SAUDIS NEED $88

BLOOMBERG - Whenever Saudi Arabian officials are asked what oil price the kingdom want, they almost always reply that they have no preference. Recent reports that the world's largest exporter was aiming for $80 a barrel elicited the same response: there's no target.

But the International Monetary Fund's latest report on the Saudi economy shows why the government would like prices to keep climbing, no matter what they say in public.

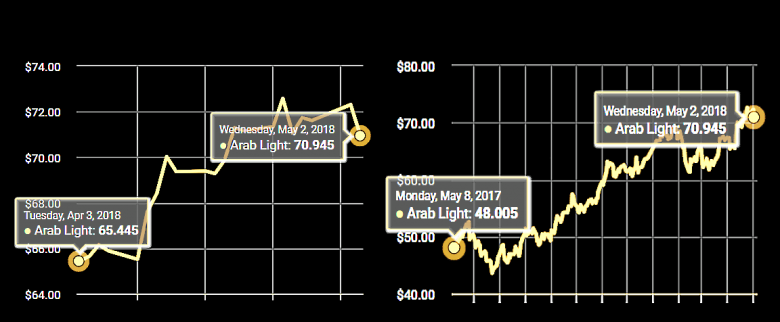

In a study released Wednesday, The IMF bolstered its estimate for the oil price the kingdom needs to balance the national budget this year to $88 a barrel, 26 percent more than an assessment made in October. Benchmark Brent crude traded at $73 in London on Wednesday.

Saudi Arabia is spearheading a 24-nation coalition of oil producers in output cuts aimed at re-balancing world markets. Though they've succeeded in clearing surplus inventories, the kingdom insists the curbs should continue, fanning speculation that it's main aim has been securing a higher price.

"It gives credibility to that," said Helima Croft, chief commodities strategist at RBC Capital Markets LLC. "It raises again the interesting question of Saudi switching from being a dove to a hawk" in terms of oil price ambitions.

While Saudi Arabia rulers have always needed sufficient revenues to provide for their citizens, the burden of Crown Prince Mohammad bin Salman is weightier as he pursues dramatic economic transformation and a drawn-out war in Yemen.

The crown prince needs a "bridge price" for oil that's high enough to cover immediate spending needs while he embarks on social change that ultimately shrinks the role of the state, Croft said.

Saudi Energy Minister Khalid al-Falih, speaking in Jeddah last month, repeated that the kingdom doesn't pursue a particular price and is focused solely on keeping markets stable over the long-term.

The kingdom's most powerful ally, the U.S. may see things a little differently. President Donald Trump took to Twitter in April to criticize OPEC for policies that mean higher gasoline prices for American consumers.

The IMF's increase reflects the government's plan to boost public spending to a record this year in an attempt to revive economic growth.

"Because of the scale of his regional and domestic ambitions" the Saudis are 'going to need to have that bridge," she said.

-----

Earlier:

2018, May, 2, 13:30:00

SAUDIS NEED $85REUTERS - Saudi Arabia has projected a budget deficit of 195 billion riyals ($52 billion) in 2018, or 7.3 percent of GDP, down from 230 billion riyals last year. It plans to balance the budget by 2023.

|

2018, April, 18, 13:12:00

RUSSIA - OPEC DIMENSIONPLATTS - Russia is committed to its OPEC pact with Saudi Arabia and will continue supplying Europe energy despite tensions with the West after US-led strikes on Bashar al-Assad's Syrian regime, said Vladimir Putin's spokesman. |

2018, April, 13, 17:55:00

HARD OIL MARKETBLOOMBERG - OPEC said its oil output fell to the lowest in a year last month amid reduced supplies from Venezuela and Saudi Arabia, suggesting global markets may tighten sharply later this year. |

2018, April, 13, 17:30:00

SAUDI'S FUNDING $11 BLNREUTERS - Saudi Arabia has largely covered its hard currency funding needs for 2018 by completing this week’s $11 billion international bond issue, the head of the kingdom’s debt management office said. |

2018, April, 2, 09:25:00

LONG-TERM OPEC COOPERATIONSHANA - Leaders of the UAE, OPEC’s biggest producer Saudi Arabia and non-OPEC member Russia support extending energy cooperation beyond 2018. Cooperation on the part of a politically influential oil producer like Russia would add to the weight and influence of OPEC in global energy markets, both politically and in terms of decision-making. |

2018, March, 26, 07:55:00

$70: INSUFFICIENT FOR INVESTMENTSBLOOMBERG - Oil’s recovery to almost $70 a barrel hasn’t been sufficient to stimulate the return of enough investment in the sector, according to Saudi Arabia’s energy minister. |

2018, February, 16, 23:30:00

SAUDIS - RUSSIA AGREEMENTFT - Crude producers led by Saudi Arabia and Russia will aim to draft an agreement to formalise their partnership for oil market co-operation by the end of 2018, the UAE’s energy minister said. |