U.S. OIL UP TO 10.9 MBD

WSJ - U.S. shale companies, which profited by continuing to pump oil as the rest of the world cut its production, are again poised to benefit as the Organization of the Petroleum Exporting Countries boosts its output.

OPEC's decision last week to increase production modestly is seen as an attempt to keep prices elevated without creating a spike. The move eased concerns among the member countries about tightening supply and the potential for a price spike, but it also lifted the stock prices of U.S. oil producers, which have learned to survive at whichever price OPEC pursues.

"We're not running our business based on what OPEC does regarding supply," said Doug Lawler, chief executive of Chesapeake Energy Corp. , a pioneer of shale drilling. "We just have to respond accordingly and focus on the technology and the innovation that helps us be efficient regardless of the price."

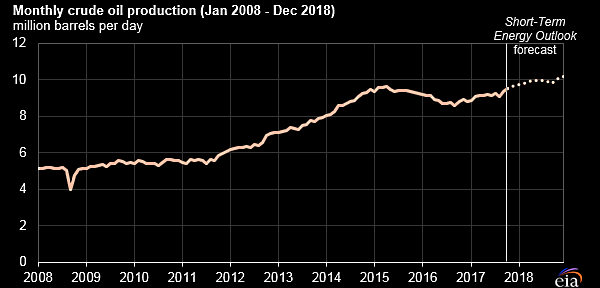

U.S. production has grown at a record-setting pace this year, hitting 10.9 million barrels a day this month after oil prices exceeded $70 a barrel for the first time since 2014. That makes the U.S. the world's No. 2 oil producer behind Russia, but ahead of Saudi Arabia.

OPEC members, plus Russia, came to an agreement two years ago to cut production to shrink excess supply and prop up prices. At the meeting last week in Vienna, OPEC ministers cobbled together a deal to reverse course and boost oil output by an effective 600,000 barrels a day to head off a possible run to $100-a-barrel oil. Russia said over the weekend that it would support OPEC's efforts.

Now U.S. shale companies are again in position to benefit from OPEC's market-balancing actions.

Speaking at the meeting in Vienna, Scott Sheffield, chairman of Pioneer Natural Resources Co. , said the company has a shared interest with OPEC in preventing overheated prices. High prices generate a short burst of profits but can undermine economic growth and tamp down demand.

Mr. Sheffield said: "$100 is not going to help OPEC. It's not going to help us in the Permian." His company is one of the top drillers in the Permian Basin of West Texas and New Mexico.

OPEC's new barrels also come at an opportune time for shale companies, which are facing production-threatening infrastructure constraints in the Permian, the country's most active drilling region. Analysts say Permian producers might have to scale back drilling until new pipelines come online in 2019.

U.S. shale companies now have some breathing room, said R.T. Dukes, a director at the energy consulting firm Wood Mackenzie.

"It leads to a little bit lower price this year, but a little bit higher price next year because you have less spare capacity, less potential for OPEC to raise production," he said. "That'll be great timing for them as they'll be ramping up getting ready for those pipeline expansions to come online in the second half of the year."

OPEC's decision wasn't without drama, as Saudi Arabia pushed other member nations to agree to an increase after a contentious week of meetings. Members such as Iran, Venezuela and Libya approved the deal but have a limited ability to produce more oil themselves because of geopolitical concerns and production constraints.

The relationship between U.S. producers and OPEC hasn't always been so symbiotic.

Initially blindsided by the advent of fracking technology and U.S. production increases, OPEC allowed oil prices to nose-dive from more than $100 a barrel in 2014 to less than $30 a barrel two years later, an apparent attempt to force shale drillers out of business.

Hopes that falling prices would kill shale producers proved hollow. U.S. drilling dropped significantly, but oil production hasn't fallen below eight million barrels a day since November 2013, even as oil prices fell roughly 75% from 2014 to 2016. U.S. production had averaged about 5.5 million barrels a day from 2000 to 2012.

