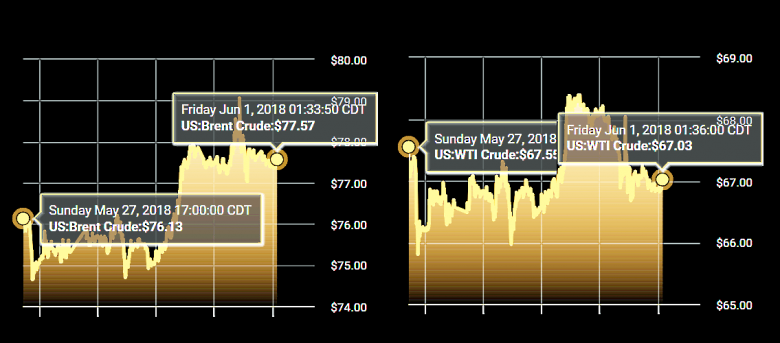

OIL PRICE: ABOVE $77 YET

REUTERS - Crude oil futures lost more ground on Friday, with the U.S. market set for a second week of decline on pressure from record U.S. production and expectations of OPEC boosting output.

U.S. West Texas Intermediate crude CLc1 lost 16 cents, or 0.2 percent, to $66.88 a barrel by 0423 GMT, after falling almost 2 percent on Thursday.

Global benchmark Brent crude LCOc1, which was little changed in the previous session, was down 9 cents, or 0.1 percent, to $77.47 per barrel.

For the week, WTI is on track for a 1.5 percent fall, adding to last week's near 5 percent decline, while Brent is set to rise 1.3 percent, widening the spread between the two benchmarks.

U.S. crude production has been rising to record-high levels since late last year. In March it jumped 215,000 barrels per day (bpd) to 10.47 million bpd, a new monthly record, the Energy Information Administration (EIA) said on Thursday.

"U.S. production is growing, the line is growing straight up when you look at U.S. production," said Tony Nunan, oil risk manager at Mitsubishi Corp in Tokyo.

"The big thing is the increasing spread between Brent and WTI. Financially it makes sense for buyers to take WTI as it is so cheap."

On Thursday, the premium for Brent over WTI surpassed $11 a barrel, the largest since early 2015. It has doubled in less than a month, as a lack of pipeline capacity in the United States has trapped a lot of output inland.

"A drop in inventories in the U.S. was overshadowed by U.S. output which jumped to a record-high level," ANZ said in a note.

U.S. crude stockpiles fell 3.6 million barrels last week, the EIA said, exceeding expectations for a decline of 525,000 barrels.

Brent hit a three-week low below $75 a barrel on Monday after OPEC and its allies, including Russia, indicated they could adjust their deal to curb supplies and increase production, but recovered later in the week.

OPEC and non-OPEC producers have committed to cut output by 1.8 million bpd until the end of 2018, but are ready to make gradual supply adjustments to deal with shortages, a Gulf source familiar with Saudi thinking told Reuters late on Wednesday.

Sources told Reuters last week that Saudi Arabia, the effective leader of OPEC, and Russia were discussing boosting output by about 1 million bpd to compensate for losses in supply from Venezuela and to address concerns about the impact of U.S. sanctions on Iranian output.

Russia would be able to raise its oil output back to pre-cut levels within months if there is a decision to unwind the price-protection deal with OPEC and other producers, a Russian energy ministry official said.

Concerns about U.S. bottlenecks are contributing to the decline in U.S. futures as well. Prices for physical barrels of U.S. light sweet crude delivered at Midland are at their largest discount to the benchmark U.S. futures price in almost four years.

-----

Earlier:

2018, May, 30, 14:10:00

OIL PRICE: ABOVE $75 TOOREUTERS - Brent LCOc1 rose 40 cents to $75.79 a barrel by 0925 GMT, after trading as low as $74.81 earlier. U.S. crude CLc1 was up 25 cents at $66.98.

|

2018, May, 30, 14:05:00

МЫ НАЙДЕМ КОМПРОМИССМИНЭНЕРГО РОССИИ - «Я думаю, что мы найдем общее согласие, общий компромисс. Все страны заинтересованы в стабильной ситуации на рынке. Никто не заинтересован в том, чтобы создавать перегрев на рынке», - отметил Министр. |

2018, May, 30, 14:00:00

UNDERINVESTMENT GLOBAL OILREUTERS - The global oil industry should ramp up investment to ensure it can cope with future consumption growth and avoid supply shortages, OPEC Secretary-General Mohammad Barkindo told a conference in Baku. |

2018, May, 30, 13:50:00

OPEC: CONFORMITY LEVEL 152%OPEC - The JMMC reported that participating countries have achieved a conformity level of 152% during the fourth month of the second year of the Declaration of Cooperation. This demonstrates the commitment of participating countries to the restoration of market stability, which is intended to serve the long term interests of producers, consumers and the global economy. |

2018, May, 28, 11:45:00

OIL PRICE: ABOVE $75 AGAINREUTERS - Brent crude futures LCOc1 stood at $75.35 a barrel at 0913 GMT, down $1.09 from the previous close and after touching a three-week low of $74.49 earlier in the session. U.S. West Texas Intermediate (WTI) crude futures were at $66.69, down $1.19, after hitting a six-week low of $65.80. |

2018, May, 28, 11:40:00

БУДЕТ ПЛАВНОЕ СОКРАЩЕНИЕМИНЭНЕРГО - «В целом, все согласны, что нужно этот вопрос очень серьезно обсудить на Министерской встрече, которая состоится в июне в Вене. Там будут предложены различные варианты. Но, скорее всего, это будет плавное сокращение. Наша задача – и не дестабилизировать рынок нефти, и не перегреть его», - сказал Александр Новак |

2018, May, 28, 11:35:00

ЦЕНА НЕФТИ: $80МИНЭНЕРГО - Глава Минэнерго России отметил, что цена на нефть сегодня близка к 80 долларам, а год назад она была 51,5 долларов. «Год назад мы наблюдали только начало балансировки рынка, сегодня мы вышли на позитивные изменения по сравнению с прошлым годом. Сделка ОПЕК+ показала положительный результат. Цели, которые ставились, достигаются», - сообщил Александр Новак.

|