U.S. IS BETTER

IMF - 2018 Article IV Consultation for the United States Opening Remarks By Christine Lagarde

Let me outline where we see the U.S. now and then turn to your questions:

Near—Term U.S. Economic Outlook

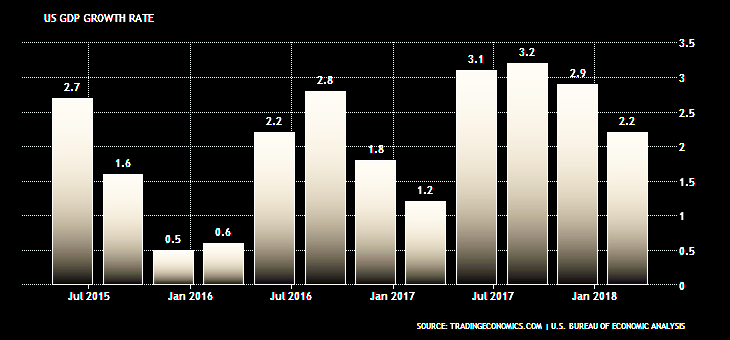

The context of this year's consultation is a U.S. economy that is doing even better than last year. Growth is stronger, unemployment is near the lowest it has been since the 1960s, inflation is contained, and consumer and business confidence are high.

Within the next few years, the U.S. economy is expected to enter its longest expansion in recorded history. The Tax Cuts and Jobs Act and the approved increase in spending are providing a significant boost to the economy. We forecast growth of close to 3 percent this year but falling from that level over the medium-term. In my discussions with Secretary Mnuchin he was clear that he regards our medium-term outlook as too pessimistic. Frankly, I hope he is right. That would be good for both the U.S. and the world economy.

Several Risks on the Horizon

Despite this good news and a bright near-term outlook, at a longer horizon the U.S. economy faces several risks.

First, the planned expansion in the federal deficit at this stage of the cycle could trigger a faster-than-expected rise in inflation. That would be accompanied by a more rapid rise in interest rates that could increase market volatility both in the U.S. and abroad. We are already starting to see symptoms of such negative effects in some emerging market countries, and this might not be the end of it. An important role of the Fund is to warn against these risks and cross-border effects.

Second, the fiscal boost is likely to translate into faster import growth and a larger trade and current account deficit in the U.S. This will be matched by growing surpluses in other systemic economies. It may also lead to a stronger U.S. dollar. All of this could lead to a growth in global imbalances, an issue that we at the Fund have long been concerned about.

International Trade Policy

Recent actions by the U.S. to impose tariffs on imports come with further risks. Unilateral trade actions can be disruptive and may even prove counterproductive to the functioning of the global economy and trading system. As I have said before, in a so-called trade war, driven by reciprocal increases of import tariffs, nobody wins. One generally finds losers on both sides. Also, let us not understate the macroeconomic impact. It would be serious, not only if the United States took action, but especially if other countries were to retaliate, notably those who would be most affected, such as Canada, Europe, and Germany, in particular.

We, therefore, encourage the U.S. to work constructively with its trading partners to resolve trade and investment disagreements without resorting to the imposition of tariff and non-tariff barriers.

Help to Poor Working Families

Our latest discussions with the U.S. authorities have focused on how to ward off these various risks that I have described and to ensure that living standards keep rising for the majority of Americans. Many of the policy details are laid out in the Concluding Statement that you have before you. Let me focus on a couple of our recommendations to help poor working families and to improve the educational system in the U.S. more broadly.

There is room to provide help to low-income families. Expanding eligibility for the earned income tax credit (EITC) as well as its size would raise the reward to work. That extra income for those entering the market at low wages—especially the young and those parents with young children—can help cover out-of-pocket costs, including transportation and child care. To further incentivize work, there is also room to avoid "cliffs" in social benefits by smoothing the phase-out for those that live close to the poverty line.

More can also be done to restore the U.S. competitive edge in education. Countries with the biggest export success have pulled way ahead of the U.S. in terms of science and math skills. Policies to regain the lead could include greater support for pre-K, and more resources for public primary and secondary schools, as well as the U.S. world-class research universities. Such outlays really would pay for themselves.

Dealing with the Fiscal Deficit

In our judgement, these policies need to be embedded in a sustained, gradual and balanced reduction in the fiscal deficit over the medium term, starting now. With the economy doing so well, what better time to do it?

However, our outlook is for growing U.S. deficits and debt. Certainly the solutions to these fiscal problems are politically difficult and will require a broad social consensus. But reducing government debt has the potential to create space to finance priorities that have broad public and legislative support, such as upgrading U.S. infrastructure.

Federal Reserve Policy

Finally, with the planned fiscal stimulus already in train, we believe that the Federal Reserve will need to raise policy rates at a faster pace to achieve its dual mandate. Of course, the Fed's continued adherence to the principles of data dependence and clear communication will be vital. I received strong assurances from Chairman Powell of his commitment to this point.

Conclusion

We believe the set of policies outlined in our Concluding Statement for this year's Article IV Consultation will be both good for the U.S. and good for the global economy.

Finally, it would be remiss of me not to express the IMF's gratitude and appreciation for the time that U.S. officials have spent this year in facilitating the Article IV.

With those introductory remarks, we will now take your questions.

-----

Earlier:

2018, June, 15, 10:45:00

U.S. - OPEC TIESREUTERS - OPEC and U.S. representatives have met at least twice this year, with a third high-profile meeting set for Vienna next week. Finding the optimal balance of crude supply and demand will be the hot topic. |

2018, June, 15, 10:30:00

U.S. FEDERAL FUNDS RATE 2%FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation. |

2018, June, 13, 13:05:00

U.S. - RUSSIA SANCTIONS ANEWU.S.DT - the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated five Russian entities and three Russian individuals under Executive Order (E.O.) 13694, “Blocking the Property of Certain Persons Engaging in Significant Malicious Cyber-Enabled Activities,” as amended, and Section 224 of the Countering America’s Adversaries Through Sanctions Act (CAATSA). |

2018, June, 8, 13:05:00

U.S. GAS EXPORT UPEIA - U.S. exports of natural gas, including exports via pipeline and as liquefied natural gas (LNG), averaged 9.6 billion cubic feet per day (Bcf/d) in the first quarter of this year, |

2018, June, 8, 12:55:00

VENEZUELA IRAN SANCTIONSBLOOMBERG - Venezuela wrote to fellow OPEC members urging them to unite against U.S. sanctions, echoing a similar letter from Iran, according to people with knowledge of the matter. |

2018, June, 8, 12:50:00

U.S. DEFICIT DOWN TO $46.2 BLNBEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $46.2 billion in April, down $1.0 billion from $47.2 billion in March, revised. |

2018, June, 4, 13:45:00

THE DRAMATIC U.S. GOVERNMENTPLATTS - "Japanese companies don't want to stop imports suddenly," he said, adding the US position needed clarifying. "The situation in the US government is drastically changing every day." |