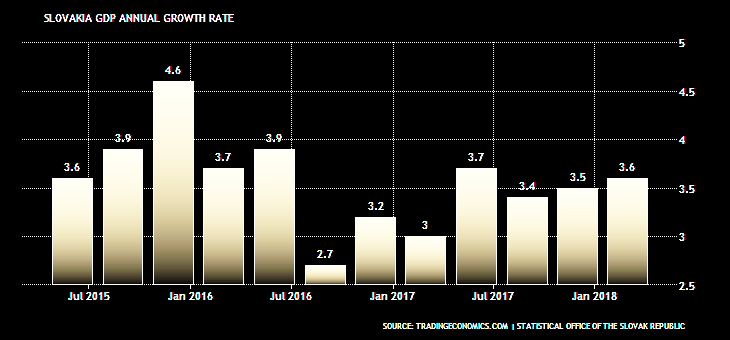

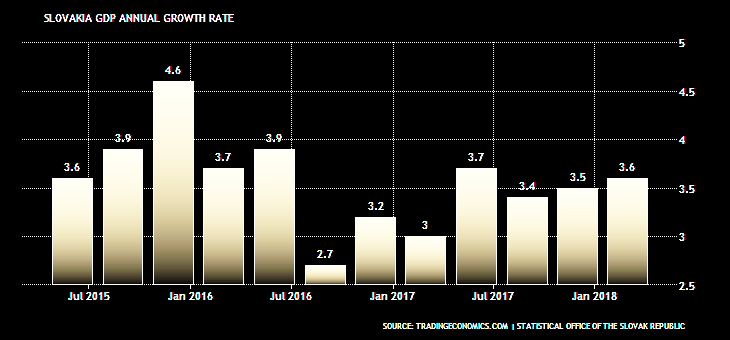

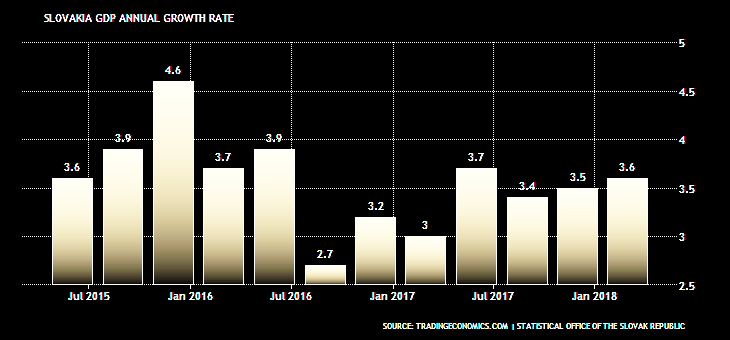

SLOVAKIA'S GDP UP TO 3%

НОВАТЭК - ПAO «НОВАТЭК» опубликовало консолидированную промежуточную сокращенную финансовую отчетность по состоянию на и за три и шесть месяцев, закончившихся 30 июня 2018 г., подготовленную в соответствии с Международными стандартами финансовой отчетности (МСФО).

Основные финансовые показатели деятельности по МСФО

(в миллионах российских рублей, если не указано иное)

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

194 818

|

128 030

|

Выручка от реализации нефти и газа

|

373 303

|

282 031

|

|

1 004

|

800

|

Прочая выручка

|

1 922

|

1 427

|

|

195 822

|

128 830

|

Итого выручка от реализации

|

375 225

|

283 458

|

|

(135 606)

|

(94 033)

|

Операционные расходы

|

(266 643)

|

(203 397)

|

|

-

|

-

|

Прибыль от выбытия долей владения

в совместных предприятиях, нетто

|

1 645

|

-

|

|

(621)

|

351

|

Прочие операционные

прибыли (убытки), нетто

|

(519)

|

625

|

|

59 595

|

35 148

|

Прибыль от операционной деятельности*

|

108 063

|

80 686

|

|

68 958

|

43 798

|

EBITDA дочерних обществ*

|

125 379

|

97 613

|

|

101 339

|

56 072

|

EBITDA с учетом доли

в EBITDA совместных предприятий*

|

177 645

|

124 252

|

|

7 380

|

13 414

|

Доходы (расходы) от финансовой деятельности

|

12 782

|

4 812

|

|

(18 215)

