SAUDIS - RUSSIA COORDINATION

FT - Saudi Arabia will not act unilaterally to increase oil supplies following renewed US sanctions on Iran's energy industry, a Gulf source familiar with Riyadh's thinking said, with any rise in output to be co-ordinated with Russia and other producers.

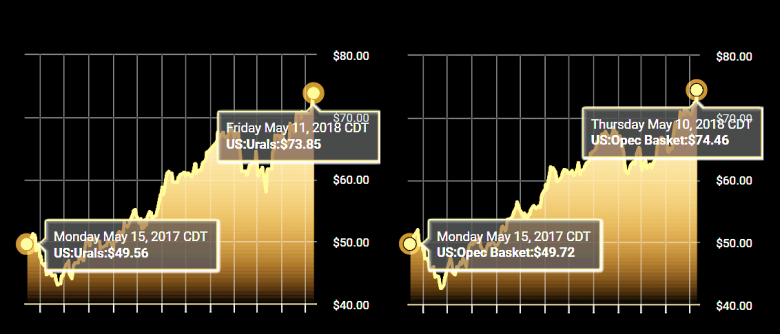

The comments, which came as oil crested $77 a barrel for the first time since 2014 on fears of a drop in Iranian exports, are a signal that the Opec kingpin is not willing to turn its back on a growing energy alliance with Russia, with which it has worked since early 2017 to manage output and help prices recover.

"Any action will be taken in co-ordination with other producers," the person said on Wednesday, adding that Saudi Arabia was already in talks with Russia and other producers, including the UAE.

Khalid al-Falih, the kingdom's energy minister, confirmed the move on Twitter, saying Saudi Arabia would "work closely" with big Opec countries and those outside the cartel to "mitigate the effects of any supply shortages".

The US Treasury said on Tuesday it was not concerned about a price jump following Washington's decision to withdraw from the Iran nuclear deal because it had spoken with oil producers, assumed to include its ally Saudi Arabia, about keeping markets well supplied.

But Saudi Arabia is not keen to return to taking sole responsibility for managing the market and remains committed to the Opec deal with Moscow, which was backed by the kingdom's powerful crown prince Mohammed bin Salman and Russian president Vladimir Putin.

Saudi Arabia will meet Russia in the next two weeks.

The kingdom's position suggests a break with past oil shortages when the US was able to push Riyadh directly to cool runaway prices.

While the kingdom still seeks market stability, co-ordination with Russia, itself hit with US sanctions, suggests an added layer of complication.

The person familiar with the kingdom's thinking said that Opec and allies outside of the cartel would again co-ordinate efforts should the market require additional supplies or if prices spiked too high. There are 24 countries participating in the current supply deal.

"Everyone has to be part of the decision," he said. "It is not going to be one country doing everything."

Debate has grown about when countries exit the existing deal, with Russia concerned about rising prices boosting rival production from the US.

Although Saudi Arabia has pushed for higher prices in recent months, particularly as it funds an ambitious reform programme, it does not want a spike in prices that could hurt demand for oil.

"We don't want prices fluctuating wildly in a way that might hurt the global economy and consumers," the person added.

Despite talk of co-ordination, he acknowledged Saudi Arabia's unique position in holding the world's largest amount of spare production capacity with the ability to pump 12.5m barrels a day. This compares with 9.9m b/d it produced in March.

Bob McNally, a former White House energy adviser, said the kingdom was trying to balance its long-term relationship with the US while not spooking allies.

He described it as "nuanced, dual-purpose signalling" that was "intended for the White House, crude traders and other . . . producers, especially Moscow".

"It's pretty clear Saudi Arabia holds the bulk of true spare [capacity] and Crown Prince MBS won't have to call President Putin for an OK to step up. Nor would President Trump accept that excuse. When a US president wants more oil in a hurry, he still has one number on the speed dial — Riyadh's."

Mr McNally, who helped co-ordinate phone calls between former US president George W Bush's administration and Riyadh in 2001, said it was likely Saudi Arabia could still choose to act unilaterally with small output increases.

Ahead of Opec and Russia's next official meeting in late June, the person familiar with Saudi thinking said there was no threshold for action yet, either in the form of lost barrels or price levels.

"We do not have a specific number," adding that the kingdom did not expect any impact on physical barrels for at least three months.

-----

Earlier:

2018, May, 10, 13:10:00

OIL MARKET STABILITYPLATTS - Saudi Arabia's energy minister Khalid al-Falih said Wednesday that the country would work closely with OPEC as well as non-OPEC producers to mitigate the impact of any shortages that might arise following the US' decision to withdraw from the Iran nuclear deal. |

2018, May, 7, 08:35:00

IRAN NEEDS REASONABLE PRICESHANA - Iranian Minister of Petroleum Bijan Zangeneh said Tehran preferred "reasonable" price for crude oil in a bid to avoid market instability.

|

2018, May, 4, 15:30:00

SAUDIS NEED $88BLOOMBERG - The IMF bolstered its estimate for the oil price the kingdom needs to balance the national budget this year to $88 a barrel, 26 percent more than an assessment made in October. |

2018, April, 27, 11:15:00

БАЛАНС МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак, говоря о перспективах соглашения о балансировке рынка, отметил, что участники рассматривают несколько вариантов дальнейшего сотрудничества. «Главная задача – не создать условия для дисбаланса на рынке», - заключил Министр. |

2018, April, 23, 14:50:00

РОССИЯ - ОПЕК: 149%МИНЭНЕРГО РОССИИ - страны ОПЕК и государства, не входящие в ОПЕК, выполнили соглашение по добровольной корректировке объемов добычи нефти на 149%, что является самым высоким показателем в истории соглашения. |

2018, April, 13, 18:05:00

OPEC - RUSSIA COOPERATION TO 2019REUTERS - “There is growing confidence that the declaration of cooperation will be extended beyond 2018,” Barkindo told. “Russia will continue to play a leading role.” |

2018, April, 13, 17:55:00

HARD OIL MARKETBLOOMBERG - OPEC said its oil output fell to the lowest in a year last month amid reduced supplies from Venezuela and Saudi Arabia, suggesting global markets may tighten sharply later this year. |