U.S. GDP UP OF 2%

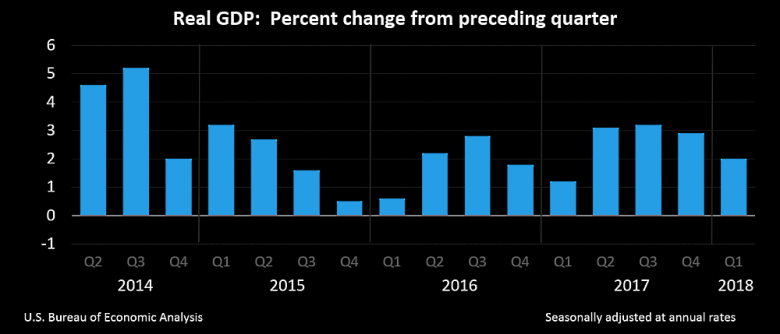

U.S. BEA - Real gross domestic product (GDP) increased at an annual rate of 2.0 percent in the first quarter of 2018, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.9 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.2 percent. With this third estimate for the first quarter, the general picture of economic growth remains the same; private inventory investment and personal consumption expenditures (PCE) were revised down.

Real gross domestic income (GDI) increased 3.6 percent in the first quarter, compared with an increase of 1.0 percent in the fourth quarter. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 2.8 percent in the first quarter, compared with an increase of 2.0 percent in the fourth quarter.

The increase in real GDP in the first quarter reflected positive contributions from nonresidential fixed investment, PCE, exports, federal government spending, and state and local government spending that were partly offset by negative contributions from residential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the first quarter reflected decelerations in PCE, exports, state and local government spending, and federal government spending and a downturn in residential fixed investment. These movements were partly offset by a smaller decrease in private inventory investment and a larger increase in nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, decelerated.

Current-dollar GDP increased 4.2 percent, or $206.0 billion, in the first quarter to a level of $19.96 trillion. In the fourth quarter, current-dollar GDP increased 5.3 percent, or $253.5 billion.

The price index for gross domestic purchases increased 2.7 percent in the first quarter, compared with an increase of 2.5 percent in the fourth quarter. The PCE price index increased 2.5 percent, compared with an increase of 2.7 percent. Excluding food and energy prices, the PCE price index increased 2.3 percent, compared with an increase of 1.9 percent.

-----

Earlier:

2018, June, 22, 13:05:00

U.S. DEFICIT UP FROM $116.1 BLN TO $124.1 BLNU.S. BEA - The U.S. current-account deficit increased to $124.1 billion (preliminary) in the first quarter of 2018 from $116.1 billion (revised) in the fourth quarter of 2017, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.5 percent of current-dollar gross domestic product (GDP) in the first quarter, up from 2.4 percent in the fourth quarter. |

2018, June, 20, 13:00:00

U.S. TRADE WARSAPI - “Instead of utilizing a transparent decision-making process that provided room for input from key stakeholders, the administration continues to take serious missteps in the trade arena that could undermine American jobs and America’s role on the global energy stage. Trade wars with key trading partners will be detrimental to the U.S. economy and consumers.” |

2018, June, 20, 12:50:00

U.S. OIL PRODUCTION + 144 TBD, GAS PRODUCTION + 1,092 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 141,000 b/d month-over-month in June from 7,198 to 7,339 thousand barrels/day , gas production to increase 1,135 million cubic feet/day from 68,624 to 69,759 million cubic feet/day .

|

2018, June, 18, 14:00:00

U.S. IS BETTERIMF - Within the next few years, the U.S. economy is expected to enter its longest expansion in recorded history. The Tax Cuts and Jobs Act and the approved increase in spending are providing a significant boost to the economy. We forecast growth of close to 3 percent this year but falling from that level over the medium-term. In my discussions with Secretary Mnuchin he was clear that he regards our medium-term outlook as too pessimistic. Frankly, I hope he is right. That would be good for both the U.S. and the world economy. |

2018, June, 18, 13:55:00

U.S. ECONOMY UPIMF - The near-term outlook for the U.S. economy is one of strong growth and job creation. Unemployment is already near levels not seen since the late 1960s and growth is set to accelerate, aided by a near-term fiscal stimulus, a welcome recovery of private investment, and supportive financial conditions. These positive outturns have supported, and been reinforced by, a favorable external environment with a broad-based pick up in global activity. Next year, the U.S. economy is expected to mark the longest expansion in its recorded history. The balance of evidence suggests that the U.S. economy is beyond full employment. |

2018, June, 18, 13:50:00

U.S. INDUSTRIAL PRODUCTION DOWN 0.1%U.S. FRB - Industrial production edged down 0.1 percent in May after rising 0.9 percent in April. Manufacturing production fell 0.7 percent in May, largely because truck assemblies were disrupted by a major fire at a parts supplier. Excluding motor vehicles and parts, factory output moved down 0.2 percent. The index for mining rose 1.8 percent, its fourth consecutive month of growth; the output of utilities moved up 1.1 percent. At 107.3 percent of its 2012 average, total industrial production was 3.5 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2017) average. |

2018, June, 15, 10:30:00

U.S. FEDERAL FUNDS RATE 2%FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation. |