|

(33 768)

|

Доля в прибыли (убытке) совместных предприятий за вычетом налога на прибыль

|

(17 052)

|

9 858

|

|

48 760

|

14 794

|

Прибыль до налога на прибыль

|

105 438

|

95 356

|

|

32 041

|

3 243

|

Прибыль, относящаяся к

акционерам ПАО «НОВАТЭК»

|

75 162

|

74 261

|

|

54 289

|

33 772

|

Прибыль, относящаяся к акционерам

ПАО «НОВАТЭК», нормализованная**

|

101 199

|

78 117

|

|

18,01

|

11,20

|

Прибыль на акцию нормализованная** (в руб.)

|

33,57

|

25,89

|

* Без учета эффекта от выбытия долей владения в совместных предприятиях.

** Без учета эффектов от выбытия долей владения в совместных предприятиях и от курсовых разниц.

Во втором квартале 2018 года наша выручка от реализации составила 195,8 млрд руб., а показатель EBITDA с учетом доли в EBITDA совместных предприятий составил 101,3 млрд руб., что представляет собой увеличение на 52,0% и 80,7% соответственно по сравнению с аналогичным периодом 2017 года. За шесть месяцев, закончившихся 30 июня 2018 г., наша выручка от реализации и нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составили 375,2 млрд руб. и 177,6 млрд руб., увеличившись на 32,4% и 43,0% соответственно по сравнению с аналогичным периодом 2017 года. Рост выручки и нормализованного показателя EBITDA в основном связан с запуском производства СПГ на первой очереди завода «Ямала СПГ» в конце 2017 года и ростом средних цен реализации жидких углеводородов и природного газа.

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», увеличилась во втором квартале 2018 года до 32,0 млрд руб. (10,63 руб. на акцию) или примерно в 10 раз и до 75,2 млрд руб. (24,93 руб. на акцию) или на 1,2% за первое полугодие 2018 года по сравнению с аналогичными периодами 2017 года. На прибыль Группы в отчетных периодах значительное влияние оказало признание существенных неденежных курсовых разниц по займам Группы и совместных предприятий, номинированным в иностранной валюте. Без учета эффекта от курсовых разниц, а также единовременной прибыли от выбытия долей владения в совместных предприятиях, нормализованная прибыль, относящаяся к акционерам ПАО «НОВАТЭК», составила 54,3 млрд руб. (18,01 руб. на акцию) во втором квартале 2018 года и 101,2 млрд руб. (33,57 руб. на акцию) в первом полугодии 2018 года, увеличившись на 60,8% и 29,5% соответственно по сравнению с аналогичными периодами 2017 года.

Объем добычи и покупки углеводородов

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

131,8

|

127,5

|

Совокупная добыча углеводородов,

млн баррелей нефтяного эквивалента (млн бнэ)

|

264,3

|

258,0

|

|

1,45

|

1,40

|

Совокупная добыча (млн бнэ в сутки)

|

1,46

|

1,43

|

|

16 418

|

15 762

|

Добыча природного газа с учетом доли в

добыче совместных предприятий (млн куб. м)

|

32 926

|

31 912

|

|

10 562

|

10 952

|

Добыча природного газа в дочерних обществах

|

20 925

|

22 211

|

|

4 420

|

2 356

|

Покупка природного газа у совместных предприятий

|

12 007

|

7 657

|

|

1 708

|

1 936

|

Прочие покупки природного газа

|

3 437

|

3 796

|

|

16 690

|

15 244

|

Итого добыча природного газа дочерними обществами и покупка (млн куб. м)

|

36 369

|

33 664

|

|

2 928

|

2 918

|

Добыча жидких углеводородов с учетом доли в добыче совместных предприятий (тыс. тонн)

|

5 864

|

5 885

|

|

1 650

|

1 687

|

Добыча жидких углеводородов в дочерних обществах

|

3 278

|

3 400

|

|

2 322

|

2 296

|

Покупка жидких углеводородов у совместных предприятий

|

4 622

|

4 639

|

|

56

|

41

|

Прочие покупки жидких углеводородов

|

100

|

78

|

|

4 028

|

4 024

|

Итого добыча дочерними обществами и покупка жидких углеводородов (тыс. тонн)

