FRANCE'S GDP UP TO 1.8%

НОВАТЭК - ПAO «НОВАТЭК» опубликовало консолидированную промежуточную сокращенную финансовую отчетность по состоянию на и за три и шесть месяцев, закончившихся 30 июня 2018 г., подготовленную в соответствии с Международными стандартами финансовой отчетности (МСФО).

Основные финансовые показатели деятельности по МСФО

(в миллионах российских рублей, если не указано иное)

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

194 818

|

128 030

|

Выручка от реализации нефти и газа

|

373 303

|

282 031

|

|

1 004

|

800

|

Прочая выручка

|

1 922

|

1 427

|

|

195 822

|

128 830

|

Итого выручка от реализации

|

375 225

|

283 458

|

|

(135 606)

|

(94 033)

|

Операционные расходы

|

(266 643)

|

(203 397)

|

|

-

|

-

|

Прибыль от выбытия долей владения

в совместных предприятиях, нетто

|

1 645

|

-

|

|

(621)

|

351

|

Прочие операционные

прибыли (убытки), нетто

|

(519)

|

625

|

|

59 595

|

35 148

|

Прибыль от операционной деятельности*

|

108 063

|

80 686

|

|

68 958

|

43 798

|

EBITDA дочерних обществ*

|

125 379

|

97 613

|

|

101 339

|

56 072

|

EBITDA с учетом доли

в EBITDA совместных предприятий*

|

177 645

|

124 252

|

|

7 380

|

13 414

|

Доходы (расходы) от финансовой деятельности

|

12 782

|

4 812

|

|

(18 215)

|

(33 768)

|

Доля в прибыли (убытке) совместных предприятий за вычетом налога на прибыль

|

(17 052)

|

9 858

|

|

48 760

|

14 794

|

Прибыль до налога на прибыль

|

105 438

|

95 356

|

|

32 041

|

3 243

|

Прибыль, относящаяся к

акционерам ПАО «НОВАТЭК»

|

75 162

|

74 261

|

|

54 289

|

33 772

|

Прибыль, относящаяся к акционерам

ПАО «НОВАТЭК», нормализованная**

|

101 199

|

78 117

|

|

18,01

|

11,20

|

Прибыль на акцию нормализованная** (в руб.)

|

33,57

|

25,89

|

* Без учета эффекта от выбытия долей владения в совместных предприятиях.

** Без учета эффектов от выбытия долей владения в совместных предприятиях и от курсовых разниц.

Во втором квартале 2018 года наша выручка от реализации составила 195,8 млрд руб., а показатель EBITDA с учетом доли в EBITDA совместных предприятий составил 101,3 млрд руб., что представляет собой увеличение на 52,0% и 80,7% соответственно по сравнению с аналогичным периодом 2017 года. За шесть месяцев, закончившихся 30 июня 2018 г., наша выручка от реализации и нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составили 375,2 млрд руб. и 177,6 млрд руб., увеличившись на 32,4% и 43,0% соответственно по сравнению с аналогичным периодом 2017 года. Рост выручки и нормализованного показателя EBITDA в основном связан с запуском производства СПГ на первой очереди завода «Ямала СПГ» в конце 2017 года и ростом средних цен реализации жидких углеводородов и природного газа.

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», увеличилась во втором квартале 2018 года до 32,0 млрд руб. (10,63 руб. на акцию) или примерно в 10 раз и до 75,2 млрд руб. (24,93 руб. на акцию) или на 1,2% за первое полугодие 2018 года по сравнению с аналогичными периодами 2017 года. На прибыль Группы в отчетных периодах значительное влияние оказало признание существенных неденежных курсовых разниц по займам Группы и совместных предприятий, номинированным в иностранной валюте. Без учета эффекта от курсовых разниц, а также единовременной прибыли от выбытия долей владения в совместных предприятиях, нормализованная прибыль, относящаяся к акционерам ПАО «НОВАТЭК», составила 54,3 млрд руб. (18,01 руб. на акцию) во втором квартале 2018 года и 101,2 млрд руб. (33,57 руб. на акцию) в первом полугодии 2018 года, увеличившись на 60,8% и 29,5% соответственно по сравнению с аналогичными периодами 2017 года.

