U.S. OIL TO CHINA DOWN

НОВАТЭК - ПAO «НОВАТЭК» опубликовало консолидированную промежуточную сокращенную финансовую отчетность по состоянию на и за три и шесть месяцев, закончившихся 30 июня 2018 г., подготовленную в соответствии с Международными стандартами финансовой отчетности (МСФО).

Основные финансовые показатели деятельности по МСФО

(в миллионах российских рублей, если не указано иное)

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

194 818

|

128 030

|

Выручка от реализации нефти и газа

|

373 303

|

282 031

|

|

1 004

|

800

|

Прочая выручка

|

1 922

|

1 427

|

|

195 822

|

128 830

|

Итого выручка от реализации

|

375 225

|

283 458

|

|

(135 606)

|

(94 033)

|

Операционные расходы

|

(266 643)

|

(203 397)

|

|

-

|

-

|

Прибыль от выбытия долей владения

в совместных предприятиях, нетто

|

1 645

|

-

|

|

(621)

|

351

|

Прочие операционные

прибыли (убытки), нетто

|

(519)

|

625

|

|

59 595

|

35 148

|

Прибыль от операционной деятельности*

|

108 063

|

80 686

|

|

68 958

|

43 798

|

EBITDA дочерних обществ*

|

125 379

|

97 613

|

|

101 339

|

56 072

|

EBITDA с учетом доли

в EBITDA совместных предприятий*

|

177 645

|

124 252

|

|

7 380

|

13 414

|

Доходы (расходы) от финансовой деятельности

|

12 782

|

4 812

|

|

(18 215)

|

(33 768)

|

Доля в прибыли (убытке) совместных предприятий за вычетом налога на прибыль

|

(17 052)

|

9 858

|

|

48 760

|

14 794

|

Прибыль до налога на прибыль

|

105 438

|

95 356

|

|

32 041

|

3 243

|

Прибыль, относящаяся к

акционерам ПАО «НОВАТЭК»

|

75 162

|

74 261

|

|

54 289

|

33 772

|

Прибыль, относящаяся к акционерам

ПАО «НОВАТЭК», нормализованная**

|

101 199

|

78 117

|

|

18,01

|

11,20

|

Прибыль на акцию нормализованная** (в руб.)

|

33,57

|

25,89

|

* Без учета эффекта от выбытия долей владения в совместных предприятиях.

** Без учета эффектов от выбытия долей владения в совместных предприятиях и от курсовых разниц.

Во втором квартале 2018 года наша выручка от реализации составила 195,8 млрд руб., а показатель EBITDA с учетом доли в EBITDA совместных предприятий составил 101,3 млрд руб., что представляет собой увеличение на 52,0% и 80,7% соответственно по сравнению с аналогичным периодом 2017 года. За шесть месяцев, закончившихся 30 июня 2018 г., наша выручка от реализации и нормализованный показатель EBITDA с учетом доли в EBITDA совместных предприятий составили 375,2 млрд руб. и 177,6 млрд руб., увеличившись на 32,4% и 43,0% соответственно по сравнению с аналогичным периодом 2017 года. Рост выручки и нормализованного показателя EBITDA в основном связан с запуском производства СПГ на первой очереди завода «Ямала СПГ» в конце 2017 года и ростом средних цен реализации жидких углеводородов и природного газа.

Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», увеличилась во втором квартале 2018 года до 32,0 млрд руб. (10,63 руб. на акцию) или примерно в 10 раз и до 75,2 млрд руб. (24,93 руб. на акцию) или на 1,2% за первое полугодие 2018 года по сравнению с аналогичными периодами 2017 года. На прибыль Группы в отчетных периодах значительное влияние оказало признание существенных неденежных курсовых разниц по займам Группы и совместных предприятий, номинированным в иностранной валюте. Без учета эффекта от курсовых разниц, а также единовременной прибыли от выбытия долей владения в совместных предприятиях, нормализованная прибыль, относящаяся к акционерам ПАО «НОВАТЭК», составила 54,3 млрд руб. (18,01 руб. на акцию) во втором квартале 2018 года и 101,2 млрд руб. (33,57 руб. на акцию) в первом полугодии 2018 года, увеличившись на 60,8% и 29,5% соответственно по сравнению с аналогичными периодами 2017 года.