|

8 000

|

8 117

|

Объем реализации углеводородов

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

15 149

|

14 380

|

Природный газ (млн куб. м)

|

35 412

|

33 132

|

|

|

|

в том числе:

|

|

|

|

14 496

|

14 380

|

Реализация в Российской Федерации

|

33 801

|

33 132

|

|

653

|

-

|

Реализация на международных рынках

|

1 611

|

-

|

|

4 273

|

4 072

|

Жидкие углеводороды (тыс. тонн)

|

8 050

|

8 185

|

|

|

|

в том числе:

|

|

|

|

2 028

|

1 763

|

Продукты переработки стабильного

газового конденсата

|

3 594

|

3 600

|

|

1 148

|

1 211

|

Сырая нефть

|

2 271

|

2 283

|

|

658

|

645

|

Сжиженный углеводородный газ

|

1 307

|

1 322

|

|

436

|

450

|

Стабильный газовый конденсат

|

872

|

974

|

|

3

|

3

|

Прочие нефтепродукты

|

6

|

6

|

На наши операционные показатели второго квартала и первого полугодия 2018 года существенное влияние оказали запуск производства СПГ на первой очереди завода «Ямала СПГ» в конце 2017 года, а также приобретения новых добывающих месторождений в конце 2017 года и в первом квартале 2018 года (Берегового, Западно-Ярояхинского и Сысконсыньинского). В результате, объем добычи природного газа за второй квартал и первое полугодие 2018 года вырос на 4,2% и 3,2% соответственно, а объем добычи жидких углеводородов изменился незначительно (увеличился на 0,3% и снизился на 0,4% соответственно).

Во втором квартале и первом полугодии 2018 года объем реализации природного газа составил 15,1 млрд и 35,4 млрд куб. м, увеличившись на 5,3% и 6,9% соответственно по сравнению с аналогичными периодами 2017 года, в результате начала поставок СПГ, приобретаемого у нашего совместного предприятия «Ямал СПГ», на международные рынки с декабря 2017 года и роста объемов реализации в Российской Федерации. По состоянию на конец второго квартала 2018 года суммарный объем газа, находящегося в основном в подземных хранилищах газа, газотранспортной системе и собственных газопроводах, составил 1,3 млрд куб. м по сравнению с 0,6 млрд куб. м на конец второго квартала 2017 года.

Во втором квартале 2018 года объем реализации жидких углеводородов составил 4,3 млн тонн, увеличившись на 4,9% по сравнению со вторым кварталом 2017 года преимущественно в результате реализации продуктов переработки стабильного газового конденсата, находившихся в пути на конец первого квартала 2018 года. Объем реализации жидких углеводородов в первом полугодии 2018 года составил 8,1 млн тонн, незначительно уменьшившись на 1,6% по сравнению с аналогичным периодом прошлого года. По состоянию на 30 июня 2018 г. совокупный объем жидких углеводородов, отраженный как «Остатки готовой продукции и товары в пути», составил 806 тыс. тонн по сравнению с 699 тыс. тонн по состоянию на 30 июня 2017 г. Остатки наших жидких углеводородов изменяются от периода к периоду и, как правило, реализуются в следующем отчетном периоде.

Выборочные статьи консолидированного отчета о финансовом положении

(в миллионах рублей)

|

|

30.06.2018 г.

|

31.12.2017 г.

|

|

Активы

|

|

|

|

Долгосрочные активы

|

954 363

|

890 726

|

|

в т.ч. основные средства

|

415 612

|

360 051

|

|

в т.ч. инвестиции в совместные предприятия

|

267 081

|

285 326

|

|

в т.ч. долгосрочные займы выданные и

дебиторская задолженность

|

235 237

|

211 901

|

|

Текущие активы

|

157 416

|

153 436

|

|

Итого активы

|

1 111 779

|

1 044 162

|

|

ОБЯЗАТЕЛЬСТВА И КАПИТАЛ

|

|

|

|

Долгосрочные обязательства

|

207 345

|

184 545

|

|

в т.ч. долгосрочные заемные средства

|

155 318

|

141 448

|

|

Текущие обязательства

|

76 330

|

83 958

|

|

Итого обязательства

|

283 675

|

268 503

|

|

Итого капитал, относящийся

к акционерам ПАО «НОВАТЭК»

|

808 299

|

757 839

|

|

Доля неконтролирующих

акционеров дочерних обществ

|

19 805

|

17 820

|

|

Итого капитал

|

828 104

|

775 659

|

|

Итого обязательства и капитал

|

1 111 779

|

1 044 162

|

-----

Раньше:

