TOTAL: GAS DEMAND UP

REUTERS - French oil and gas company Total SA expects the global natural gas market to grow far faster than that for crude oil over the next two decades thanks to booming demand for the cleaner-burning fuel in Asia, an outlook that underpinned Total's recent big investments in the space, Chief Executive Patrick Pouyanne said on Monday.

Total expects to close a $1.5 billion acquisition of Engie SA's liquefied natural gas assets in July, making it the second biggest producer of the super-cooled gas in the world behind Royal Dutch Shell Plc.

"Over the next 20 years ... we see many scenarios where consumption of natural gas will grow at a pace of next to 2 percent per year, versus 1 percent or 1.5 percent for oil," Pouyanne said at the World Gas Conference in Washington, D.C.

Total's numbers differ from those of the U.S. Energy Information Administration, which predicts global natural gas growth to average 1.5 percent per year between now and 2050, versus 0.7 percent for crude oil.

When Total completes the Engie LNG acquisition, it will have 10 percent of the world LNG market, from 6 percent now. It will manage 40 million tonnes per annum (MTPA) of LNG volumes, from 15.6 MTPA now and will boost the number of LNG carriers it operates to 13 from three.

Pouyanne said Total is investing in the entire natural gas chain from production to liquefaction for overseas shipping, to sale as a fuel for power, petrochemicals and transport.

He said the global growth the company expects is being driven by low-cost production from U.S. shale fields alongside strong demand in Asia, particularly in China.

China this month threatened 25 percent tariffs on U.S. petroleum imports in response to U.S. tariffs on Chinese goods, but did not add LNG to the list.

"I hope we will not lose the Chinese market," Pouyanne said.

But even if LNG was impacted by the trade dispute in the short-term, Total remained bullish, he said.

"When you invest in something like LNG, you're doing it for the next 25 or 30 years," Pouyanne said.

In an effort to create more demand for gas, Total has also invested $83.4 million to buy 25 percent of Clean Energy Fuels Corp, a distributor of compressed natural gas and LNG for transportation.

As part of the deal, Pouyanne and Andrew Littlefair, CEO of Clean Energy, said Total would provide up to $100 million in a leasing program intended to place thousands of new natural gas heavy-duty trucks on the road.

Although Total is looking to boost gas' share of hydrocarbon production from 50 percent now to 60 percent in 2035, the company is still investing in oil. In March, Total closed on its Maersk Oil acquisition, making it the second biggest operator in the North Sea, while in the Gulf of Mexico the company in April acquired assets in the Cobalt International bankruptcy auction.

-----

Earlier:

2018, June, 13, 12:55:00

GLOBAL LNG TRADE UPEIA - Global trade in liquefied natural gas (LNG) reached 38.2 billion cubic feet per day (Bcf/d) in 2017, a 10% (3.5 Bcf/d) increase from 2016 and the largest annual volume increase on record, |

2018, May, 16, 12:05:00

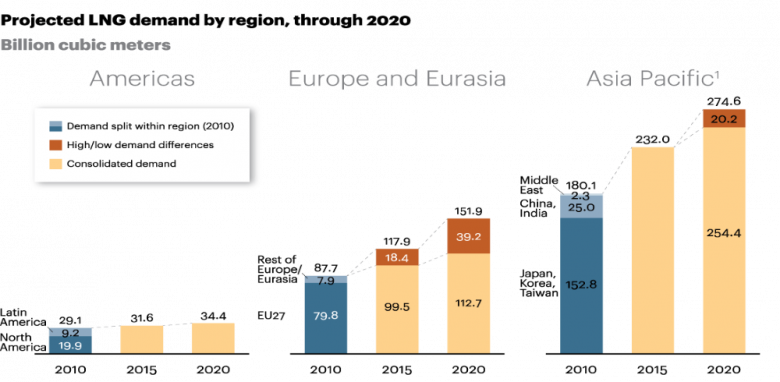

LNG FOR EUROPE & CHINA UPBLOOMBERG - Europe and China will be comparable in significance as importing regions in the coming years, Cheniere Energy Inc. said, citing data from Wood Mackenzie Ltd. That follows “absolutely phenomenal” growth in China last year, Andrew Walker, vice president for strategy at the company that pioneered the transformation of the U.S. shale boom into global exports, said in Amsterdam. |

2018, May, 4, 15:20:00

GLOBAL LNG TRADE UP 10%EIA - Global trade in liquefied natural gas (LNG) increased by 3.5 billion cubic feet per day (Bcf/d) to 38.2 Bcf/d in 2017, a 10% increase from 2016 and the largest annual increase in the history of LNG trade |

2018, April, 25, 09:55:00

ASIA'S LNG DEMANDREUTERS - global liquefied natural gas (LNG) imports have risen 40 percent since 2015, to almost 40 billion cubic meters (bcm) a month. Growth accelerated in 2017, with imports up by a fifth, largely because of rising demand in China, but also in South Korea and Japan. |

2018, April, 23, 14:30:00

GLOBAL LNG IMPORTS UP 10%PLATTS - Global LNG imports in 2017 increased by nearly 10%, the highest annual growth rate since 2010, reaching 289.8 million mt, while expectations of an LNG surplus failed to materialize as rising imports into China contributed to balancing the market. |

2018, February, 27, 13:45:00

GLOBAL LNG DEMAND UP TO 293 MTSHELL - The global liquefied natural gas (LNG) market has continued to defy expectations of many market observers, with demand growing by 29 million tonnes to 293 million tonnes in 2017, according to Shell’s annual LNG Outlook. Such strong growth in demand is consistent with Shell’s first LNG Outlook, published in 2017. Based on current demand projections, Shell sees potential for a supply shortage developing in mid-2020s, unless new LNG production project commitments are made soon. |

2018, January, 12, 13:00:00

ТРАНСФОРМАЦИЯ МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - На энергетическом рынке происходят существенные трансформации, появляются новые технологии, что в итоге приводит к изменению энергобаланса. В частности, за последние 10 лет добыча газа в мире выросла на 20% -- до 580 млрд м3, его доля в энергобалансе расширилась с 21 до 22%. При этом мировая торговля газом за тот же период увеличилась на 42%, или на 313 млрд м3. |