BP: GROWTH IN ENERGY DEMAND UP

BP - BP Statistical Review of World Energy, the 2018 edition

In 2017 global energy demand grew by 2.2%, above its 10-year average of 1.7%. This above-trend growth was driven by stronger economic growth in the developed world and a slight slowing in the pace of improvement in energy intensity.

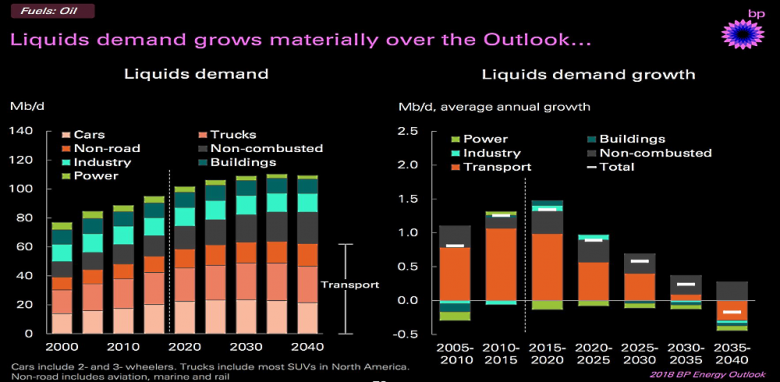

Demand for oil grew by 1.8% while growth in production was below average for the second consecutive year. Production from OPEC and the 10 other countries that agreed cuts decreased, while producing countries outside of that group, particularly the US driven by tight oil, saw increases. Consumption exceeded production for much of 2017 and as a result OECD inventories fell back to more normal levels.

2017 was a strong year for natural gas with consumption up 3% and production up 4% – the fastest growth rates since immediately following the global financial crisis. The single biggest factor fueling global gas consumption was the surge in Chinese gas demand, where consumption increased by over 15%, driven by government environmental policies encouraging coal-to-gas switching.

Renewables grew strongly in 2017, with wind and solar leading the way. Coal consumption was also up, growing for the first time since 2013.

Review highlights

Primary energy

Primary energy consumption growth averaged 2.2% in 2017, up from 1.2 % last year and the fastest since 2013. This compares with the 10-year average of 1.7% per year.

By fuel, natural gas accounted for the largest increment in energy consumption, followed by renewables and then oil.

Energy consumption rose by 3.1% in China. China was the largest growth market for energy for the 17th consecutive year.

Carbon emissions from energy consumption increased by 1.6%, after little or no growth for the three years from 2014 to 2016.

Oil

The oil price (Dated Brent) averaged $54.19 per barrel, up from $43.73/barrel in 2016. This was the first annual increase since 2012.

Global oil consumption growth averaged 1.8%, or 1.7 million barrels per day (b/d), above its 10-year average of 1.2% for the third consecutive year. China (500,000 b/d) and the US (190,000 b/d) were the single largest contributors to growth.

Global oil production rose by 0.6 million b/d, below average for the second consecutive year. US (690,000 b/d) and Libya (440,000 b/d) posted the largest increases in output, while Saudi Arabia (-450,000 b/d) and Venezuela (-280,000 b/d) saw the largest declines.

Refinery throughput rose by an above-average 1.6 million b/d, while refining capacity growth was only 0.6 million b/d, below average for the third consecutive year. As a result, refinery utilisation climbed to its highest level in nine years.

Natural gas

Natural gas consumption rose by 96 billion cubic metres (bcm), or 3%, the fastest since 2010.

Consumption growth was driven by China (31 bcm), the Middle East (28 bcm) and Europe (26 bcm). Consumption in the US fell by 1.2%, or 11 bcm.

Global natural gas production increased by 131 bcm, or 4%, almost double the 10-year average growth rate. Russian growth was the largest at 46 bcm, followed by Iran (21 bcm).

Gas trade expanded by 63 bcm, or 6.2%, with growth in LNG outpacing growth in pipeline trade.

The increase in gas exports was driven largely by Australian and US LNG (up by 17 and 13 bcm respectively), and Russian pipeline exports (15 bcm).

Coal

Coal consumption increased by 25 million tonnes of oil equivalent (mtoe), or 1%, the first growth since 2013.

