SAUDI ARABIA & RUSSIA: +1 MBD

ARAB NEWS - Saudi Arabian and Russian oil market policy is set to dominate the Vienna OPEC meeting next week.

The summit, to include Russia and other non-OPEC members known as "OPEC+" will gather to review a production-cuts agreement, hammered out in 2016 — amid fears of a supply crunch.

Output cuts have helped crude to rise from below $40 per barrel in early 2015 to $76 on June 15. But severe outages from crisis-hit Venezuela are also a major factor behind the rise in the price, according to the International Energy Agency.

Richard Mallinson, chief geopolitical analyst at London-based Energy Aspects, told Arab News: "The Saudis and Russians have been talking extensively throughout this process about aligning their goals and achieving a long-term impact. The OPEC+ arrangement is not a short-term deal which expires (at the end of 2018) and then everyone goes their separate ways."

On June 14, Saudi Arabia's energy minister, Khalid Al-Falih, said it was "inevitable" OPEC+ participants would vote to boost oil production gradually at next week's meeting .

Speaking to reporters in Moscow, Al-Falih said "as usual we will do the right thing ... I think we'll come to an agreement that satisfies most importantly the market."

The deal leaders, Saudi Arabia and Russia, are said to have proposed plans for the group to add as much as 1 million barrels per day to production.

When the time comes to unwind their accord, "they will do so in an orderly way as possible to maintain their influence on the market," said Mallinson.

Carsten Fritsch, senior oil analyst at Germany's Commerzbank, said the June meeting would probably see the signatories agree to comply at 100 percent, rather than current over-compliance at 170 percent.

But that may not happen immediately as it remains to be seen how much Iranian crude will be lost following President Donald Trump's decision to reimpose sanctions on Tehran last month.

"I don't see any reason to continue these production cuts at the current scale (the target was to reduce supply by 1.8 million barrels per day) into the new year," Fritsch told Arab News in a phone interview from Frankfurt.

But there will be ongoing, joint-policy cooperation to avoid price and production spikes, he suggested.

"What I see developing is 'informal guidance,' much like comments from the chairman of the US Federal Reserve with regard to interest rate policy, in order to try to anchor market expectations," said Fritsch.

Looking at the Vienna meeting, he said the message would probably be that production increases would be gradual and depend on the extent of further losses from Venezuela and the magnitude of shortfalls from Iran. These wouldn't become apparent until the end of the year, and so it was "impossible to predict production levels that will hold in 2019," he said.

With prices spiking at $80 per barrel in May in the wake of President Donald Trump's decision to terminate the nuclear deal with Iran and reimpose sanctions, "the world has woken up to the fact that oversupply is no longer an issue," and that there are looming fears of a supply squeeze, said Mallinson.

"Some of us have been saying for quite a while that the overhang would disappear and we would come back into this sort of world ... a supply crunch," he said. "What we are hearing is that there is no desire from OPEC and others to pre-empt the supply losses coming later this year.

"Iranian exports will start falling soon, but only when the world feels the 'actual' loss, will the Saudis, Russians and others begin to ramp up production," said Mallinson.

Shakil Begg, global head of oil research at Thomson Reuters, said the message from producers seemed to be that they still wanted to maintain some sort of coordinated agreement.

"GCC countries are thinking about the need to replace lost Iranian barrels. They may maintain an output agreement, but the quotas for the individual countries could change."

Begg said peak OECD inventories had been cut from around their 5-year average, at a level targeted by OPEC+ to get rid of the overhang built up between 2010-14.

Those inventory figures, however, did not fully capture what was happening in Asia where there was quite a lot of crude that had been put into storage. "If you look at China, for example, they are refining a lot more crude than they actually need, so inventories are going up there," Begg said.

OPEC+ is under pressure to manage market expectations, but will likely indicate at Vienna that its response will come later, when supplies tighten further, he said.

As OPEC and Russia are producing significantly less oil than intended by the cuts agreement — and less than the market needs — thanks to production outages in Venezuela, observers agree that output could easily be expanded by Saudi Arabia, Russia, Kuwait and others.

"That would rebalance the oil market, driving Brent down to $65 by year's end," according to a Commerz-bank circular on May 21.

Comments from Saudi and Russian ministers at a recent energy forum in St. Petersburg have put pay to soaring prices with Brent plunging by more than 6 percent to $75 per barrel within days.

Still, compared to where we were, this looks like a suppliers market by any other name.

"Yes, but we think the Saudis will be more focused on preventing a really big price spike than they are on limiting or stopping prices at $75, $80 or $85, we don't think they are concerned at the moment," said Mallinson.

"What worries the Saudis is a massive price hike that could see crude smash through the $100 barrier."

If that happened, he said, it could have a damaging impact on the global economy and this was not lost on OPEC and Russia. Price stability was viewed as critical for longer term demand for oil and a big spike would undermine their claims to be responsible participants, able to manage both the downside and upside of the price cycle.

Mallinson said the lurking danger was that another upward surge in the price would boost technological advances and energy efficiency gains, bolster consumer purchases of electric vehicles, and accelerate rapid shifts to alternative technologies and fuels.