2018, July, 23, 13:30:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК» и/или «Компания») поставило первые партии сжиженного природного газа (СПГ) с проекта «Ямал СПГ» в Китай по Северному морскому пути (СМП).

|

2018, July, 12, 10:10:00

НОВАТЭК - В первом полугодии 2018 года добыча углеводородов составила 264,3млн баррелей нефтяного эквивалента (бнэ), в том числе 32,93 млрд куб. м природного газа и 5 864 тыс. тонн жидких углеводородов (газовый конденсат и нефть). По сравнению с первым полугодием 2017 года добыча углеводородов выросла на 6,3 млн бнэ или на 2,4%.

|

2018, June, 25, 12:05:00

НОВАТЭК - Подписанный меморандум закрепляет намерения сторон рассмотреть возможности вхождения KOGAS в проект «Арктик СПГ 2» и приобретения СПГ с проекта, участие в проекте перевалки на Камчатке и других инфраструктурных проектах, а также развивать сотрудничество в области торговли СПГ и оптимизации логистики, включая своповые операции.

|

2018, May, 25, 10:30:00

НОВАТЭК - В рамках XXII Петербургского международного экономического форума, в присутствии Президента России Владимира Путина и Президента Франции Эммануэля Макрона, Председатель Правления ПАО «НОВАТЭК» Леонид Михельсон и Председатель Совета директоров и Исполнительный директор концерна «Тоталь» Патрик Пуянне подписали обязывающее соглашение об условиях вхождения в проект «Арктик СПГ 2».

|

2018, February, 27, 13:10:00

НОВАТЭК - Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», уменьшилась до 156,4 млрд руб. (51,85 руб. на акцию) или на 39,3% по сравнению с 2016 годом.

|

2018, February, 12, 07:05:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК»), Total и Eni подписали с правительством Ливанской республики соглашения о разведке и добыче углеводородов (далее – «Соглашения») в отношении шельфовых блоков 4 и 9 в восточной части Средиземного моря. Доля участия «НОВАТЭКа» в Соглашениях составляет 20%, доли Total и Eni составляют 40%, оператором проекта является Total.

|

2017, December, 4, 22:40:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК» и/или «Компания») сообщает, что дочернее общество Компании Novatek Gas & Power Asia PTE. LTD. подписало Меморандум о взаимопонимании с компаниями Total Gas & Power Business Services S.A.S и Siemens Aktiengesellschaft.

|

SLOVAKIA'S GDP UP TO 3%

IMF- On July 23, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the 2018 Article IV Consultation with the Slovak Republic.

Slovakia's economic performance continues to be favorable, with real per capita GDP growing at the average annual rate of 3 percent over the past five years. Growth has been supported by predominantly domestic demand. Private consumption continued to benefit from strong credit growth, robust job creation, and rising wages, while investment reversed its temporary decline from 2016 that was due to a slow start in the implementation of new EU funds programming period. Unemployment reached a record low of 7.7 percent at end-2017. The output gap is slightly positive with inflation picking up recently, likely reflecting both strong domestic demand and a tight labor market. On the back of strong economic growth, fiscal consolidation has continued putting public debt on a firmly downward trajectory. The banking sector is well-capitalized and profitable. Despite a declining interest margin, banks have maintained their profitability by increasing lending volumes.

Real GDP growth is projected to accelerate to 4 percent this year and 4.2 percent in 2019, reflecting additional investment in the automotive industry and expanded export capacity, before converging towards its potential of 3½ percent in the medium term. The current account balance is expected to continue improving along with the trade balance. On the external front, rising trade protectionism constitutes the main downside risk for Slovakia's export-dependent economy as well as possible financial turmoil in the euro area. On the domestic front, downside risks arise from labor shortages, particularly for skilled workers, and vulnerabilities related to the fast credit growth. On the upside, growth can become stronger if there is a pick-up in investment, including from higher absorption of the EU funds.