Объем добычи и покупки углеводородов

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

131,8

|

127,5

|

Совокупная добыча углеводородов,

млн баррелей нефтяного эквивалента (млн бнэ)

|

264,3

|

258,0

|

|

1,45

|

1,40

|

Совокупная добыча (млн бнэ в сутки)

|

1,46

|

1,43

|

|

16 418

|

15 762

|

Добыча природного газа с учетом доли в

добыче совместных предприятий (млн куб. м)

|

32 926

|

31 912

|

|

10 562

|

10 952

|

Добыча природного газа в дочерних обществах

|

20 925

|

22 211

|

|

4 420

|

2 356

|

Покупка природного газа у совместных предприятий

|

12 007

|

7 657

|

|

1 708

|

1 936

|

Прочие покупки природного газа

|

3 437

|

3 796

|

|

16 690

|

15 244

|

Итого добыча природного газа дочерними обществами и покупка (млн куб. м)

|

36 369

|

33 664

|

|

2 928

|

2 918

|

Добыча жидких углеводородов с учетом доли в добыче совместных предприятий (тыс. тонн)

|

5 864

|

5 885

|

|

1 650

|

1 687

|

Добыча жидких углеводородов в дочерних обществах

|

3 278

|

3 400

|

|

2 322

|

2 296

|

Покупка жидких углеводородов у совместных предприятий

|

4 622

|

4 639

|

|

56

|

41

|

Прочие покупки жидких углеводородов

|

100

|

78

|

|

4 028

|

4 024

|

Итого добыча дочерними обществами и покупка жидких углеводородов (тыс. тонн)

|

8 000

|

8 117

|

Объем реализации углеводородов

|

II кв.

2018 г.

|

II кв.

2017 г.

|

|

1П

2018 г.

|

1П

2017 г.

|

|

15 149

|

14 380

|

Природный газ (млн куб. м)

|

35 412

|

33 132

|

|

|

|

в том числе:

|

|

|

|

14 496

|

14 380

|

Реализация в Российской Федерации

|

33 801

|

33 132

|

|

653

|

-

|

Реализация на международных рынках

|

1 611

|

-

|

|

4 273

|

4 072

|

Жидкие углеводороды (тыс. тонн)

|

8 050

|

8 185

|

|

|

|

в том числе:

|

|

|

|

2 028

|

1 763

|

Продукты переработки стабильного

газового конденсата

|

3 594

|

3 600

|

|

1 148

|

1 211

|

Сырая нефть

|

2 271

|

2 283

|

|

658

|

645

|

Сжиженный углеводородный газ

|

1 307

|

1 322

|

|

436

|

450

|

Стабильный газовый конденсат

|

872

|

974

|

|

3

|

3

|

Прочие нефтепродукты

|

6

|

6

|

На наши операционные показатели второго квартала и первого полугодия 2018 года существенное влияние оказали запуск производства СПГ на первой очереди завода «Ямала СПГ» в конце 2017 года, а также приобретения новых добывающих месторождений в конце 2017 года и в первом квартале 2018 года (Берегового, Западно-Ярояхинского и Сысконсыньинского). В результате, объем добычи природного газа за второй квартал и первое полугодие 2018 года вырос на 4,2% и 3,2% соответственно, а объем добычи жидких углеводородов изменился незначительно (увеличился на 0,3% и снизился на 0,4% соответственно).

Во втором квартале и первом полугодии 2018 года объем реализации природного газа составил 15,1 млрд и 35,4 млрд куб. м, увеличившись на 5,3% и 6,9% соответственно по сравнению с аналогичными периодами 2017 года, в результате начала поставок СПГ, приобретаемого у нашего совместного предприятия «Ямал СПГ», на международные рынки с декабря 2017 года и роста объемов реализации в Российской Федерации. По состоянию на конец второго квартала 2018 года суммарный объем газа, находящегося в основном в подземных хранилищах газа, газотранспортной системе и собственных газопроводах, составил 1,3 млрд куб. м по сравнению с 0,6 млрд куб. м на конец второго квартала 2017 года.

Во втором квартале 2018 года объем реализации жидких углеводородов составил 4,3 млн тонн, увеличившись на 4,9% по сравнению со вторым кварталом 2017 года преимущественно в результате реализации продуктов переработки стабильного газового конденсата, находившихся в пути на конец первого квартала 2018 года. Объем реализации жидких углеводородов в первом полугодии 2018 года составил 8,1 млн тонн, незначительно уменьшившись на 1,6% по сравнению с аналогичным периодом прошлого года. По состоянию на 30 июня 2018 г. совокупный объем жидких углеводородов, отраженный как «Остатки готовой продукции и товары в пути», составил 806 тыс. тонн по сравнению с 699 тыс. тонн по состоянию на 30 июня 2017 г. Остатки наших жидких углеводородов изменяются от периода к периоду и, как правило, реализуются в следующем отчетном периоде.