Neil Atkinson, head of oil industry and markets at the International Energy Agency, said Venezuela's production could fall by the end of this year by another several hundred thousand barrels a day, given the degradation of the oil industry there. "And that is a prognosis that is quite widely accepted," he said.

Then factor in probable Iranian losses. "If for the sake of argument, Iranian barrels fell by about 1 million barrels a day like last time around, combined with the Venezuelan collapse, you are in a situation where unless there are compensatory increases from elsewhere, the market could tighten very rapidly. Indeed, the market is already tightening today," said Atkinson.

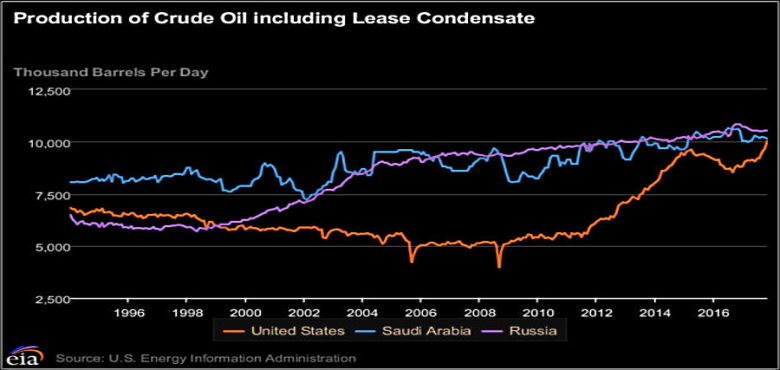

US shale production is rising significantly, with the IEA forecasting an extra 1.3 million barrels per day more in 2018 compared with 2017.

"To some extent, US supply is held back by bottlenecks, but not significantly. "But US production by itself was never going to be enough to plug gaps left by Iran and Venezuela."

Atkinson said: "Maybe at the next OPEC meeting, they will formalize some sort of relaxation of the agreement, by some given volume, at some given time. But I don't think the intention is for prices to rise significantly above where they are today, because at that point there is the risk of 'demand destruction.'"

Whether action will take crude down to $60 or $75 is anyone's guess.

Mallinson believes we are no longer in the mantra of "lower for longer."

And there is a bigger point to be made, he suggested. It's now clear there is more influence in OPEC's hands than some had been claiming.

"Remember a couple of years ago they were writing off the group as irrelevant, because of US shale ... because people thought oversupply would last forever. Now, OPEC is back in the spotlight, it has some difficult challenges ahead. But, together with Russia, it has reconfirmed it has influence in the market.

"The big overhang is done. But the fact that OPEC members are not doing a victory dance indicates they don't see the job as yet finished," he said.

-----

Earlier:

2018, June, 15, 11:30:00

RUSSIA - SAUDI ARABIA COOPERATIONARAB NEWS - Saudi Arabia’s Crown Prince Mohammed bin Salman held talks with Russian President Vladimir Putin in Moscow Thursday. |

2018, June, 13, 13:20:00

RUSSIA'S OIL PRODUCTION: 11 MBDBLOOMBERG - The nation boosted crude supply to the highest in 14 months in the first week of June as some companies breached their caps, said a person with knowledge of the matter. While both the Kremlin and oil bosses remain publicly committed to the accord, production of 11.09 million barrels a day exceeds the 10.95 million limit agreed with OPEC, the official said. |

2018, June, 13, 13:15:00

SAUDIS OIL PRODUCTION: 10 MBDBLOOMBERG - Saudi Arabia, which along with Russia is trying to garner support for lifting output limits, told the Organization of Petroleum Exporting Countries that its daily production rose 162,000 barrels a day to 10.030 million in May compared with the previous month, a person with knowledge of the data said, asking not to be identified because the information isn’t public. |

2018, June, 13, 13:10:00

OIL PRICES: 2018 - $71, 2019 - $68EIA - Brent crude oil spot prices averaged $77 per barrel (b) in May, an increase of $5/b from the April level and the highest monthly average price since November 2014. EIA forecasts Brent spot prices will average $71/b in 2018 and $68/b in 2019. The 2019 forecast price is $2/b higher than in the May STEO. EIA expects West Texas Intermediate (WTI) crude oil prices will average almost $7/b lower than Brent prices in 2018 and $6/b lower than Brent prices in 2019

|

2018, June, 8, 13:20:00

OPEC: WORLD OIL DEMAND UP, PRODUCTION DOWNOPEC - World oil demand averaged 97.20 mb/d in 2017, up by 1.7 per cent y-o-y, with the largest increases taking place in Asia and Pacific region (particularly China and India), Europe and North America. The 2017 oil demand in Africa and the Middle East grew by around 100,000 b/d, as compared to 2016, while oil demand declined in Latin America for the third year in a row. |

2018, June, 8, 13:15:00

OIL DEMAND UP TO 2030PLATTS - Global oil demand will peak around 2030 at 111 million b/d as a sharp rise in electric vehicles and energy efficiency gains offset growing demand from the aviation and petrochemical sectors, Norwegian producer Equinor said |

2018, June, 6, 12:20:00

OPEC - RUSSIA OPINIONREUTERS - “We have to look into the situation which has panned out on the market today, from the point of view of the volume cuts, inventories decline, shortages on the market, and to adjust the figures,” Novak told reporters. |