OIL PRICE: NEAR $74

REUTERS - Oil prices rose on Monday on worries over supply after tensions worsened between Iran and the United States, while some offshore workers began a 24-hour strike on three oil and gas platforms in the British North Sea.

Iranian Supreme Leader Ayatollah Ali Khamenei on Saturday backed a suggestion by President Hassan Rouhani that Iran could block Gulf oil shipments if its exports were stopped.

The Iranian leadership was responding to the threat of U.S. sanctions after President Donald Trump in May pulled out of a multinational agreement to trade with Tehran in return for its commitment not to develop nuclear weapons.

The Trump administration has launched an offensive of speeches and online communications meant to foment unrest and help pressure Iran to end its nuclear program and its support of militant groups, U.S. officials said.

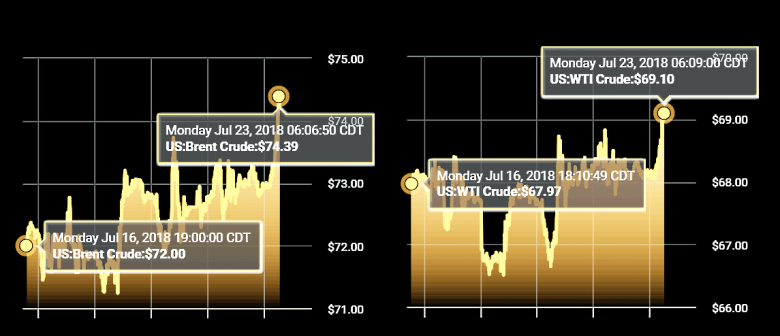

Brent crude oil LCOc1 rose $1.19 a barrel to a high of $74.26 before easing to around $74.05 by 1030 GMT. U.S. light crude CLc1 was up 70 cents at $68.96 a barrel.

"Potential Gulf supply is at risk - this is triggering the upward trend," said Tamas Varga, analyst at London brokerage PVM Oil Associates.

The rise also followed news of a 24-hour strike by 40 rig workers on three oil and gas platforms in the British North Sea. The dispute curbed gas flows to shore, but stored crude was expected to mitigate any oil supply disruption.

Limiting supply worries were concerns about the impact on global economic growth and energy demand of the escalating trade dispute between the United States and its trading partners.

Finance ministers and central bank governors from the world's 20 biggest economies ended a meeting in Buenos Aires over the weekend calling for more dialogue to prevent trade and geopolitical tensions from hurting growth.

"Downside risks over the short and medium term have increased," the finance leaders said in a statement.

The talks occurred amid escalating rhetoric in a trade dispute between the United States and China, the world's largest economies, which have already slapped tariffs on $34 billion worth of each other's goods.

Trump threatened on Friday to impose tariffs on all $500 billion of Chinese exports to the United States unless Beijing agreed major changes to its technology transfer, industrial subsidy and joint venture policies.

Economic and oil demand growth are correlated as expanding economies support fuel consumption for trade and travel, as well as for automobiles.

-----

Earlier:

2018, July, 16, 11:05:00

OIL PRICE: NEAR $75REUTERS - Brent crude futures were down 66 cents, or 0.9 percent, at $74.67 a barrel at 0645 GMT. U.S. West Texas Intermediate (WTI) crude was down 57 cents, or 0.8 percent, at $70.43 a barrel.

|

2018, July, 16, 11:00:00

IEA: OIL SUPPLY ISSUESIEA - The re-emergence of Libya as a risk factor in global supply follows a series of attacks on key infrastructure that saw production plummet to around 500 kb/d in July from close to the 1 mb/d level seen for about a year.

|

2018, July, 16, 10:55:00

SAUDI ARABIA - IRAN RESOLUTIONPLATTS - "The shift from reporting individual country conformity to reporting overall conformity will be adopted to reflect the June 23 decision of the 4th OPEC and non-OPEC Ministerial Meeting that countries will strive to adhere to the overall conformity level, voluntarily adjusted to 100%, as of July 2018," Saudi energy minister Khalid al-Falih wrote to his counterparts Thursday in a letter. |

2018, July, 16, 10:30:00

LIBYA'S OIL DOWN 160 TBDREUTERS - Production at Libya’s giant Sharara oil field was expected to fall by at least 160,000 barrels per day (bpd) on Saturday after two staff were abducted in an attack by an unknown group, the National Oil Corporation (NOC) said

|

2018, July, 12, 10:55:00

OIL PRICE: ABOVE $74REUTERS - Brent crude LCOc1 rose $1.23, or 1.7 percent, to $74.63 a barrel by 0544 GMT after slumping 6.9 percent on Wednesday. U.S. West Texas Intermediate (WTI) CLc1 added 46 cents, or 0.7 percent, to $70.84 a barrel, after falling 5 percent the previous session.

|

2018, July, 12, 10:45:00

OPEC: OIL DEMAND UP BY 1.65 MBDOPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East. |

2018, July, 12, 10:35:00

OPEC & RUSSIA 1 MBD: INSUFFICIENTPLATTS - OPEC's recent decision with Russia and other allies to boost crude output by a combined 1 million b/d may be insufficient to meet global demand in the months ahead, according to the producer group's own forecast. |