Выборочные статьи консолидированного отчета о финансовом положении

(в миллионах рублей)

|

|

30.06.2018 г.

|

31.12.2017 г.

|

|

Активы

|

|

|

|

Долгосрочные активы

|

954 363

|

890 726

|

|

в т.ч. основные средства

|

415 612

|

360 051

|

|

в т.ч. инвестиции в совместные предприятия

|

267 081

|

285 326

|

|

в т.ч. долгосрочные займы выданные и

дебиторская задолженность

|

235 237

|

211 901

|

|

Текущие активы

|

157 416

|

153 436

|

|

Итого активы

|

1 111 779

|

1 044 162

|

|

ОБЯЗАТЕЛЬСТВА И КАПИТАЛ

|

|

|

|

Долгосрочные обязательства

|

207 345

|

184 545

|

|

в т.ч. долгосрочные заемные средства

|

155 318

|

141 448

|

|

Текущие обязательства

|

76 330

|

83 958

|

|

Итого обязательства

|

283 675

|

268 503

|

|

Итого капитал, относящийся

к акционерам ПАО «НОВАТЭК»

|

808 299

|

757 839

|

|

Доля неконтролирующих

акционеров дочерних обществ

|

19 805

|

17 820

|

|

Итого капитал

|

828 104

|

775 659

|

|

Итого обязательства и капитал

|

1 111 779

|

1 044 162

|

-----

Раньше:

2018, July, 23, 13:30:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК» и/или «Компания») поставило первые партии сжиженного природного газа (СПГ) с проекта «Ямал СПГ» в Китай по Северному морскому пути (СМП).

|

2018, July, 12, 10:10:00

НОВАТЭК - В первом полугодии 2018 года добыча углеводородов составила 264,3млн баррелей нефтяного эквивалента (бнэ), в том числе 32,93 млрд куб. м природного газа и 5 864 тыс. тонн жидких углеводородов (газовый конденсат и нефть). По сравнению с первым полугодием 2017 года добыча углеводородов выросла на 6,3 млн бнэ или на 2,4%.

|

2018, June, 25, 12:05:00

НОВАТЭК - Подписанный меморандум закрепляет намерения сторон рассмотреть возможности вхождения KOGAS в проект «Арктик СПГ 2» и приобретения СПГ с проекта, участие в проекте перевалки на Камчатке и других инфраструктурных проектах, а также развивать сотрудничество в области торговли СПГ и оптимизации логистики, включая своповые операции.

|

2018, May, 25, 10:30:00

НОВАТЭК - В рамках XXII Петербургского международного экономического форума, в присутствии Президента России Владимира Путина и Президента Франции Эммануэля Макрона, Председатель Правления ПАО «НОВАТЭК» Леонид Михельсон и Председатель Совета директоров и Исполнительный директор концерна «Тоталь» Патрик Пуянне подписали обязывающее соглашение об условиях вхождения в проект «Арктик СПГ 2».

|

2018, February, 27, 13:10:00

НОВАТЭК - Прибыль, относящаяся к акционерам ПАО «НОВАТЭК», уменьшилась до 156,4 млрд руб. (51,85 руб. на акцию) или на 39,3% по сравнению с 2016 годом.

|

2018, February, 12, 07:05:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК»), Total и Eni подписали с правительством Ливанской республики соглашения о разведке и добыче углеводородов (далее – «Соглашения») в отношении шельфовых блоков 4 и 9 в восточной части Средиземного моря. Доля участия «НОВАТЭКа» в Соглашениях составляет 20%, доли Total и Eni составляют 40%, оператором проекта является Total.

|

2017, December, 4, 22:40:00

НОВАТЭК - ПAO «НОВАТЭК» (далее – «НОВАТЭК» и/или «Компания») сообщает, что дочернее общество Компании Novatek Gas & Power Asia PTE. LTD. подписало Меморандум о взаимопонимании с компаниями Total Gas & Power Business Services S.A.S и Siemens Aktiengesellschaft.

|

U.S. OIL TO CHINA DOWN

PLATTS - China's crude oil imports from the US for July have fallen sharply from June, and are expected to drop even further for August, vessel tracking data showed, as Beijing's tariffs on US crude imports get closer to implementation.