Объем добычи и покупки углеводородов

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

131,8

|

127,5

|

Совокупная добыча углеводородов,

млн баррелей нефтяного эквивалента (млн бнэ)

|

264,3

|

258,0

|

|

1,45

|

1,40

|

Совокупная добыча (млн бнэ в сутки)

|

1,46

|

1,43

|

|

16 418

|

15 762

|

Добыча природного газа с учетом доли в

добыче совместных предприятий (млн куб. м)

|

32 926

|

31 912

|

|

10 562

|

10 952

|

Добыча природного газа в дочерних обществах

|

20 925

|

22 211

|

|

4 420

|

2 356

|

Покупка природного газа у совместных предприятий

|

12 007

|

7 657

|

|

1 708

|

1 936

|

Прочие покупки природного газа

|

3 437

|

3 796

|

|

16 690

|

15 244

|

Итого добыча природного газа дочерними обществами и покупка (млн куб. м)

|

36 369

|

33 664

|

|

2 928

|

2 918

|

Добыча жидких углеводородов с учетом доли в добыче совместных предприятий (тыс. тонн)

|

5 864

|

5 885

|

|

1 650

|

1 687

|

Добыча жидких углеводородов в дочерних обществах

|

3 278

|

3 400

|

|

2 322

|

2 296

|

Покупка жидких углеводородов у совместных предприятий

|

4 622

|

4 639

|

|

56

|

41

|

Прочие покупки жидких углеводородов

|

100

|

78

|

|

4 028

|

4 024

|

Итого добыча дочерними обществами и покупка жидких углеводородов (тыс. тонн)

|

8 000

|

8 117

|

Объем реализации углеводородов

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

15 149

|

14 380

|

Природный газ (млн куб. м)

|

35 412

|

33 132

|

|

|

|

в том числе:

|

|

|

|

14 496

|

14 380

|

Реализация в Российской Федерации

|

33 801

|

33 132

|

|

653

|

-

|

Реализация на международных рынках

|

1 611

|

-

|

|

4 273

|

4 072

|

Жидкие углеводороды (тыс. тонн)

|

8 050

|

8 185

|

|

|

|

в том числе:

|

|

|

|

2 028

|

1 763

|

Продукты переработки стабильного

газового конденсата

|

3 594

|

3 600

|

|

1 148

|

1 211

|

Сырая нефть

|

2 271

|

2 283

|

|

658

|

645

|

Сжиженный углеводородный газ

|

1 307

|

1 322

|

|

436

|

450

|

Стабильный газовый конденсат

|

872

|

974

|

|

3

|

3

|

Прочие нефтепродукты

|

6

|

6

|

На наши операционные показатели второго квартала и первого полугодия 2018 года существенное влияние оказали запуск производства СПГ на первой очереди завода «Ямала СПГ» в конце 2017 года, а также приобретения новых добывающих месторождений в конце 2017 года и в первом квартале 2018 года (Берегового, Западно-Ярояхинского и Сысконсыньинского). В результате, объем добычи природного газа за второй квартал и первое полугодие 2018 года вырос на 4,2% и 3,2% соответственно, а объем добычи жидких углеводородов изменился незначительно (увеличился на 0,3% и снизился на 0,4% соответственно).

Во втором квартале и первом полугодии 2018 года объем реализации природного газа составил 15,1 млрд и 35,4 млрд куб. м, увеличившись на 5,3% и 6,9% соответственно по сравнению с аналогичными периодами 2017 года, в результате начала поставок СПГ, приобретаемого у нашего совместного предприятия «Ямал СПГ», на международные рынки с декабря 2017 года и роста объемов реализации в Российской Федерации. По состоянию на конец второго квартала 2018 года суммарный объем газа, находящегося в основном в подземных хранилищах газа, газотранспортной системе и собственных газопроводах, составил 1,3 млрд куб. м по сравнению с 0,6 млрд куб. м на конец второго квартала 2017 года.

Во втором квартале 2018 года объем реализации жидких углеводородов составил 4,3 млн тонн, увеличившись на 4,9% по сравнению со вторым кварталом 2017 года преимущественно в результате реализации продуктов переработки стабильного газового конденсата, находившихся в пути на конец первого квартала 2018 года. Объем реализации жидких углеводородов в первом полугодии 2018 года составил 8,1 млн тонн, незначительно уменьшившись на 1,6% по сравнению с аналогичным периодом прошлого года. По состоянию на 30 июня 2018 г. совокупный объем жидких углеводородов, отраженный как «Остатки готовой продукции и товары в пути», составил 806 тыс. тонн по сравнению с 699 тыс. тонн по состоянию на 30 июня 2017 г. Остатки наших жидких углеводородов изменяются от периода к периоду и, как правило, реализуются в следующем отчетном периоде.

