U.S. FEDERAL FUNDS RATE 1.5 - 1.75%

U.S. FRB - Information received since the Federal Open Market Committee met in March indicates that the labor market has continued to strengthen and that economic activity has been rising at a moderate rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Recent data suggest that growth of household spending moderated from its strong fourth-quarter pace, while business fixed investment continued to grow strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace in the medium term and labor market conditions will remain strong. Inflation on a 12-month basis is expected to run near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

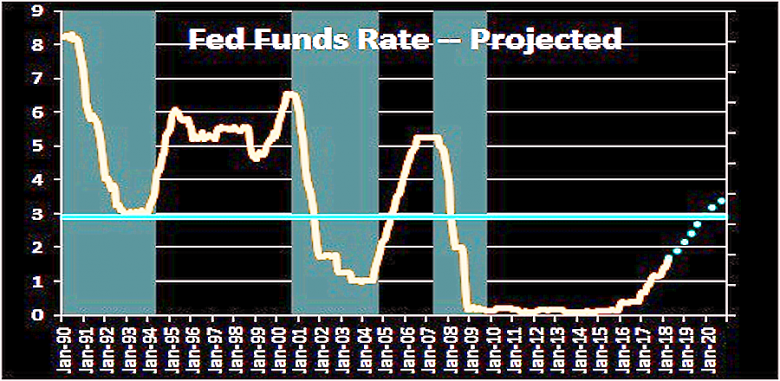

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

-----

Earlier:

2018, April, 30, 10:10:00

U.S. GDP UP 2.3%BEA - Real gross domestic product (GDP) increased at an annual rate of 2.3 percent in the first quarter of 2018 , according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.9 percent. |

2018, April, 23, 14:40:00

U.S. OIL DEMAND UP TO 20.6 MBDAPI - the American Petroleum Institute reported that U.S. petroleum demand reached 20.6 million barrels per day (MBD) last month, the highest level since 2007. To satisfy demand, domestic refineries utilized 91.5 percent of their capacity – a record for the month of March – and processed 17 MBD of oil and natural gas liquids (NGLs). The U.S. also produced a record 10.4 MBD of crude oil plus another 3.9 MBD of NGLs. |

2018, April, 18, 13:04:00

U.S. INDUSTRIAL PRODUCTION UP 0.5%FRB - Industrial production rose 0.5 percent in March after increasing 1.0 percent in February; the index advanced 4.5 percent at an annual rate for the first quarter as a whole. After having climbed 1.5 percent in February, manufacturing production edged up 0.1 percent in March. Mining output rose 1.0 percent, mostly as a result of gains in oil and gas extraction and in support activities for mining. The index for utilities jumped 3.0 percent after being suppressed in February by warmer-than-normal temperatures. At 107.2 percent of its 2012 average, total industrial production was 4.3 percent higher in March than it was a year earlier. Capacity utilization for the industrial sector moved up 0.3 percentage point in March to 78.0 percent, a rate that is 1.8 percentage points below its long-run (1972–2017) average. |

2018, April, 6, 18:10:00

U.S. DEFICIT UP $0.9 BLN TO $57.6 BLNBEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced that the goods and services deficit was $57.6 billion in February, up $0.9 billion from $56.7 billion in January. |

2018, March, 30, 11:17:00

U.S. GDP UP 2.9%BEA - Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2017. In the third quarter, real GDP increased 3.2 percent. |

2018, March, 23, 08:20:00

U.S. DEFICIT UP TO $128.2 BLNBEA - The U.S. current-account deficit increased to $128.2 billion (preliminary) in the fourth quarter of 2017 from $101.5 billion (revised) in the third quarter, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.6 percent of current- dollar gross domestic product (GDP) in the fourth quarter, up from 2.1 percent in the third quarter. |

2018, March, 23, 08:15:00

U.S. FEDERAL FUNDS RATE 1.5 - 1.75%FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-1/2 to 1-3/4 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation. |