADNOC'S 2030 STRATEGYAOG - ADNOC’s 2030 strategy, he said, aims to capitalise on predicted global economic growth and demand for oil and petrochemical products, particularly in non-OECD countries. As its business responds to changing market dynamics, the company will continue to broaden its partnership base, strengthen its profitability, adapt to new realities and expand market access. |

2017, November, 29, 09:45:00

ADNOC INVESTMENT $100 BLNADNOC - The SPC approved ADNOC’s plans for capital expenditure of over AED 400 billion, over the next five years, as it embarks on its Upstream and Downstream expansion and growth projects. The SPC also approved ADNOC’s plans to explore and appraise Abu Dhabi’s unconventional gas resources, as the company seeks to enable future value creation from its untapped gas resources. And, the SPC gave the green light to ADNOC to pursue international downstream investments that will position ADNOC as a global player in the downstream market. |