Выборочные статьи консолидированного отчета о финансовом положении

(в миллионах рублей)

|

|

30.06.2018 г.

|

31.12.2017 г.

|

|

Активы

|

|

|

|

Долгосрочные активы

|

954 363

|

890 726

|

|

в т.ч. основные средства

|

415 612

|

360 051

|

|

в т.ч. инвестиции в совместные предприятия

|

267 081

|

285 326

|

|

в т.ч. долгосрочные займы выданные и

дебиторская задолженность

|

235 237

|

211 901

|

|

Текущие активы

|

157 416

|

153 436

|

|

Итого активы

|

1 111 779

|

1 044 162

|

|

ОБЯЗАТЕЛЬСТВА И КАПИТАЛ

|

|

|

|

Долгосрочные обязательства

|

207 345

|

184 545

|

|

в т.ч. долгосрочные заемные средства

|

155 318

|

141 448

|

|

Текущие обязательства

|

76 330

|

83 958

|

|

Итого обязательства

|

283 675

|

268 503

|

|

Итого капитал, относящийся

к акционерам ПАО «НОВАТЭК»

|

808 299

|

757 839

|

|

Доля неконтролирующих

акционеров дочерних обществ

|

19 805

|

17 820

|

|

Итого капитал

|

828 104

|

775 659

|

|

Итого обязательства и капитал

|

1 111 779

|

1 044 162

|

-----

Раньше:

2018, July, 23, 13:30:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК» и/или «Компания») поставило первые партии сжиженного природного газа (СПГ) с проекта «Ямал СПГ» в Китай по Северному морскому пути (СМП).

|

2018, July, 12, 10:10:00

НОВАТЭК - В первом полугодии 2018 года добыча углеводородов составила 264,3млн баррелей нефтяного эквивалента (бнэ), в том числе 32,93 млрд куб. м природного газа и 5 864 тыс. тонн жидких углеводородов (газовый конденсат и нефть). По сравнению с первым полугодием 2017 года добыча углеводородов выросла на 6,3 млн бнэ или на 2,4%.

|

2018, June, 25, 12:05:00

НОВАТЭК - Подписанный меморандум закрепляет намерения сторон рассмотреть возможности вхождения KOGAS в проект «Арктик СПГ 2» и приобретения СПГ с проекта, участие в проекте перевалки на Камчатке и других инфраструктурных проектах, а также развивать сотрудничество в области торговли СПГ и оптимизации логистики, включая своповые операции.

|

2018, May, 25, 10:30:00

НОВАТЭК - В рамках XXII Петербургского международного экономического форума, в присутствии Президента России Владимира Путина и Президента Франции Эммануэля Макрона, Председатель Правления ПАО «НОВАТЭК» Леонид Михельсон и Председатель Совета директоров и Исполнительный директор концерна «Тоталь» Патрик Пуянне подписали обязывающее соглашение об условиях вхождения в проект «Арктик СПГ 2».

|

2018, February, 27, 13:10:00

НОВАТЭК - Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», уменьшилась до 156,4 млрд руб. (51,85 руб. на акцию) или на 39,3% по сравнению с 2016 годом.

|

2018, February, 12, 07:05:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК»), Total и Eni подписали с правительством Ливанской республики соглашения о разведке и добыче углеводородов (далее – «Соглашения») в отношении шельфовых блоков 4 и 9 в восточной части Средиземного моря. Доля участия «НОВАТЭКа» в Соглашениях составляет 20%, доли Total и Eni составляют 40%, оператором проекта является Total.

|

2017, December, 4, 22:40:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК» и/или «Компания») сообщает, что дочернее общество Компании Novatek Gas & Power Asia PTE. LTD. подписало Меморандум о взаимопонимании с компаниями Total Gas & Power Business Services S.A.S и Siemens Aktiengesellschaft.

|

FRANCE'S GDP UP TO 1.8%

IMF- On July 25, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with France.