Notwithstanding the favorable outlook, Slovakia faces some important structural challenges. As in other countries, post-crisis productivity growth has slowed significantly. Some initial progress has been made on structural reforms, including plans to expand the provision of formal childcare and pre-primary education, and efforts to enhance public administration transparency. However, challenges remain, including acute labor shortages, significant gaps in quality of education and institutions relative to EU peers, and an ageing workforce.

Executive Board Assessment

Executive Directors welcomed the Slovak economy's favorable performance, with robust real per capita GDP growth, record‑low unemployment, and sustained improvement in fiscal balances. Strong real convergence has been facilitated by increasing and successful integration into the European Union and the euro area. Growth is expected to accelerate in 2018 and converge to its potential over the medium term. However, Directors noted risks from rising international trade tensions, persistent labor shortages, and a potential sudden downturn in the property market. Directors urged the authorities to decisively address these challenges.

Directors noted that labor shortages and low labor force participation of women and disadvantaged groups pose constraints to potential growth. They highlighted the need to focus structural policies on increasing labor supply and improving education and institutional quality to strengthen productivity and potential growth.

To address rising labor shortages and skills mismatches, Directors supported recent measures to streamline the issuance of work permits for foreign workers, and recommended further simplification of administrative procedures. Focusing active labor market policies on training, job counseling, and enhancing labor mobility will be important. Directors also welcomed the planned expansion of formal childcare services and broadly encouraged greater gender flexibility in the use of childcare‑related leave.

To close the education gap, Directors encouraged further measures to enhance the attractiveness of the teaching profession and strengthen collaboration between vocational schools and employers. Investment in R&D will also be important to foster innovation and move up the export value chain. On governance, Directors underscored the importance of the effective implementation of the recently approved Civil Service Act and Anti‑Offshore Law, as well as a more competitive public procurement system.

Directors supported the authorities' fiscal policy efforts which, together with robust growth, are helping to improve fiscal balances and create policy space. The planned fiscal path to achieve a balanced position in the medium term would create sufficient buffers to weather macroeconomic shocks within the framework of the Fiscal Responsibility Law. Continued efforts to improve public sector efficiency would unlock resources to finance policy priorities, such as measures to increase domestic labor supply and address gaps in infrastructure and education quality. Against this backdrop, Directors welcomed planned measures to combat tax evasion and further improve tax administration, and urged the authorities to fully capture the savings identified in the ongoing public expenditure reviews.

Directors concurred that the banking system is well capitalized, liquid, and profitable. However, they cautioned that increased household indebtedness renders households and the banking sector vulnerable to adverse macroeconomic shocks and a property market downturn. In this respect, Directors commended the authorities for proactively using macroprudential policies over the past four years to curb lending to risky and highly‑indebted borrowers. They viewed these measures as striking an appropriate balance between financial deepening and safeguarding financial stability, and welcomed the authorities' readiness to further tighten macroprudential measures if needed. Many Directors also saw scope to raise property taxes or reduce tax subsidy to help manage housing demand.

It is expected that the next Article IV consultation with the Slovak Republic will be held on the standard 12‑month cycle.

|

Slovak Republic: Selected Economic Indicators, 2015–2020

|

| |

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

| |

|

|

Est.

|

Projections

|

| |

|

|

|

|

|

|

|

National income, prices and wages (Annual percentage change)

|

|

|

|

|

Real GDP

|

3.9

|

3.3

|

3.4

|

4.0

|

4.2

|

3.8

|

|

Inflation (HICP)

|

-0.3

|

-0.5

|

1.3

|

2.4

|

2.1

|

2.0

|

|

Inflation (HICP, end of period)

|

-0.5

|

0.2

|

2.0

|

2.5

|

2.0

|

2.0

|

|

Employment

|

2.0

|

2.4

|

2.2

|

1.6

|

1.1

|

1.0

|

|

Unemployment rate (Percent)

