QATAR'S GDP GROWTH 2.6%

IMF - On May 18, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Qatar.

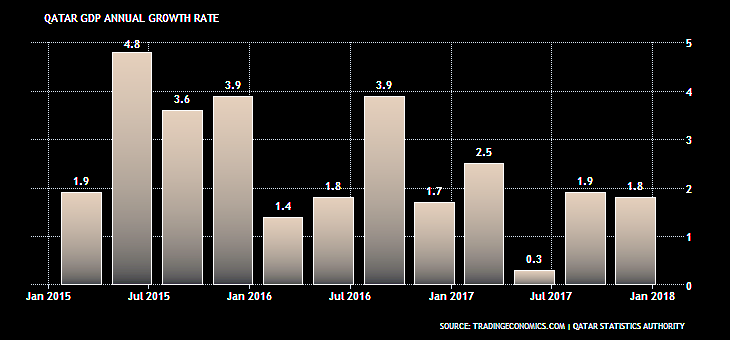

Growth performance remains resilient. The direct economic and financial impact of the diplomatic rift between Qatar and some countries in the region has been manageable. Non-hydrocarbon real GDP growth is estimated to have moderated to about 4 percent in 2017 due to on-going fiscal consolidation and the effect of the diplomatic rift. A self-imposed moratorium on new projects in the North Oil Field until the second quarter of 2017 and the OPEC+ deal had restrained the growth of hydrocarbon output, culminating in overall real GDP growth of 2.1 percent in 2017. Headline inflation remains subdued, primarily due to lower rental prices. The real estate price index fell by 11 percent in 2017 (year-on-year basis) following cumulative increase of 53 percent during 2013–16, reflecting increased supply of new properties and reduced effective demand.

The near-term growth outlook is broadly positive. Overall, GDP growth of 2.6 percent is projected for 2018. Inflation is expected to peak at 3.9 percent in 2018—as the impact of the value-added tax being introduced during the second half of 2018 would mostly be felt in that year—before easing to 2.2 percent in the medium term. The availability of significant external and fiscal buffers and the strong financial sector should enable the country to withstand downside risks, including lower-than-envisaged oil prices, tighter global conditions and an escalation of the diplomatic rift.

The underlying fiscal position continues to improve. The fiscal deficit is estimated to have narrowed to about 6 percent of GDP in 2017 from 9.2 percent in 2016. The deficit has been financed by a combination of domestic and external financing. Public debt (estimated at 54 percent of GDP as at end-2017) remains sustainable. The current account is improving in the context of increased oil and gas.

Qatar's banking sector remains healthy overall, reflecting high asset quality and strong capitalization. As at end-September 2017, banks had high capitalization (capital adequacy ratio of 15.4 percent), high profitability despite recent moderation (return on assets of 1.6 percent), low non‑performing loans (ratio of 1.5 percent), and reasonable provisioning ratio of non‑performing loans (85 percent). Nonetheless, real estate prices have been on a downward trend. Liquidity has been generally comfortable––with a liquid asset to total asset ratio of 27.3 percent––though bank reserves have declined since 2015.

Executive Board Assessment

Executive Directors noted that considerable buffers and sound macroeconomic policies have helped Qatar successfully absorb shocks from lower hydrocarbon prices and the diplomatic rift with some countries in the region. Directors noted that while the economic outlook is broadly favorable, risks remain. They welcomed the authorities' continued commitment to prudent economic and financial policies, which are important to sustain the economy's resilience and promote diversified and inclusive growth.

Directors concurred that Qatar has ample fiscal space to continue with gradual fiscal consolidation to ensure sufficient saving of the hydrocarbon wealth for future generations. They supported efforts to enhance non‑oil revenue, including putting in place a VAT and excises. Directors noted that strengthened expenditure control, with emphasis on further public‑service reform and accelerated reform of the public utility companies, would help to improve economic efficiency. They also emphasized the importance of wage reform to reduce the public to private wage gap. Directors recommended that further enhancing the medium‑term fiscal framework with a clear medium‑term objective would help guide fiscal efforts. In addition, further improvement in the reporting of fiscal accounts would strengthen accountability, transparency, and policy effectiveness.