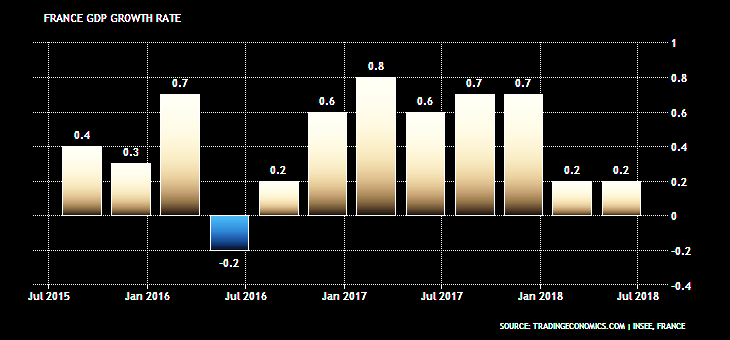

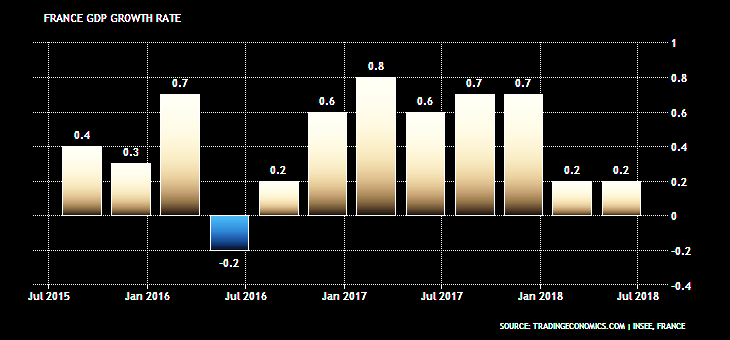

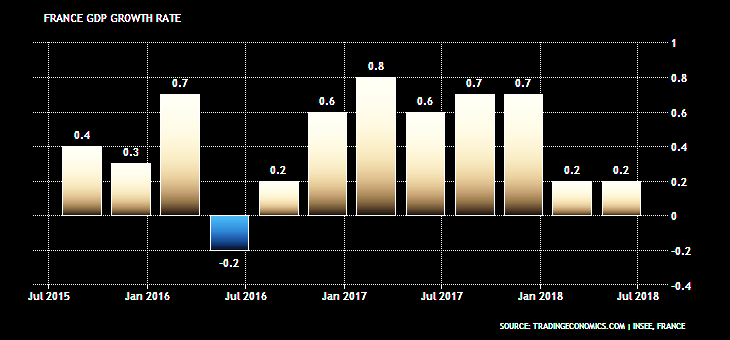

Near-term growth prospects remain favorable, although less buoyant than in 2017. Real GDP growth is projected to reach 1.8 percent this year and 1.7 percent in 2019, supported by robust investment and solid consumption. While the contribution of net exports turned slightly positive in 2017 and the current account deficit shrunk, France's external position is assessed to be moderately weaker than implied by economic fundamentals and desirable policy settings. Job growth has picked up and the unemployment rate has declined to around 9 percent. Inflation is expected to reach 1.8 percent this year, spurred by energy prices and a gradual increase in core inflation. The fiscal deficit fell to 2.6 percent in 2017, below the EDP limit of 3 percent for the first time in a decade, largely driven by the improved macroeconomic outcomes.

The government has initiated an ambitious reform strategy aimed at addressing France's structural challenges and bolstering the economy's resilience. Key labor market and tax reforms have been enacted, which should help enhance labor market flexibility and better align labor costs with productivity. Upcoming structural reforms focus on revamping France's vocational training and professional development and improving the business environment, which should help bolster the employment prospects of low-skilled workers and further support competitiveness. As to fiscal policy, the government aims to reduce the fiscal deficit and debt in the medium term by reforming public spending. On the financial sector front, the authorities have activated macroprudential policies to prevent the buildup of imbalances.

The medium-term outlook is predicated on the full implementation of ongoing reforms. Output growth is projected to gradually converge towards its long-run potential of around 1½ percent, supported by labor and product market reforms that help boost labor force participation and productivity. Spending reforms are expected to rebuild room for fiscal maneuver, while the preemptive use of macroprudential policies will further strengthen the resilience of the financial sector and its ability to support long-run growth.

Executive Board Assessment

Executive Directors noted that France experienced a broad-based cyclical recovery and a pick-up in job growth in 2017, supported by structural reform implementation and a favorable global conjuncture. Directors welcomed the substantial track record of reform implementation that the government established in its first year in office.