"It may be the case that oil policy now in Russia and Saudi Arabia is run by single individuals, but there is no oil policy in the U.S. It's a market," said Ed Morse, global head of commodities research at Citigroup. "And there are 1,000 cockroach companies, and you can't stamp them out and you can't bankrupt them. They keep coming back."

The tug of war over the global oil market left scars on both sides. Nearly 200,000 oil workers lost their jobs in the U.S., and OPEC eventually was forced to cut production. But U.S. producers used the downturn to become more efficient and have continued their production gains.

"The U.S. has broken OPEC's ability to totally control the market," said Ben "Bud" Brigham, who has made hundreds of millions of dollars as an oilman in shale plays in North Dakota and Texas. "We're their most significant competitor in terms of production."

Shale drillers and OPEC have reached something of a detente recently. U.S. antitrust laws prevent companies here from coordinating production, but shale producers have met with OPEC several times in the past two years. The meetings have helped the group better understand the technological and financial drivers behind shale's production surge, analysts and executives say.

"Their hope for this to be a short-lived phenomenon is gradually fading," Mr. Morse said.

-----

Earlier:

2018, June, 20, 12:50:00

U.S. OIL PRODUCTION + 144 TBD, GAS PRODUCTION + 1,092 MCFDEIA - Crude oil production from the major US onshore regions is forecast to increase 141,000 b/d month-over-month in June from 7,198 to 7,339 thousand barrels/day , gas production to increase 1,135 million cubic feet/day from 68,624 to 69,759 million cubic feet/day . |

2018, June, 18, 13:40:00

U.S. RIGS DOWN 3 TO 1,059BAKER HUGHES A GE - U.S. Rig Count is down 3 rigs from last week to 1,059, with oil rigs up 1 to 863, gas rigs down 4 to 194 and miscellaneous rigs unchanged at 2. Canada Rig Count is up 27 rigs from last week to 139, with oil rigs up 18 to 87 and gas rigs up 9 to 52. |

2018, June, 15, 10:45:00

U.S. - OPEC TIESREUTERS - OPEC and U.S. representatives have met at least twice this year, with a third high-profile meeting set for Vienna next week. Finding the optimal balance of crude supply and demand will be the hot topic. |

2018, June, 13, 13:10:00

OIL PRICES: 2018 - $71, 2019 - $68EIA - Brent crude oil spot prices averaged $77 per barrel (b) in May, an increase of $5/b from the April level and the highest monthly average price since November 2014. EIA forecasts Brent spot prices will average $71/b in 2018 and $68/b in 2019. The 2019 forecast price is $2/b higher than in the May STEO. EIA expects West Texas Intermediate (WTI) crude oil prices will average almost $7/b lower than Brent prices in 2018 and $6/b lower than Brent prices in 2019 |

2018, June, 4, 13:25:00

U.S. ENERGY THREATAPI - “The implementation of new tariffs will disrupt the U.S. oil and natural gas industry’s complex supply chain, compromising ongoing and future U.S. energy projects, which could weaken our national security. Additionally, Canada, Mexico and the European Union are imperative members of our Defense Industrial Base (DIB) and are top military allies – far from a threat to America’s security. |

2018, May, 23, 10:40:00

U.S. THE WORLD'S TOPEIA - The United States remained the world's top producer of petroleum and natural gas hydrocarbons in 2017, reaching a record high. The United States has been the world's top producer of natural gas since 2009, when U.S. natural gas production surpassed that of Russia, and the world's top producer of petroleum hydrocarbons since 2013, when U.S. production exceeded Saudi Arabia’s. Since 2008, U.S. petroleum and natural gas production has increased by nearly 60%. |

2018, May, 21, 10:40:00

U.S. PETROLEUM DEMAND UP BY 750 TBDAPI - American Petroleum Institute reported that the first four months of this year saw U.S. petroleum demand average 750 thousand barrels a day above the same period in 2017 despite higher prices, a sign of solid economic activity. April also saw the U.S. produce a record 10.5 million barrels per day (MBD) of oil. |