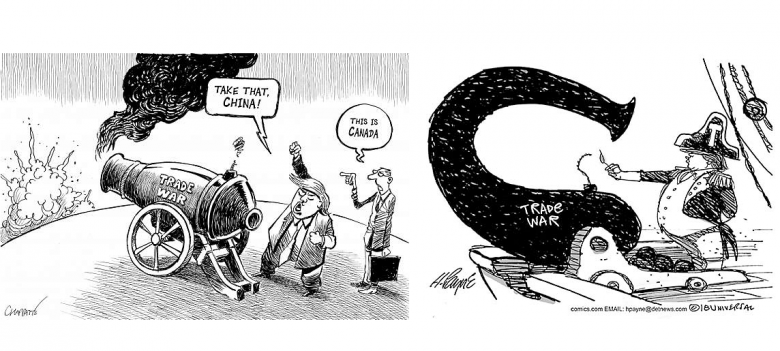

U.S. TRADE WARS

API - API's President and CEO Jack Gerard expressed his heightened concern with the lack of transparency leading up to the newly announced tariffs on China, as well as the impact on the U.S. energy renaissance and consumers.

"API is concerned about the detrimental effect of the new Section 301 tariffs on a wide range of industrial parts and products used in the U.S. natural gas and oil industry because they place the costs of China's market distorting behavior on U.S. consumers and their access to affordable and reliable energy. We have very vocally opposed the implementation of Section 232 tariffs under the guise of national security concerns, and we are now also troubled with the Administration's process around the implementation of Section 301 tariffs on China.

"The lack of transparency in the process, as well as the absence of consultation with the U.S. natural gas and oil industry to determine the potential impact on U.S. investments, jobs, and consumers, is especially troubling. Section 301 tariffs, as well as the recently implemented Section 232 tariffs, will have a real impact on current and future U.S. energy projects, and could ultimately harm our energy renaissance which provides high-paying jobs and affordable and reliable energy to Americans.

"Instead of utilizing a transparent decision-making process that provided room for input from key stakeholders, the administration continues to take serious missteps in the trade arena that could undermine American jobs and America's role on the global energy stage. Trade wars with key trading partners will be detrimental to the U.S. economy and consumers."

API is the only national trade association representing all facets of the oil and natural gas industry, which supports 10.3 million U.S. jobs and nearly 8 percent of the U.S. economy. API's nearly 620 members include large integrated companies, as well as exploration and production, refining, marketing, pipeline, and marine businesses, and service and supply firms. They provide most of the nation's energy and are backed by a growing grassroots movement of more than 45 million Americans.

-----

Earlier:

2018, June, 18, 14:00:00

U.S. IS BETTERIMF - Within the next few years, the U.S. economy is expected to enter its longest expansion in recorded history. The Tax Cuts and Jobs Act and the approved increase in spending are providing a significant boost to the economy. We forecast growth of close to 3 percent this year but falling from that level over the medium-term. In my discussions with Secretary Mnuchin he was clear that he regards our medium-term outlook as too pessimistic. Frankly, I hope he is right. That would be good for both the U.S. and the world economy. |

2018, June, 18, 13:55:00

U.S. ECONOMY UPIMF - The near-term outlook for the U.S. economy is one of strong growth and job creation. Unemployment is already near levels not seen since the late 1960s and growth is set to accelerate, aided by a near-term fiscal stimulus, a welcome recovery of private investment, and supportive financial conditions. These positive outturns have supported, and been reinforced by, a favorable external environment with a broad-based pick up in global activity. Next year, the U.S. economy is expected to mark the longest expansion in its recorded history. The balance of evidence suggests that the U.S. economy is beyond full employment. |

2018, June, 18, 13:50:00

U.S. INDUSTRIAL PRODUCTION DOWN 0.1%U.S. FRB - Industrial production edged down 0.1 percent in May after rising 0.9 percent in April. Manufacturing production fell 0.7 percent in May, largely because truck assemblies were disrupted by a major fire at a parts supplier. Excluding motor vehicles and parts, factory output moved down 0.2 percent. The index for mining rose 1.8 percent, its fourth consecutive month of growth; the output of utilities moved up 1.1 percent. At 107.3 percent of its 2012 average, total industrial production was 3.5 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2017) average. |

2018, June, 15, 10:30:00

U.S. FEDERAL FUNDS RATE 2%FRB - In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-3/4 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation. |

2018, June, 8, 12:50:00

U.S. DEFICIT DOWN TO $46.2 BLNBEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $46.2 billion in April, down $1.0 billion from $47.2 billion in March, revised. |

2018, June, 4, 13:45:00

THE DRAMATIC U.S. GOVERNMENTPLATTS - "Japanese companies don't want to stop imports suddenly," he said, adding the US position needed clarifying. "The situation in the US government is drastically changing every day." |

2018, June, 4, 13:25:00

U.S. ENERGY THREATAPI - “The implementation of new tariffs will disrupt the U.S. oil and natural gas industry’s complex supply chain, compromising ongoing and future U.S. energy projects, which could weaken our national security. Additionally, Canada, Mexico and the European Union are imperative members of our Defense Industrial Base (DIB) and are top military allies – far from a threat to America’s security. |