SOUTHEAST ASIA: THE MAIN ENGINE

IMF - IMF the latest Regional Economic Outlook for Asia and Pacific.

First, the region remains the main engine of global growth, accounting for more than 60 per cent of the global growth. Regional output is projected to grow by 5.6 per cent in 2018 and 2019; 5.6 per cent is about 0.1 percentage point higher than we expected in last October, supported by trade as well as accommodative global financial conditions.

Second, in the short term, clouds are gathering. Risks are broadly balanced for now. But over the medium term, downside risks dominate; including from a tightening of global financial conditions, a shift towards more inward-looking trade policies, and an increase in geopolitical tensions. Over the longer term, Asia faces a number of important challenges, from population aging, slowing productivity growth, and the digital revolution, which of course brings huge opportunities together with challenges.

Third, Asia has enjoyed relatively subdued inflation even as growth has been strong; but policymakers should not be complacent -- temporary global forces have been a key driver of low inflation in Asia; and these could well reverse in the near future.

Fourth, the strong economic outlook provides a valuable opportunity to focus macroeconomic policies on building buffers, increasing resilience, and pushing ahead with structural reforms to address longer-term challenges. As our Managing Director mentioned, while the sun is shining, it's the time to fix the roof.

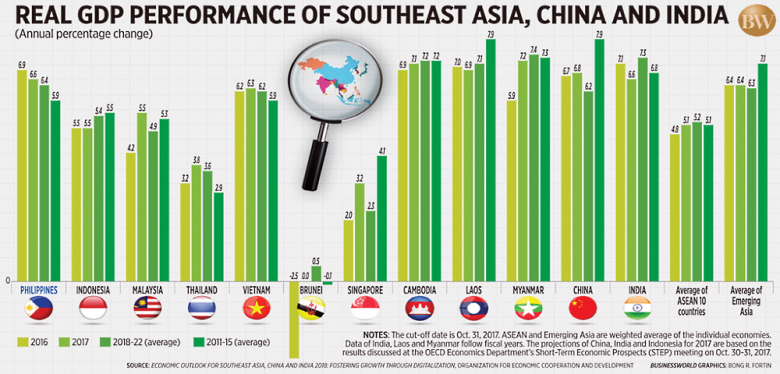

For most economies, we revised our growth forecast upward relative to last October's forecast. In China, growth is expected to moderate to 6.6 percent in 2018 - 0.1 percentage point higher than expected in October - as financial, housing and fiscal tightening measures take effect. Hong Kong economy's growth is expected to remain strong at about 3.6 per cent in 2018. In Japan, growth has been above potential for eight consecutive quarters and is expected to remain strong at 1.2 percent this year. In India, growth is forecast to rebound to 7.4 percent in fiscal year 2018/19 as the economy recovers from disruptions related to the currency exchange initiative and the rollout of the new Goods and Services Tax.

So broadly speaking, the big picture is quite bright in Asia. Another good news is that the current pick-up and growth momentum is quite diverse and broad-based. In the last couple of years, China actually led Asia's growth; but currently, India is one of the fastest-growing large economies in the world. The growth momentum of Japan is also quite strong. So overall, I think Asia has many growth engines at this moment. On the other hand, clouds are gathering. So, let's discuss about risks.

On the upside, the global recovery could again prove stronger than expected amid strong consumer and business confidence and still loose financial conditions; especially US growth may be higher than expected due to the temporary fiscal stimulus. Recent releases of national accounts data for Q1 in China and the US are broadly in line with our projections, even though Q1 performance in the Euro Area seems slightly lower than we expected.

On the downside risk, Asia remains vulnerable to a tightening in global financial conditions. In the last few weeks, US 10-year sovereign yield started rising, the US Dollar strengthened, and capital flows to emerging markets slowed down. We haven't seen capital outflow evidence, but still there is some evidence building up that capital inflow to the emerging markets slowed down. Another downside risk is definitely the more inward-looking trade policies, as highlighted by recent tariff actions and announcements. That will certainly affect an open region like Asia. Also, geopolitical tensions could have serious repercussions on financial markets and on oil prices.

