AFRICA'S MODEST GROWTH

IMF - Sub-Saharan Africa is set to enjoy a modest growth uptick, and decisive policies are needed to both reduce vulnerabilities and raise medium-term growth prospects. Average growth in the region is projected to rise from 2.8 percent in 2017 to 3.4 percent in 2018, with growth accelerating in about two-thirds of the countries in the region aided by stronger global growth, higher commodity prices, and improved capital market access. On current policies, average growth in the region is expected to plateau below 4 percent—barely 1 percent in per capita terms—over the medium term.

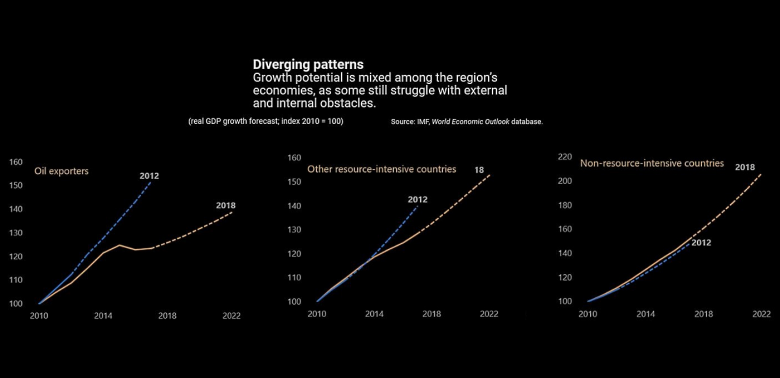

Across countries, there is diversity in economic outcomes and prospects. Oil exporters are still dealing with the legacy of the largest real oil price decline since 1970, with growth well below past trends. Several other economies, both resource intensive and non-resource intensive and some fragile states, continue to grow at 6 percent or more. Other countries are mired in internal conflicts, giving rise to large numbers of refugees and internally displaced people. The two largest economies in the region, Nigeria and South Africa, remain below trend growth, weighing heavily on prospects for the region.

Public debt levels in the region have risen. Fifteen of the region's 35 low-income countries are now rated as being in debt distress or at high risk of debt distress. Interest payments have also increased, consuming a growing share of revenues. For the region, median interest payments doubled from 5 percent to 10 percent of revenues between 2014 and 2017.

Rising nonperforming loans and a broad-based slowdown in private sector credit growth raise additional concerns. The increase in nonperforming loans was particularly large among resource-intensive countries, where weak economic activity has translated into a decline in credit quality and where government arrears continue to affect the banking sector.

If current policies persist, average growth in the region could plateau below 4 percent over the medium term, falling far short of levels envisaged five years ago and below what is needed for countries to achieve their Sustainable Development Goals.

Turnaround prospects

Policymakers should seize the opportunity provided by favorable external conditions to turn the current recovery into durable, robust growth by taking policy steps to reduce debt and raise medium-term growth potential.

Prudent fiscal policy, with an emphasis on increasing domestic revenue, is critical to preventing excessive public debt accumulation and making room for key infrastructure and social spending.

Despite substantial progress in revenue mobilization over the past two decades, sub-Saharan Africa has the lowest revenue-to-GDP ratio, with a median of 18 percent in 2016, 5 percentage points lower than other emerging and developing economies. Most countries in the region have considerable potential to collect higher revenue. The report estimates that sub-Saharan Africa could, on average, collect between 3-5 percent of GDP in additional tax revenues, significantly more than what the region receives each year through international aid.

Revenue mobilization could be further strengthened be improving value-added and income tax systems, streamlining exemptions, and broadening the tax base. Experience in the region suggests that such efforts are most effective when they are implemented as part of a medium-term revenue strategy; have a broad base of supporters for reform, and encourage commitment to improved governance and transparency.

Making room for private investment

Increasing private investment is critical for the region to achieve sustainable strong growth over the medium term. Private investment in sub-Saharan Africa remains low compared with other regions.

Raising private investment requires reforms, which include a sound business environment, well-developed infrastructure, trade openness, and financial development. As these reforms take time, countries are pursuing other avenues to jump start private investment, such as public-private partnerships, creating special economic zones, and implementing mechanisms to target foreign direct investment.

Country experiences also show that, while surges in private investment can follow commodity price booms or conflict resolutions, episodes of sustained private investment growth are typically associated with macroeconomic stability, including low public debt and inflation, and maintaining the momentum to upgrade institutions.

There is huge potential for boosting growth in the sub-Saharan region, and the current global environment provides the opportune time to push forward these reforms.

-----

Earlier:

2018, May, 7, 08:25:00

WBG WANTS NIGERIAWBG - For Nigeria to tap its spatial drivers of development, policymakers may want to focus on investments that reinforce clusters and economies of scale; optimize the connectivity between rural areas and the major urban markets; and address structural and land management issues in major urban nodes and along major growth corridors to remove or alleviate barriers that undermine the growth potential. |

2018, March, 12, 08:35:00

CHINA'S INVESTMENT FOR AFRICA: $35 BLNFT - The loans bring total Chinese energy finance in Africa since 2000 to $34.8bn. While this is well behind the $69bn lent in Europe and Central Asia, the $62bn in Latin America and the $60bn in Asia over the same period, the 2017 data illustrate Africa’s growing importance. |

2018, March, 9, 13:15:00

RUSSIA DISCUSSES AFRICA'S NUCLEARWNN - Russian Foreign Minister Sergey Lavrov is this week discussing the prospect of closer economic and political ties, including nuclear energy projects, in a number of African countries. Lavrov has so far visited Angola, Namibia, Mozambique and Zimbabwe, and will complete his trip to the region in Ethiopia. |

2018, February, 7, 07:20:00

SOUTH AFRICA'S EXPLORATIONTOTAL - Total has signed an agreement to sell a 25% interest in the Exploration Block 11B/12B, offshore South Africa, to Qatar Petroleum. The transaction remains subject to regulatory approval. |

2018, February, 27, 13:05:00

NIGERIA'S ECONOMY UP TO 1.92%REUTERS - Oil production rose to 1.91 million barrels a day (mbpd) in the last quarter of 2017 compared with 1.76 mbpd in the same period of 2016, the statistics office said. |

2018, February, 2, 12:05:00

SOUTH AFRICA'S GAS UPEIA - South Africa is one of the world’s leading emitters of energy-related carbon dioxide (CO2), ranking fifteenth globally in 2015 and accounting for more than any other country in Africa. In an effort to reduce CO2 emissions, South Africa is planning to diversify its energy portfolio, replacing coal with lower CO2-emitting fuels such as natural gas and renewable sources. The country’s Intended National Determined Contribution, submitted as part of the Paris Agreement, plans for CO2 emissions to peak by 2025, remain flat for a decade, and begin to decline around 2035. |

2017, December, 27, 12:20:00

NIGERIA'S CHALLENGESIMF - Overall growth is slowly picking up but recovery remains challenging. Economic activity expanded by 1.4 percent year-on-year in the third quarter of 2017—the second consecutive quarter of positive growth after five quarters of recession—driven by recovering oil production and agriculture. |