OIL PRICE: ABOVE $75 YET

REUTERS - Oil prices eased slightly on Tuesday, a day after hitting 3-1/2 year highs, as investors braced for President Donald Trump's decision on whether to withdraw the United States from the Iran nuclear deal, a move that could disrupt global oil supply.

European shares are seen steady to slightly firmer after Asian shares picked up, helped by technology stocks as generally upbeat earnings overcame weakness in the global smartphone market and concerns about more regulation.

Spread-betters expect Britain's FTSE to rise 0.2 percent and Germany's Dax to inch up 0.1 percent.

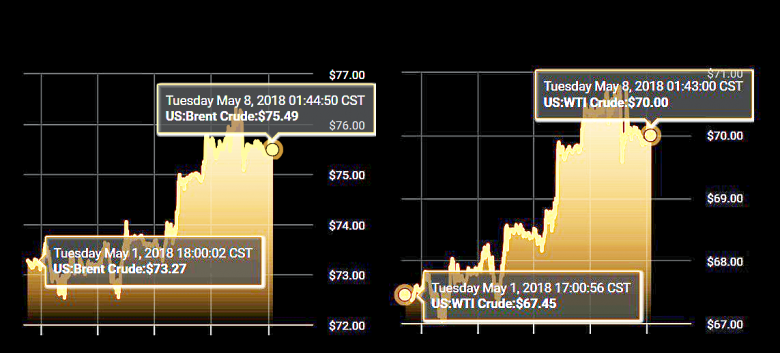

U.S. West Texas Intermediate (WTI) crude futures on Monday rose above $70 for the first time since November 2014, putting it more than 18 percent above this year's low touched in February.

On Tuesday, some of those oil-price gains were pared as traders took profit after Trump said in a tweet he would announce his decision on the nuclear deal at 1800 GMT Tuesday.

"The oil market has priced in the high likelihood of Trump withdrawing from the nuclear deal with Iran. If he is going to impose sanctions similar to those the U.S. had in 2012, that would likely cause a shortage in oil," said Tatsufumi Okoshi, senior commodity economist at Nomura Securities.

Adding to market pressures, falls in Venezuelan oil production due to problems at the country's oil company PDVSA also added to the rally.

U.S. crude futures last traded at $70.11 per barrel, down 0.9 percent from Monday's settlement price.

Global benchmark Brent crude futures stood at $75.64 per barrel, down 0.7 percent, having risen as high as $76.34 on Monday.

While caution on Trump's statement kept investors edgy in early trade, technology firms helped to generate gains for Asian equities.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.6 percent, with information technology shares rising 1.3 percent. Japan's Nikkei was 0.2 percent higher.

SOARING VALUATIONS

Some analysts cautioned that the rally in technology shares could face a short-term correction as valuations soar.

Yoshinori Shigemi, global market strategist at JPMorgan Asset Management in Tokyo, noted that technology shares have been moving higher, taking up a larger share of indices as more money flows into the exchange trade funds (ETF) market.

There is currently a "positive feedback loop", but if some sort of unforeseen negative event takes place, it "may turn into a negative feedback loop," he said.

China's blue-chip CSI300 index rose 1.3 percent after the White House said on Monday that U.S.-China trade talks would resume next week.

On Tuesday, China reported exports and imports jumped in April, beating forecasts, but the news did not impact markets.

On Wall Street on Monday, the S&P 500 gained 0.35 percent, boosted by Apple's sixth straight day of gains.

In currency markets, the dollar broadly held firm on the prospect of solid U.S. economic growth, helped partly by Trump's tax cuts and spending, pointed to further rises in U.S. interest rates down the road.

That prompted investors to buy back dollars they had sold earlier this year on worries about Trump's protectionist trade policies.

The euro hit a four-month low of $1.1897 on Monday and last stood at $1.1930.

Against the yen, the dollar stood little changed at 108.93 yen, off its three-month high of 110.05 yen.

The combination of higher oil prices, a strong dollar and higher U.S. rates is risky for some emerging market assets as it could significantly worsen their trade balance and also encourage investors to shift funds to higher-yielding U.S. assets.

"The emerging market currencies are now playing catch up with some of the excessive losses seen in developed currencies ... Asian currencies have also fallen victim to the latest round of USD buying momentum," Jameel Ahmad, Global Head of Currency Strategy & Market Research at FXTM wrote in a note.

JPMorgan's emerging market bond index hit its lowest level in more than a year.

The Indian rupee hit a 15-month low while the Indonesian rupiah hit its lowest level since December 2015 on Tuesday.

Dhian Karyantono, fixed income analyst at Mirae Asset Sekuritas Indonesia, said that the rupiah had weakened after weaker-than-expected first-quarter growth data.

Indonesia's economy grew at 5.06 percent in January-March, down from 5.19 percent in the previous quarter.

The divergence between developed and emerging markets was also visible in equity prices. Brazil's Bovespa hit three-month lows on Monday, when Germany's Dax hit three-month highs and Italian shares hit 8-1/2-year highs.

-----

Earlier:

2018, May, 7, 08:50:00

OIL PRICE: ABOVE $75REUTERS - Brent crude oil futures were at $75.71 per barrel, up 84 cents, or 1.12 percent from their last close at 0416 GMT after climbing to $75.89 a barrel earlier in the session, its highest since November 2014. U.S. West Texas Intermediate (WTI) crude futures rose 0.95 percent to trade at $70.39 per barrel, up 66 cents from their last settlement. |

2018, May, 7, 08:45:00

ЦЕНА URALS: $ 66,15МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – апреля 2018 года составила $ 66,15 за баррель. В 2017 году средняя цена на Urals в январе – апреле составила $ 51,84 за баррель. Средняя цена на нефть марки Urals в апреле 2018 года сложилась в размере $ 69,08 за баррель, что в 1,35 раза выше, чем в апреле 2017 года ($ 51,11 за баррель). |

2018, May, 7, 08:35:00

IRAN NEEDS REASONABLE PRICESHANA - Iranian Minister of Petroleum Bijan Zangeneh said Tehran preferred "reasonable" price for crude oil in a bid to avoid market instability. |

2018, May, 4, 15:40:00

OIL PRICE: NOT ABOVE $74 YETREUTERS - Brent crude oil futures LCOc1 were up 31 cents at $73.44 a barrel by 0900 GMT, after falling nearly 3 percent on Tuesday to its lowest in two weeks. U.S. West Texas Intermediate (WTI) crude futures rose 50 cents to $67.75 per barrel. |

2018, May, 4, 15:30:00

SAUDIS NEED $88BLOOMBERG - The IMF bolstered its estimate for the oil price the kingdom needs to balance the national budget this year to $88 a barrel, 26 percent more than an assessment made in October.

|

2018, May, 2, 13:35:00

OIL PRICE: NOT ABOVE $74 ANEWREUTERS - Brent crude oil futures LCOc1 were up 31 cents at $73.44 a barrel by 0900 GMT, after falling nearly 3 percent on Tuesday to its lowest in two weeks. U.S. West Texas Intermediate (WTI) crude futures rose 50 cents to $67.75 per barrel.

|

2018, April, 30, 10:25:00

OIL PRICE: ABOVE $74 ANEWREUTERS - Brent crude futures LCOc1, the international benchmark, had dipped 50 cents, or 0.7 percent, to $74.14 a barrel by 0633 GMT. Prices climbed as high as $75.47 last week, levels not seen since November, 2014. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $67.82 a barrel, down 28 cents, or about 0.4 percent, from their last settlement.

|