Looking forward, Directors considered that the outlook remains positive, but downside risks have risen, in particular, related to trade tensions, geopolitical uncertainty, and other political risks in Europe, which could weigh on investment and growth prospects. Directors recommended taking advantage of the favorable outlook to press ahead with the reform agenda to further increase the economy's resilience and to address remaining structural challenges: high structural unemployment, weak competitiveness, and high public and private debt burdens.

Directors welcomed the recent labor code and taxation reforms that are aimed at enhancing labor market flexibility and better aligning labor costs with productivity. They supported the authorities' plans to reform training and apprenticeship systems to reduce structural unemployment and improve job opportunities for disadvantaged groups. Directors noted that these reforms would need to be closely and continuously monitored for their effectiveness. Should the reforms not produce the desired effects, there would be a need to reinforce them with further measures to increase flexibility in wage setting, reinforce training for young workers, and strengthen work incentives in the unemployment benefit system.

Directors considered that complementary product market measures will be essential to foster growth and competitiveness, in addition to labor market and tax reforms. In this regard, they welcomed the recent reform of the railway sector and the planned legislation which aims to facilitate business growth, innovation, and employment. Directors also underscored the need for further efforts to liberalize regulated professions.

Directors stressed that putting public debt on a firm downward path requires further efforts to permanently reduce public spending. They noted that spending reforms at all levels of the government will be needed to support the authorities' appropriately ambitious debt and deficit-reduction objectives. This is also an opportunity to reevaluate how public services are provided and to modernize and enhance their efficiency. To enhance the strategy's credibility, Directors recommended that the reform measures be specified early, starting with the 2019 budget.

Directors noted that the banking sector is now stronger, and has been able to support the recovery. However, vulnerabilities remain, especially related to elevated debt levels in parts of the corporate sector against a backdrop of global interest rate normalization. Directors welcomed the recent macro-prudential measures aimed at reducing imbalances and underlined the need for continued monitoring of vulnerabilities and building bank buffers against shocks, including through the implementation of ongoing international regulatory changes.

|

France: Selected Economic Indicators, 2016–19

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

Projections

|

| |

|

2016

|

2017

|

2018

|

2019

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Real economy (change in percent)

|

|

|

|

|

|

Real GDP

|

1.1

|

2.3

|

1.8

|

1.7

|

|

Domestic demand

|

1.6

|

2.2

|

1.3

|

1.6

|

|

Private consumption

|

2.1

|

1.0

|

1.1

|

1.6

|

|

Public consumption

|

1.4

|

1.3

|

0.8

|

0.3

|

|

Gross fixed investment

|

2.8

|

4.5

|

2.9

|

3.0

|

|

Foreign balance (contr. to GDP growth)

|

-0.5

|

0.1

|

0.4

|

0.0

|

|

Exports of goods and services

|

1.5

|

4.5

|

4.4

|

4.7

|

|

Imports of goods and services

|

3.0

|

4.0

|

3.0

|

4.4

|

|

Nominal GDP (billions of euros)

|

2,229

|

2,292

|

2,364

|

2,441

|

| |

|

|

|

|

|

|

CPI (year average)

|

0.3

|

1.2

|

1.8

|

1.7

|

|

GDP deflator

|

0.3

|

0.5

|

1.4

|

1.6

|

| |

|

|

|

|

|

|

Gross national savings (percent of GDP)

|

21.9

|

22.9

|

22.9

|

23.0

|

|

Gross domestic investment (percent of GDP)

|

22.7

|

23.5

|

23.7

|

23.7

|

| |

|

|

|

|

|

|

Public finance (percent of GDP)

|

|

|

|

|

|

General government balance

|

-3.4

|

-2.6

|

-2.4

|

-2.6

|

|

Revenue

|

53.0

|

53.8

|

53.5

|

52.2

|

|

Expenditure

|

56.6

|

56.4

|

55.9

|

54.9

|

|

Structural balance (percent of pot. GDP)

|

-2.8

|

-2.4

|

-2.2

|

-2.7

|

|

Primary balance

|

-1.8

|

-0.9

|

-0.6

|

-0.8

|

|

General government gross debt

|

96.6

|

96.8

|

96.2

|

95.8

|

| |

|

|

|

|

|

|

Labor market (percent change)

|

|

|

|

|

|

Employment

|

0.6

|

0.6

|

0.6

|

0.5

|

|

Labor force

|

0.3

|

-0.1

|

0.0

|

0.1

|

|

Unemployment rate (percent)

|

10.1

|

9.4

|

8.9

|

8.5

|

|

Total compensation per employee

|

1.1

|

2.5

|

…

|

…

|

| |

|

|

|

|

|

|

Credit and interest rates (percent)

|

|

|

|

|

|

Growth of credit to the private non-financial sector

|

3.8

|

5.6

|

4.7

|

4.5

|

|

Money market rate (Euro area)

|

-0.3

|

-0.4

|

...