Directors noted that the banking sector is healthy with high asset quality and strong capitalization. However, they observed that the loan concentration in the real estate sector amid softening property prices warrants vigilance. Directors also highlighted that FinTech, which will likely create new challenges and opportunities, will require additional regulatory capacity. They supported the authorities' efforts to strengthen macro prudential regulation and consolidated supervision, and agreed that further progress in improving liquidity monitoring and forecasting would help in anticipating and planning for potential system‑wide pressures. Directors encouraged the authorities to continue to strengthen the AML/CFT framework and address the identified gaps.

Directors concurred that the currency peg to the U.S. dollar continues to serve Qatar well, providing a clear and credible monetary anchor. They underscored that the exchange rate regime should be reviewed periodically to ensure that it remains appropriate as the economy moves toward a more diversified export structure.

Directors supported the authorities' efforts to enhance economic diversification and promote private sector development. They welcomed reform efforts related to the labor law, privatization, special economic zones, and increased foreign ownership limits. They cautioned, however, that these efforts should avoid import‑substitution strategies, and special tax incentives or labor policies that might result in market distortions. Directors considered that additional measures to improve the business environment, including contract enforcement and reform of the insolvency mechanism, will boost private sector growth prospects. They noted that laws promoting equal remuneration and discouraging gender‑based discrimination would help contribute to inclusive growth. Directors encouraged the authorities to continue to enhance macroeconomic statistics.

-----

Earlier:

2018, May, 7, 08:20:00

ROSNEFT - QATAR DEALREUTERS - Qatar is taking a nearly 19 percent stake in Rosneft (ROSN.MM), rescuing the Russian oil major from its stalled deal to sell a major stake to China’s CEFC. |

2018, March, 7, 14:15:00

IMF: QATAR IS BETTERIMF - The Qatari economy remains competitive, though there are certain areas that deserve attention. Qatar has fallen to 25th place (out of 137) in the World Economic Forum’s Global Competitiveness Index (2017–18), down from 18 th in 2016–17. Nonetheless, it still ranks ahead of most emerging markets, a reflection of a stronger infrastructure base. |

2018, January, 31, 10:45:00

SAUDI - QATAR COMPETITIONBLOOMBERG - Oil exports from Qatar, one of OPEC’s smaller crude producers, to Japan last year slumped by almost a quarter to its lowest level since 1990, while shipments from giant supplier Saudi Arabia grew 8.1 percent, boosting its market share in the Asian nation to a record. Over in South Korea, imports from Qatar sank 26 percent to the least in seven years. |

2018, January, 4, 12:25:00

QATARGAS & RASGAS MERGERTOGY - The merger of the world’s largest LNG producers, Qatargas and RasGas, is complete, and the new entity, called Qatargas, has started operations, parent company Qatar Petroleum (QP) announced |

2017, September, 27, 13:30:00

QATAR - BANGLADESH LNGRasGas Company Limited sealed a landmark 15-yr LNG Sales and Purchase Agreement (SPA) with Bangladesh Oil, Gas and Mineral Corporation (Petrobangla). The agreement was signed in Doha by Mr. Hamad Mubarak Al-Muhannadi, CEO of RasGas, and Mr. Abdul Mansur Md Faizullah, Petrobangla Chairman. |

2017, September, 22, 08:35:00

QATAR - TURKEY LNGQatargas has agreed to sell 1.5 million tpy of LNG to Turkey’s BOTAŞ Petroleum Pipeline Corporation (BOTAŞ) over a period of three years

|

2017, July, 5, 12:15:00

QATAR SHOW STRENGTHQatar mounted what appeared to be a show of strength on Tuesday, when the state-owned Qatar Petroleum announced plans to raise liquefied natural gas capacity by 30 percent. Its immediate effect will be to worsen a glut on the LNG market where Australia, the United States and Russia vie. |