ROSNEFT: OIL PRICE $75

PLATTS - Rosneft CEO Igor Sechin said that he expects oil prices to remain at around $75/barrel up to the end of the year, in an interview aired on Russia's Channel 1 on Sunday.

"Our own budget is based on a price of $63/b. Today we see that prices are around $75/b, I think that prices will be at around this level -- $75, or a maximum of $80/b," Sechin said when asked about his expectations for price levels by the end of 2018.

Sechin's comments come amid uncertainty over price dynamics over the next six months, fueled by concerns that output in key producing countries including Iran, Venezuela and Libya may drop significantly.

Regarding Rosneft's own operations, Sechin said he does not expect the company to complete any major new acquisitions in the near future and is focusing on improving efficiency.

"Speaking of non-organic growth, we have completed the main acquisitions. We are now focused on achieving organic growth and synergies that we expect to gain from these acquisitions," Sechin said.

He also sees Rosneft's current shareholder structure as stable.

"At this stage I think that the shareholder structure has been established, I don't think there should be any new changes," he said.

Sechin welcomed the Qatar Investment Authority's decision to take a direct stake in Rosneft, describing it as a positive decision.

"The initial decision to take loans from European banks is less effective in the current circumstances, and shifting to direct ownership will be more effective for the Qatari fund," he said.

There have been several changes to Rosneft's shareholder structure in the last year and a half. In May the planned sale of a 14.16% stake in the company to China's CEFC was cancelled amid an investigation into CEFC chairman Ye Jianming's alleged involvement in economic crimes. At the time the QIA and Glencore said a new ownership structure will be introduced, with Glencore holding a 0.57% equity stake, and QIA 18.93% in Rosneft.

QIA and Glencore acquired the Rosneft stake in late 2016, before agreeing to sell the majority to CEFC in a deal worth an estimated $9 billion, that had been slated for completion by the end of Q1 2018.

Other key stakeholders in the company are state holding company Rosneftegaz with 50% and BP with 19.5%.

Sechin reiterated Sunday that the company continues to operate despite Western sanctions that target Rosneft and Sechin directly.

"Our task is to guarantee that the company operates effectively in any conditions, we will do this in any case," Sechin said.

POSSIBLE GERMAN EXPANSION

Sechin said that Rosneft may also open its own network of filling stations in Germany. The company already supplies oil products to German consumers via outlets owned by its partners BP and Total. "But it is possible that we will develop our own network," he said.

He did not give specific timeframes, commenting that it would depend on the market and whether it makes more economic sense to purchase an existing chain or build a chain. "We will need some time to take a final decision," he said.

Rosneft owns around 12% of Germany's refining capacity.

-----

Earlier:

2018, July, 23, 13:55:00

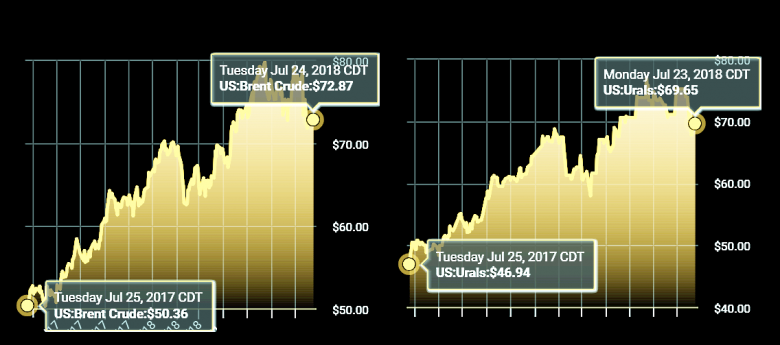

OIL PRICE: NEAR $74REUTERS - Brent crude oil LCOc1 rose $1.19 a barrel to a high of $74.26 before easing to around $74.05 by 1030 GMT. U.S. light crude CLc1 was up 70 cents at $68.96 a barrel. |

2018, July, 23, 13:50:00

ЦЕНА URALS: $ 73,53905МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 июня по 14 июля 2018 года составила $ 73,53905 за баррель, или $ 536,8 за тонну. Согласно расчетам Минфина России экспортная пошлина на нефть в РФ с 1 августа 2018 года понизится на $ 3,7 и составит $ 135,4 за тонну. |

2018, July, 16, 11:00:00

IEA: OIL SUPPLY ISSUESIEA - The re-emergence of Libya as a risk factor in global supply follows a series of attacks on key infrastructure that saw production plummet to around 500 kb/d in July from close to the 1 mb/d level seen for about a year.

|

2018, July, 12, 10:45:00

OPEC: OIL DEMAND UP BY 1.65 MBDOPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East. |

2018, July, 11, 09:25:00

OIL PRICES 2018 - 19: $73 - $69EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level. |

2018, June, 22, 13:30:00

ЛУКОЙЛ: ЦЕНА $75, ДОБЫЧА +50%ИНТЕРФАКС - Думаю, что при цене в $75 за баррель нужно увеличить добычу на 50% от уровня введенных ограничений. При этом если увеличение производства и повлияет на цену, то краткосрочно. В среднесрочном периоде она восстановится, потому что потребление нефти в мире растет, а коммерческие запасы достаточно быстро снижаются. Полагаю, что цена в $75 за баррель это баланс, который уже нащупан. |

2018, June, 15, 11:10:00

BP: GROWTH IN ENERGY DEMAND UPBP - In 2017 global energy demand grew by 2.2%, above its 10-year average of 1.7%. This above-trend growth was driven by stronger economic growth in the developed world and a slight slowing in the pace of improvement in energy intensity. |