|

...

|

|

Government bond yield, 10-year

|

0.5

|

0.8

|

...

|

...

|

| |

|

|

|

|

|

|

Balance of payments (percent of GDP)

|

|

|

|

|

|

Current account

|

-0.8

|

-0.6

|

-0.8

|

-0.6

|

|

Trade balance of goods and services

|

-0.8

|

-0.9

|

-0.9

|

-0.7

|

|

Exports of goods and services

|

31.7

|

32.1

|

31.3

|

32.3

|

|

Imports of goods and services

|

-32.4

|

-33.0

|

-32.3

|

-33.1

|

|

FDI (net)

|

1.1

|

0.3

|

0.5

|

0.6

|

|

Official reserves (US$ billion)

|

56.1

|

54.8

|

...

|

...

|

|

Current account

|

-0.8

|

-0.6

|

-0.8

|

-0.6

|

| |

|

|

|

|

|

|

Exchange rates

|

|

|

|

|

|

Euro per U.S. dollar, period average

|

0.90

|

0.89

|

...

|

...

|

|

NEER, ULC-styled (2000=100)

|

98.7

|

100.0

|

...

|

...

|

|

REER, ULC-based (2000=100)

|

92.3

|

92.6

|

...

|

...

|

| |

|

|

|

|

|

|

Potential output and output gap

|

|

|

|

|

|

Potential output (change in percent)

|

1.2

|

1.4

|

1.5

|

1.5

|

|

Memo: per working age person

|

0.8

|

0.9

|

1.0

|

1.1

|

|

Output gap

|

-1.0

|

-0.1

|

0.1

|

0.3

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Sources: Haver Analytics, INSEE, Banque de France, and IMF staff calculations.

|

|

-----

Earlier:

2018, July, 11, 09:15:00

PLATTS - The Russian government is extending a production sharing agreement with France's Total for development of the Kharyaga oil field by 13 years to the end of 2031, in the latest sign that many Western majors' operations in Russia are continuing despite sanctions on the oil sector.

|

2018, June, 29, 10:15:00

ROSATOM - ROSATOM and the French EDF Group signed a Memorandum of Understanding on Development of Innovative Cooperation at the World Nuclear Exhibition 2018 (WNE). The document was signed by Alexey Likhachev, General Director of ROSATOM and Jean-Bernard L?vy, Chairman and CEO of EDF Group.

|

2018, May, 30, 13:40:00

ROSATOM - ROSATOM and French Alternative Energies and Atomic Energy Commission signed the strategic document on French-Russian partnership in the peaceful uses of atomic energy.

|

2018, May, 25, 10:30:00

NOVATEK - At the 22nd Saint Petersburg International Economic Forum, in the presence of the President of Russia Vladimir Putin and the President of France Emmanuel Macron, Chairman of the Management Board of PAO NOVATEK (“NOVATEK”) Leonid Mikhelson and Chairman and Chief Executive Officer of TOTAL S.A. (“TOTAL”) Patrick Pouyanné signed a binding agreement on the terms to enter the Arctic LNG 2 project.

|

2018, April, 30, 10:05:00

WNN - A statement of intent to strengthen cooperation on fast neutron sodium-cooled reactors has been signed between the US Department of Energy (DOE) and the French Alternative Energies and Atomic Energy Commission (CEA). The partners have also a statement of intent to begin cooperation in the field of artificial intelligence.

|

2018, March, 28, 10:40:00

WNN - France has demonstrated a strong commitment to nuclear security, according to the International Atomic Energy Agency (IAEA). The Vienna-based agency carried out a two-week International Physical Protection Advisory Service (IPPAS) follow-up mission at the French government's request.

|

2018, March, 18, 11:15:00

PENNENERGY - Siemens Gamesa Renewable Energy has secured orders for the supply of 39 onshore wind turbines in France, with aggregate capacity of 104 MW, at five wind farms being developed in the regions of Hauts de France, Grand Est, Burgundy and in Western France.

|

Tags:

FRANCE,

GDP,

ECONOMY