|

11.5

|

9.7

|

8.1

|

7.4

|

6.8

|

6.4

|

| |

|

|

|

|

|

|

|

Public finance, general government (Percent of GDP)

|

|

|

|

|

Revenue

|

42.5

|

39.3

|

39.4

|

38.4

|

38.1

|

38.6

|

|

Expenditure

|

45.2

|

41.5

|

40.4

|

39.1

|

38.6

|

38.6

|

|

Overall balance

|

-2.7

|

-2.2

|

-1.0

|

-0.8

|

-0.5

|

0.0

|

|

General government debt

|

52.3

|

51.8

|

50.9

|

49.3

|

46.7

|

44.9

|

| |

|

|

|

|

|

|

|

Monetary and financial indicators (Percent)

|

|

|

|

|

|

Credit to private sector (Growth rate)

|

9.6

|

9.7

|

11.0

|

10.3

|

9.7

|

9.0

|

|

Lending rates1

|

2.7

|

2.0

|

…

|

…

|

…

|

…

|

|

Deposit rates2

|

1.0

|

0.9

|

…

|

…

|

…

|

…

|

|

Government 10-year bond yield

|

0.9

|

0.5

|

…

|

…

|

…

|

…

|

| |

|

|

|

|

|

|

|

Balance of payments (Percent of GDP)

|

|

|

|

|

|

|

|

Trade balance (goods)

|

1.3

|

2.0

|

0.8

|

0.3

|

0.9

|

1.5

|

|

Current account balance

|

-1.7

|

-1.5

|

-2.1

|

-1.8

|

-0.9

|

-0.3

|

|

Gross external debt

|

85.2

|

90.9

|

110.8

|

110.0

|

108.9

|

108.0

|

| |

|

|

|

|

|

|

|

Sources: National Authorities; and IMF staff projections.

|

|

|

|

|

1 Average of interest rates on new housing loans to households and loans of less than €1 million to nonfinancial corporations (all maturities).

|

|

2 Average of interest rates on new deposits with agreed maturity (up to 1 year) from households and nonfinancial corporations.

|

|

-----

Earlier:

2018, April, 11, 13:15:00

PLATTS - Russian flows of natural gas into Germany and Slovakia combined rose above 400 million cu m/d in each of the final three days of Week 14 for the first time on almost five months as Brotherhood flows increased, data from S&P Global Platts Analytics showed.

|

2017, December, 4, 23:00:00

EBRD - To date, the EBRD has invested €2.3 billion in more than 130 projects in the country. The Bank combines project financing with policy engagement and most recently supported the Slovak Republic in creating the legal foundations for covered bonds with amendments to the relevant law in line with best practice recommendations by the European Banking Authority.

|

2016, July, 4, 18:30:00

Gazprom will send some of the gas from its controversial Nord Stream 2 pipeline through Slovakia, the Russian state-controlled company said, in a move that may soften Slovak opposition to the project.

|

2016, July, 4, 18:20:00

Eustream said June 30 that it welcomed assurances from Gazprom at the meetings that the Slovak and the Czech gas transmission systems will be used in long term even if NS2 is built. Eustream said also it “highly appreciates the understanding between both parties that the entry point from Ukraine to Slovakia shall remain fully functional even if NS2 is commissioned.”

|

2015, June, 5, 18:50:00

Slovakian Prime Minister Robert Fico met with Russian Prime Minister Dmitry Medvedev in Moscow and proposed a plan that would transfer gas from the Turkish border through Bulgaria, Romania, Hungary and Slovakia, thereby bypassing Greece.

|

2015, May, 24, 19:50:00

Hungary, Romania, Bulgaria and Slovakia will sign an agreement to interconnect their natural gas networks whih to allow also the reverse transit, announced on Thursday night the Hungarian minister of Foreign Affairs and Trade Peter Szijjarto on the Hungarian public television station M1, MTI reports, according to Mediafax.

|

2014, October, 2, 20:40:00

Russia cut natural gas supplies to European Union member Slovakia by 50% Wednesday, Moscow's latest and most significant reduction in energy supplies to an EU country that is helping Ukraine build gas supplies ahead of winter.

|

Tags:

SLOVAKIA,

GDP,

ECONOMY