One aspect we are focussing on at this moment is low inflation in Asia. Despite strong growth, inflation in Asia has remained relatively low. Indeed, the gaps between actual inflation and inflation targets are generally larger in Asia than in other regions.

Our analysis suggests that recent low inflation in Asia has been driven mainly by temporary forces, including imported inflation from advanced economies, and higher oil and commodity prices, but these could of course reverse. Moreover, the inflation process has become more backward-looking, that is stickier, suggesting that if inflation rises in the future, it may persist. And finally, there is some evidence that the Phillips curve has flattened, which means that the sensitivity of inflation to economic slack has decreased. This suggests that if inflation rises again, the output cost to rein in inflation pressure may be large. So for Asia policymakers, now is a good time to be more attentive to the inflation dynamics in the region. I do not mean that at this moment, inflation momentum is very strong; but there's a good reason that Asia policymakers need to be more attentive.

So, what should we do and what is our policy recommendations for Asia? Against this backdrop, policies should aim to strengthen buffers, increase resilience and ensure sustainability. With output gaps closing in much of the region, fiscal policy should generally be geared towards strengthening buffers and safeguard sustainability. Subdued inflation provides scope for continuing accommodative monetary policy in much of Asia if the output gap still exists. But given our research findings on inflation, policymakers should be vigilant towards any incipient signs of inflation pressure. Strengthening monetary policy frameworks and central bank communications can better anchor expectations, and exchange rate flexibility can help to insulate economies from imported inflation.

The current growth momentum, in sum, provides an opportunity to pursue fiscal, financial, and structural reforms; including those to promote inclusive growth and allow economies to reap the full benefits of the digital revolution. In sum, the big picture is bright; but clouds are gathering. So it's a time to fix the roof while the sun is shining. That is our key messages. Thank you.

-----

Earlier:

2018, May, 10, 13:15:00

INDIA'S OIL RISKBLOOMBERG - India sees a greater probability of global crude oil prices remaining high for a longer period, a scenario that threatens to dent growth and fan inflation in Asia’s third-largest economy. |

2018, May, 4, 15:25:00

CHINA'S OIL DEMAND UP 6.8%PLATTS - China ended the first quarter of 2018 with robust apparent oil demand growth of 6.8% year on year, as stronger-than-expected GDP growth boosted consumption from the industrial and construction sectors and outweighed concerns over rising oil prices |

2018, April, 30, 10:20:00

СОТРУДНИЧЕСТВО ЯПОНИИ И РОССИИМИНЭНЕРГО РОССИИ - В заключение заседания Александр Новак подчеркнул приверженность сконцентрированной работе, направленной на реализацию достигнутых договоренностей по совместным проектам сотрудничества. «Минэнерго России продолжит и дальше оказывать максимальное содействие проектам российско-японского энергетического сотрудничества. Главное – последовательно наращивать усилия наших министерств, сообща помогать бизнесу в осуществлении коммерческих инициатив», - резюмировал Министр. |

2018, April, 25, 09:55:00

ASIA'S LNG DEMANDREUTERS - global liquefied natural gas (LNG) imports have risen 40 percent since 2015, to almost 40 billion cubic meters (bcm) a month. Growth accelerated in 2017, with imports up by a fifth, largely because of rising demand in China, but also in South Korea and Japan. |

2018, April, 16, 09:30:00

SOUTHEAST ASIA: ENHANCING POTENTIALWBG - Growth in developing East Asia and Pacific (EAP) is expected to remain strong and reach 6.3 percent in 2018, according to the latest World Bank economic report on the region. Prospects for a continued broad-based global recovery and robust domestic demand underpin this positive outlook. Still, emerging risks to stability and sustained growth require close attention. |

2018, April, 16, 09:25:00

WBG: SOUTH ASIA'S GROWTHWBG - South Asia has regained its lead as the fastest growing region in the world, supported by recovery in India. With the right mix of policies and reforms, growth is expected to accelerate to 6.9 percent in 2018 and 7.1 percent next year. |

2018, April, 11, 13:30:00

INDIA WANTS $50BLOOMBERG - “We are a very price-sensitive consumer,’’ Pradhan said on Tuesday. “From Indian consumers’ point of view, I will be more than happy if the price is around $50 a barrel.’’ |