Consumption growth was driven largely by India (18 mtoe), with China consumption also up slightly (4 Mtoe) following three successive annual declines during 2014-2016. OECD demand fell for the fourth year in a row (-4 mtoe).

Coal's share in primary energy fell to 27.6%, the lowest since 2004.

World coal production grew by 105 mtoe or 3.2%, the fastest rate of growth since 2011. Production rose by 56 mtoe in China and 23 mtoe in the US.

Renewables, hydro and nuclear

Renewable power grew by 17%, higher than the 10-year average and the largest increment on record (69 mtoe).

Wind provided more than half of renewables growth, while solar contributed more than a third despite accounting for just 21% of the total.

In China, renewable power generation rose by 25 mtoe – a country record, and the second largest contribution to global primary energy growth from any single fuel and country, behind natural gas in China.

Hydroelectric power rose by just 0.9%, compared with the 10-year average of 2.9%. China's growth was the slowest since 2011, while European output declined by 10.5% (-16 mtoe).

Global nuclear generation grew by 1.1%. Growth in China (8 mtoe) and Japan (3 mtoe) was partially offset by declines in South Korea (-3 mtoe) and Taiwan (-2 mtoe).

Power generation

Power generation rose by 2.8%, close to the 10-year average. Practically all growth came from emerging economies (94%). Generation in the OECD has remained relative flat since 2010.

Renewables accounted for almost half of the growth in power generation (49%), with most of the remainder provided for by coal (44%).

The share of renewables in global power generation increased from 7.4% to 8.4%.

Key materials

Cobalt production has grown by only 0.9% per annum since 2010, while Lithium production has increased by 6.8% p.a. over the same period.

Cobalt prices more than doubled in 2017, while Lithium carbonate prices increased by 37%.

-----

Earlier:

2018, June, 8, 13:15:00

OIL DEMAND UP TO 2030PLATTS - Global oil demand will peak around 2030 at 111 million b/d as a sharp rise in electric vehicles and energy efficiency gains offset growing demand from the aviation and petrochemical sectors, Norwegian producer Equinor said |

2018, May, 28, 11:10:00

TOTAL DECARBONIZATION OF THE GLOBAL ECONOMYGAZPROM - It seems that putting renewables ahead of everything else doesn’t accomplish anything in today’s world. And striving for a total decarbonization of the global economy is downright quixotic. One should understand that fossil fuels will continue to play an essential role in the next 20 years. |

2018, May, 23, 10:10:00

CLEAN NUCLEAR FUTUREWNN - The United States, Canada, and Japan are launching the Nuclear Innovation: Clean Energy (NICE) Future Initiative. This global effort will make sure nuclear has a seat at the table during discussions about innovation and advanced clean energy systems of the future. |

2018, May, 7, 08:10:00

U.S. LONG-DURATION ENERGY STORAGEU.S. DOE - Energy storage will play an increasingly critical role in the resilient grid of the future. Storage systems provide important services, including improving grid stability, providing backup power, and allowing for greater integration of renewable resources. Today’s dominant storage options have limitations that inhibit their use as long-duration solutions, particularly their high cost. |

2018, March, 28, 11:15:00

GLOBAL ENERGY DEMAND + 2.1%IEA - Global energy demand rose by 2.1% in 2017, more than twice the previous year’s rate, boosted by strong global economic growth, with oil, gas and coal meeting most of the increase in demand for energy, and renewables seeing impressive gains. |

2018, February, 16, 23:35:00

ФУНДАМЕНТАЛЬНЫЕ ПРЕОБРАЗОВАНИЯ РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак поделился своим видением будущего углеводородной энергетики: «Она обладает огромным потенциалом цифровизации своих процессов, гибкой подстройки под нужды потребителей. Доля углеводородов, безусловно, будет снижаться, но с учетом роста населения, автопарка, спроса на энергию, абсолютное потребление продолжит расти. Если мы хотим надежно обеспечить мир энергией, нам придется найти разумный баланс между традиционной и новой энергетикой». |

2018, February, 5, 07:45:00

EXXON ENERGY OUTLOOK - 2040EXXONMOBIL - Despite efficiency gains, global energy demand will likely increase nearly 25 percent. Nearly all growth will be in non-OECD countries (e.g. China, India), where demand will likely increase about 40 percent, or about the same amount of energy used in the Americas today. |