OIL PRICE: ABOVE $75 TOO

REUTERS - Oil climbed towards $76 a barrel on Wednesday, supported by tight supplies despite expectations OPEC and its allies will pump more in the second half of 2018 and helped by forecasts U.S. inventories fell.

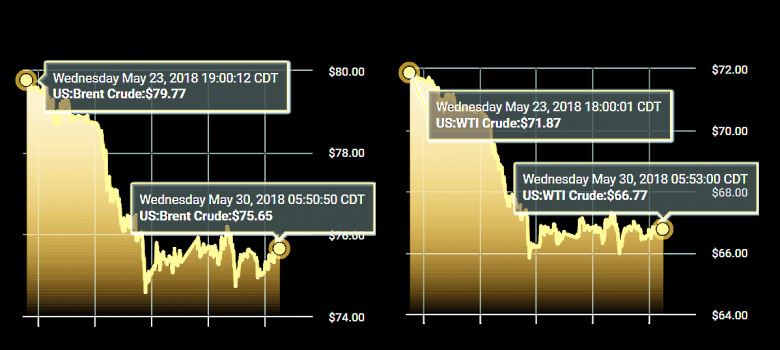

Global benchmark Brent crude has dropped almost $5 from a 3 1/2-year high of $80.50 a barrel on May 17, after reports that OPEC and Russia may increase supply at a June meeting.

This would reverse policy after 17 months of supply curbs that have largely removed excess global oil inventories.

Brent LCOc1 rose 40 cents to $75.79 a barrel by 0925 GMT, after trading as low as $74.81 earlier. U.S. crude CLc1 was up 25 cents at $66.98.

"Fundamentally, not much has changed. Oil remains well supported, although the sweetspot has entered a mature phase," said Konstantinos Venetis, senior economist at TS Lombard.

"Some air is fizzling out of the market and position-squaring raises the likelihood of an overshooting to the downside in the run-up to OPEC's June meeting."

Political turmoil in Italy has sent the euro to a 10-month low against the dollar on concern a snap election would lead to a eurosceptic government in Rome. A stronger dollar makes dollar-denominated oil more expensive for holders of other currencies.

"A dearth of bullish catalysts will make hard work of any recovery," said Stephen Brennock of oil broker PVM.

The Organization of the Petroleum Exporting Countries and non-OPEC producers led by Russia have had a pact to curb output by about 1.8 million barrels per day since January 2017, driving down inventories and pushing up oil prices.

Amid concerns the price rally has gone too far, Saudi Arabia and Russia are discussing raising OPEC and non-OPEC oil output by around 1 million bpd, sources told Reuters on May 25. OPEC meets in Vienna on June 22.

Still, some analysts remain cautious as the details have yet to be worked out. Ministers from Saudi Arabia, Kuwait and the United Arab Emirates meet this weekend, a source said.

"Clarity will likely take some time to emerge," said JBC Energy.

Lending some support to prices were expectations that U.S. crude inventories probably fell by 1.8 million barrels last week according to a Reuters poll.

Industry group American Petroleum Institute (API) releases its weekly supply report at 2030 GMT on Wednesday, followed by the official government data on Thursday.

-----

Earlier:

2018, May, 28, 11:45:00

OIL PRICE: ABOVE $75 AGAINREUTERS - Brent crude futures LCOc1 stood at $75.35 a barrel at 0913 GMT, down $1.09 from the previous close and after touching a three-week low of $74.49 earlier in the session. U.S. West Texas Intermediate (WTI) crude futures were at $66.69, down $1.19, after hitting a six-week low of $65.80. |

2018, May, 28, 11:40:00

БУДЕТ ПЛАВНОЕ СОКРАЩЕНИЕМИНЭНЕРГО - «В целом, все согласны, что нужно этот вопрос очень серьезно обсудить на Министерской встрече, которая состоится в июне в Вене. Там будут предложены различные варианты. Но, скорее всего, это будет плавное сокращение. Наша задача – и не дестабилизировать рынок нефти, и не перегреть его», - сказал Александр Новак |

2018, May, 28, 11:35:00

ЦЕНА НЕФТИ: $80МИНЭНЕРГО - Глава Минэнерго России отметил, что цена на нефть сегодня близка к 80 долларам, а год назад она была 51,5 долларов. «Год назад мы наблюдали только начало балансировки рынка, сегодня мы вышли на позитивные изменения по сравнению с прошлым годом. Сделка ОПЕК+ показала положительный результат. Цели, которые ставились, достигаются», - сообщил Александр Новак.

|

2018, May, 25, 10:55:00

OIL PRICE: ABOVE $78REUTERS - Brent crude futures LCOc1 were at $78.63 per barrel at 0534 GMT, down 16 cents from their last close, and more than 2.2 percent below the $80.50 multi-year high they reached on May 17. Brent broke through $80 for the first time in more than three years earlier in May. U.S. West Texas Intermediate (WTI) crude futures were at $70.60 a barrel, down 11 cents from their last settlement. |

2018, May, 25, 10:50:00

ПЕРСПЕКТИВЫ СДЕЛКИ ОПЕК+МИНЭНЕРГО РОССИИ - Министр отметил, что в ходе предстоящей встречи с коллегой из Саудовской Аравии Халидом аль-Фалихом планируется обсудить текущую ситуацию на рынке нефти и дальнейшие действия в рамках сделки ОПЕК+. «Возможность смягчения ограничений по сделке имеется, но должна основываться на тщательном анализе ситуации. По большому счету, мы занимаем достаточно гибкую позицию», – сказал Александр Новак. |

2018, May, 23, 10:50:00

OIL PRICE: ABOVE $79 ANEWREUTERS - Brent LCOc1 futures fell 43 cents, or 0.5 percent, to $79.14 a barrel by 0218 GMT, after climbing 35 cents on Tuesday. Last week, the global benchmark hit $80.50 a barrel, the highest since November 2014. U.S. West Texas Intermediate (WTI) crude CLc1 futures eased 25 cents, or 0.4 percent, to $71.95 a barrel, having climbed on Tuesday to $72.83 a barrel, the highest since November 2014. |

2018, May, 23, 10:45:00

HARD OIL MARKETFT - Most oil majors can now cover dividends and capital expenditure at prices around $50 per barrel, meaning that, at $80, they make a healthy surplus. |