U.S. INDUSTRIAL PRODUCTION UP 0.6%

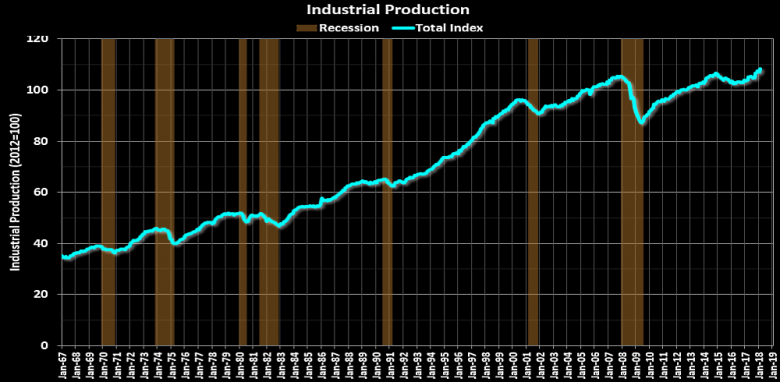

U.S. FRB - Industrial production rose 0.6 percent in June after declining 0.5 percent in May. For the second quarter as a whole, industrial production advanced at an annual rate of 6.0 percent, its third consecutive quarterly increase. Manufacturing output moved up 0.8 percent in June. The production of motor vehicles and parts rebounded last month after truck assemblies fell sharply in May because of a disruption at a parts supplier. Factory output, aside from motor vehicles and parts, increased 0.3 percent in June. The index for mining rose 1.2 percent and surpassed the level of its previous historical peak (December 2014); the output of utilities moved down 1.5 percent. At 107.7 percent of its 2012 average, total industrial production was 3.8 percent higher in June than it was a year earlier. Capacity utilization for the industrial sector increased 0.3 percentage point in June to 78.0 percent, a rate that is 1.8 percentage points below its long-run (1972–2017) average.

Market Groups

The rebound in the output of motor vehicles and parts contributed to gains of about 1/2 percent for consumer goods and for materials and to a jump of about 2 percent for business equipment.

Excluding automotive products, the index for consumer goods was little changed; the output of other durable consumer goods, on net, edged up, and the indexes for non-energy nondurable consumer goods and for consumer energy products both edged down. The advances in business equipment and in materials reflected gains in nearly all of their other major components in addition to the indexes related to motor vehicles.

The results were mixed for major market groups that are not directly affected by swings in the production of motor vehicles and parts. The index for construction supplies declined, the index for business supplies was little changed, and the index for defense and space equipment moved up.

Industry Groups

Manufacturing output moved up 0.8 percent in June and increased at an annual rate of 1.9 percent in the second quarter, about the same pace as in the first quarter. In June, the index for durables advanced 1.6 percent, while the production of nondurables was little changed. The output of other manufacturing (publishing and logging) declined 0.7 percent. Within durables, the rebound of about 8 percent for motor vehicles and parts was accompanied by increases of 1 percent or more for wood products, for computer and electronic products, and for aerospace and miscellaneous transportation equipment. Within nondurable manufacturing, a large drop for apparel and leather and smaller declines for plastics and rubber products and for food, beverage, and tobacco products were offset by gains elsewhere.

Mining output rose more than 1 percent in June for its fifth consecutive monthly increase; the index jumped more than 19 percent at an annual rate in the second quarter. Gains in the oil and gas sector continued to support the expansion of the mining sector so far this year. In June, the index for utilities decreased 1 1/2 percent, as a loss for electric utilities outweighed a gain for gas utilities.

Capacity utilization for manufacturing rose 0.5 percentage point to 75.5 percent in June, a rate that is 2.8 percentage points below its long-run average. The operating rate for durables increased about 1 percentage point, and the rate for nondurables was unchanged. The utilization rate for mining rose to 92.7 percent, which is about 6 percentage points higher than its long-run average and about 1 percentage point above its peak in 2014. The rate for utilities moved down 1.3 percentage points and remained well below its long-run average.

-----

Earlier:

2018, July, 12, 10:30:00

U.S. FOREIGN DIRECT INVESTMENT: $259.6 BLNU.S. BEA - Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $259.6 billion (preliminary) in 2017. Expenditures were down 32 percent from $379.7 billion (revised) in 2016 and were below the annual average of $359.9 billion for 2014-2016. As in previous years, acquisitions of existing businesses accounted for a large majority of total expenditures. |

2018, July, 9, 15:10:00

U.S. DEFICIT DOWN $3 BLN TO $43.1 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in May, down $3.0 billion from $46.1 billion in April, |

2018, July, 9, 14:55:00

U.S. UNEMPLOYMENT UP TO 4%U.S. BLS - Total nonfarm payroll employment increased by 213,000 in June, and the unemployment rate rose to 4.0 percent,

|

2018, July, 4, 12:10:00

U.S. ECONOMY UP AGAINIMF - The near-term outlook for the U.S. economy is one of strong growth and job creation. Unemployment is near levels not seen in 50 years, and growth is set to accelerate, aided by a fiscal stimulus, a recovery of private investment, and supportive financial conditions. These positive outturns have supported, and been reinforced by, a favorable external environment. The balance of evidence suggests that the U.S. economy is beyond full employment. |

2018, June, 18, 14:00:00

U.S. IS BETTERIMF - Within the next few years, the U.S. economy is expected to enter its longest expansion in recorded history. The Tax Cuts and Jobs Act and the approved increase in spending are providing a significant boost to the economy. We forecast growth of close to 3 percent this year but falling from that level over the medium-term. In my discussions with Secretary Mnuchin he was clear that he regards our medium-term outlook as too pessimistic. Frankly, I hope he is right. That would be good for both the U.S. and the world economy. |

2018, June, 18, 13:55:00

U.S. ECONOMY UPIMF - The near-term outlook for the U.S. economy is one of strong growth and job creation. Unemployment is already near levels not seen since the late 1960s and growth is set to accelerate, aided by a near-term fiscal stimulus, a welcome recovery of private investment, and supportive financial conditions. These positive outturns have supported, and been reinforced by, a favorable external environment with a broad-based pick up in global activity. Next year, the U.S. economy is expected to mark the longest expansion in its recorded history. The balance of evidence suggests that the U.S. economy is beyond full employment.

|

2018, June, 18, 13:50:00

U.S. INDUSTRIAL PRODUCTION DOWN 0.1%U.S. FRB - Industrial production edged down 0.1 percent in May after rising 0.9 percent in April. Manufacturing production fell 0.7 percent in May, largely because truck assemblies were disrupted by a major fire at a parts supplier. Excluding motor vehicles and parts, factory output moved down 0.2 percent. The index for mining rose 1.8 percent, its fourth consecutive month of growth; the output of utilities moved up 1.1 percent. At 107.3 percent of its 2012 average, total industrial production was 3.5 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2017) average. |