OIL PRICE: NOT ABOVE $74 ANEW

REUTERS - Oil recovered some ground on Wednesday after the previous day's slide, helped by concerns about possible renewed U.S. sanctions on major exporter Iran although price gains were capped by rising U.S. supply.

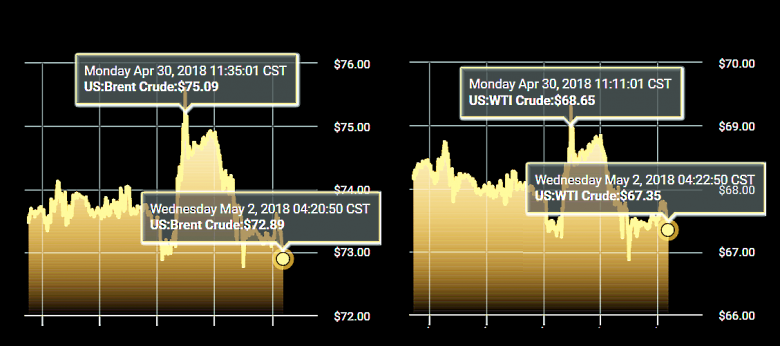

Brent crude oil futures LCOc1 were up 31 cents at $73.44 a barrel by 0900 GMT, after falling nearly 3 percent on Tuesday to its lowest in two weeks.

U.S. West Texas Intermediate (WTI) crude futures rose 50 cents to $67.75 per barrel.

"Geopolitical noise remains loud and in part pushed oil prices towards $75 per barrel," said Norbert Ruecker, head of commodity and macro strategy at Julius Baer. "The elevated uncertainty suggests volatile but range-bound oil prices going forward."

Iran, a member of the Organization of the Petroleum Exporting Countries, re-emerged as a major oil exporter in January 2016 when some international sanctions against Tehran were lifted in return for curbs on Iran's nuclear programme.

The United States has questioned Iran's sincerity in implementing the nuclear curbs and President Donald Trump has threatened to reimpose sanctions if adjustments are not made to the agreement.

Iran's oil exports hit 2.6 million barrels per day (bpd) in April, according to the Oil Ministry, a record since the lifting of sanctions. China and India bought more than half of the oil.

"The expectation that the U.S. will leave the sanctions waivers is leading Iran to sell as much as it can," Petromatrix strategist Olivier Jakob said.

Trump will decide by May 12 whether to restore U.S. sanctions on Iran, which would likely reduce its oil exports.

"If Trump abandons the deal, he risks a spike in global oil prices," said Ole Hansen, head of commodity strategy at Saxo Bank, adding that re-introducing U.S. sanctions could remove 300,000-500,000 bpd of Iranian oil from global supplies.

However, the rising value of the dollar since mid-April .DXY and soaring U.S. supplies has helped check further oil price gains, traders said.

U.S. crude inventories rose by 3.4 million barrels to 432.575 million in the week to March 27, according to a report by the American Petroleum Institute on Tuesday.

Rising inventories are partly due to soaring U.S. production, which jumped by a quarter in the last two years to 10.6 million bpd.

The United States has now overtaken Saudi Arabia to become world's second biggest crude producer after Russia.

-----

Earlier:

2018, April, 30, 10:25:00

OIL PRICE: ABOVE $74 ANEWREUTERS - Brent crude futures LCOc1, the international benchmark, had dipped 50 cents, or 0.7 percent, to $74.14 a barrel by 0633 GMT. Prices climbed as high as $75.47 last week, levels not seen since November, 2014. U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $67.82 a barrel, down 28 cents, or about 0.4 percent, from their last settlement.

|

2018, April, 27, 11:20:00

OIL PRICE: ABOVE $74 YETREUTERS - Global benchmark Brent crude futures LCOc1 were down 27 cents, or 0.4 percent, at $74.47 a barrel by 0644 GMT, after rising 1 percent on Thursday. U.S. West Texas Intermediate (WTI) crude CLc1 fell 19 cents, or 0.3 percent, to $68 a barrel. The contract gained 0.2 percent the previous session. |

2018, April, 27, 11:15:00

БАЛАНС МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак, говоря о перспективах соглашения о балансировке рынка, отметил, что участники рассматривают несколько вариантов дальнейшего сотрудничества. «Главная задача – не создать условия для дисбаланса на рынке», - заключил Министр. |

2018, April, 27, 10:50:00

NEW CHINA'S OILEIA - As Asia-Pacific oil demand continues to grow, some market participants believe the region needs an oil price benchmark based on local supply and demand conditions. Last month marked the beginning of trading for the new Shanghai crude oil futures contract in China. For the Shanghai contract to become an accepted regional benchmark, it will have to attract a wide variety of market participants, and its usage for price discovery must be established. |

2018, April, 25, 10:20:00

OIL PRICE: NOT ABOVE $74 AGAINREUTERS - Brent crude oil futures LCOc1 were at $73.89 per barrel at 0455 GMT, up 3 cents from their last close but around $1.60 below the November-2014 high of $75.47 a barrel reached the previous day. U.S. West Texas Intermediate (WTI) futures were flat at $67.7 63 per barrel, but off the late-2014 highs of $69.56 a barrel marked earlier in April. |

2018, April, 23, 14:50:00

РОССИЯ - ОПЕК: 149%МИНЭНЕРГО РОССИИ - страны ОПЕК и государства, не входящие в ОПЕК, выполнили соглашение по добровольной корректировке объемов добычи нефти на 149%, что является самым высоким показателем в истории соглашения. |

2018, April, 20, 09:20:00

OIL STOCKS & PRICES UPFT - Oil prices hit their highest level since 2014 on Thursday, moving above $74 a barrel and lifting energy companies to the top of global stock indices. |