TIGHT MARKET BALANCE

IEA - The decision by the United States to withdraw from the Joint Comprehensive Plan of Action regulating Iran's nuclear activities has switched the focus of oil market analysis from the fundamentals to geopolitics. In these early days, there is understandable uncertainty about its potential impact on Iran's oil exports, which are currently about 2.4 mb/d. There is a 180-day period for customers to adjust their purchasing strategies and it remains to be seen how waivers and other aspects of the sanctions will be implemented. In addition, other signatories to the JCPOA have said that they will continue with the agreement.

When sanctions were imposed in 2012, Iran's exports fell by about 1.2 mb/d. It is too soon to say what will happen this time, but we should examine whether other producers could step in to ensure an orderly flow of oil to the market and offset a disruption to Iranian exports. Neither Venezuela nor Mexico can raise output in the short term, but some of the 1.5 mb/d that have been cut by other producers under the Vienna Agreement might be available to keep markets well supplied. A statement by Saudi Arabia shortly after the US announcement acknowledged the need to work with producers and consumers to mitigate possible supply shortfalls. This is especially welcome since the possibility of lower Iranian exports is not the only supply risk hanging over the market today.

In Venezuela, the pace of decline of oil production is accelerating and by the end of this year output could have fallen by several hundred thousand barrels a day. Our April data show that Venezuela's production is 550 kb/d lower than its target under the Vienna Agreement and this "excess" is more than Saudi Arabia's total commitment. The potential double supply shortfall represented by Iran and Venezuela could present a major challenge for producers to fend off sharp price rises and fill the gap, not just in terms of the number of barrels but also in terms of oil quality.

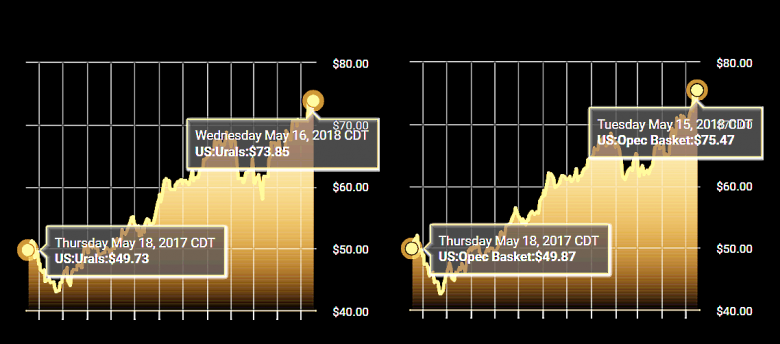

The decision by the US Administration had, to some extent, already been factored into oil prices. Even so, alongside steady demand growth, solid compliance with the Vienna Agreement, and new data showing a further fall in stocks, it contributed to Brent prices rising above $77/bbl. As key players consider how to react to the new policy, this Report shows that the market balance continues to tighten, though by slightly less than seen last month. Because of rising prices, we lowered our estimate for 2018 global oil demand growth by 40 kb/d to 1.4 mb/d, and we increased our expectation for US oil production growth this year by 120 kb/d.

As the International Monetary Fund noted recently, the global economy is doing well. Therefore, we remain confident that underlying demand growth remains strong around the world, which has been an important factor in the rise in oil prices. Still, the fact is that crude oil prices have risen by nearly 75% since June 2017. It would be extraordinary if such a large jump did not affect demand growth, especially as end- user subsidies have been reduced or cut in several emerging economies in recent years.

On the supply side, in today's uncertain geopolitical climate, higher production from the US will be an important contribution to compensating for lower volumes from elsewhere. For now, this Report shows a modest increase in our estimate for US output growth in 2018, mindful of the current logistics constraints that have manifested themselves in the extraordinary widening of the differential between WTI prices at Midland and the Gulf Coast to $15/bbl. We note that several projects are in development to ease regional bottlenecks and to help rising US production reach markets.

For some time, the focus has been on OECD stocks, and new data show a further decline in March of 27 mb to the lowest level in three years and to 1 mb below the widely cited five-year average figure. For now, the rapidly changing geopolitical landscape will move the attention away from stocks as producers and consumers consider how to limit volatility in the oil market. For its part, the IEA will monitor developments closely and is ready to act if necessary to ensure that markets remain well supplied.

-----

Earlier:

2018, May, 16, 12:30:00

OIL MARKET BALANCEPLATTS - "It is too early to say [what the impact of the US decision on the oil market will be]. In any case, we have all the tools that could be used to balance the market," Novak said, commenting on the potential impact of the move on the oil markets. |

2018, May, 10, 13:10:00

OIL MARKET STABILITYPLATTS - Saudi Arabia's energy minister Khalid al-Falih said Wednesday that the country would work closely with OPEC as well as non-OPEC producers to mitigate the impact of any shortages that might arise following the US' decision to withdraw from the Iran nuclear deal. |

2018, April, 27, 11:15:00

БАЛАНС МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак, говоря о перспективах соглашения о балансировке рынка, отметил, что участники рассматривают несколько вариантов дальнейшего сотрудничества. «Главная задача – не создать условия для дисбаланса на рынке», - заключил Министр. |

2018, April, 23, 14:50:00

РОССИЯ - ОПЕК: 149%МИНЭНЕРГО РОССИИ - страны ОПЕК и государства, не входящие в ОПЕК, выполнили соглашение по добровольной корректировке объемов добычи нефти на 149%, что является самым высоким показателем в истории соглашения. |

2018, April, 18, 13:12:00

RUSSIA - OPEC DIMENSIONPLATTS - Russia is committed to its OPEC pact with Saudi Arabia and will continue supplying Europe energy despite tensions with the West after US-led strikes on Bashar al-Assad's Syrian regime, said Vladimir Putin's spokesman. |

2018, April, 13, 18:05:00

OPEC - RUSSIA COOPERATION TO 2019REUTERS - “There is growing confidence that the declaration of cooperation will be extended beyond 2018,” Barkindo told. “Russia will continue to play a leading role.” |

2018, April, 11, 13:35:00

RUSSIA - OPEC UNLIMITEDPLATTS - Maintaining a long-term oil management alliance with Russia and other allies will allow OPEC producers to react more quickly to changing fundamentals and stabilize the market, |