The decline is reflected in changing trade patterns of oil tankers loaded with US crude headed to Asia and in the procurement activity of state-run Unipec, the trading arm of China Petroleum & Chemical Corp or Sinopec, the world's largest refiner by capacity.

"Sinopec will continue to take deliveries of crude from the US in August, but will reduce buying from the producer for the rest of the year," said an executive at a Sinopec refinery, who declined to be named.

Sinopec has lost buying interest in US crude. London-based market sources said Unipec resold its June-loading US cargoes after Beijing announced in mid-June that it was considering imposing a 25% import tariff on US crude. Asian refineries also confirmed receiving offers for Unipec's US cargoes.

Unipec had purchased nearly 16 million barrels of light sweet US crudes in June. These cargoes included the WTI Midland, Eagle Ford, Bakken and Domestic Sweet Blend grades, and were expected to be delivered to China over July-August.

China received 14.65 million barrels of US crude in June, which was a historical high, but volumes more than halved to just 6.9 million barrels in July, according to S&P Global Platts' vessel tracker cFlow. Arrivals in August are expected to shrink even more to around 6 million barrels.

REDIRECTED OIL TANKERS

Oil tankers laden with US crude that were initially headed to China appear to be getting diverted to other buyers, cFlow data showed.

The 317,821 dwt VLCC Layla was chartered by Unipec and departed the US Gulf Coast on June 29, with a 2-million-barrel cargo of US crude, for delivery at Qingdao, China, in August, according to the vessel's original shipping fixture. But its destination has been alternating between South Korea, Japan and India in the last few days.

Similarly, the 299,946 dwt VLCC Aquitaine, carrying a 1.88-million-barrel cargo of US crude, was originally headed for Qingdao but arrived at a terminal in Rayong, Thailand, earlier this week, where PTT has a refinery.

This cargo is in addition to PTT's purchase of around 0.5 million barrels of Bakken crude two months ago, on behalf of IRPC, for delivery over July 20-August 10, Platts reported previously. The 146,639 dwt Cap Romuald is currently on a US-Thailand voyage and expected to arrive at Sriracha on August 10.

Several other tankers on the US-China route are expected to change course in coming weeks.

US crude arrivals in China hit 317,175 b/d in the first seven months of this year. Sinopec had been keen to raise its shipments from the US by around 80% to 200,000 b/d in 2018 from around 112,000 b/d last year. This is now unlikely to happen.

TRADE WAR TROUBLES

On July 6, the US imposed a 25% tariff on Chinese imports worth $34 billion to which China imposed proportional retaliatory tariffs. The next action would be 25% tariffs on another $16 billion of goods, and China has included US crude oil in this batch.

The US Trade Representative's office held public hearings for the tariffs on July 24-25, and has set July 31 as the deadline for rebuttals. The tariffs could take another month to be implemented, and China's response will be immediate.

It is possible that US crude shipments that remain unsold by Unipec continue to head to Chinese ports, but end up as stragglers due to the uncertain date of the tariffs.

"If the tariff is imposed ahead of the US crude arrival, we will put the barrels into bonded storage in China first then decide what to do with them," said a second Sinopec refiner in southern China.

-----

Earlier:

2018, July, 25, 09:30:00

REUTERS - China, which purchased 14 percent of all U.S. LNG shipped between February 2016-April 2018, has taken delivery from just one vessel that left the United States in May and none in June compared with 14 during the first four months of the year.

|

2018, July, 23, 13:40:00

МИНЭНЕРГО РОССИИ - «Последовательно реализуются ключевые проекты двустороннего взаимодействия, включая поставки природного газа по «восточному» маршруту и «Ямал СПГ». Ведется кооперация в нефтяной сфере в рамках организации поставок по нефтепроводу «Сковородино-Мохэ». Заинтересованы в участии китайских компаний и в других перспективных проектах, включая Арктик СПГ 2».

|

2018, July, 23, 13:35:00

МИНЭНЕРГО РОССИИ - «Проект реализован в пятистах километрах за Полярным кругом, в месте, где полностью ранее отсутствовала инфраструктура. Для проекта создан флот газовозов ледового класса Arc 7. Запуск первой линии проекта состоялся в декабре прошлого года с опережением графика, выход «Ямал СПГ» на полную мощность – 17,4 млн тонн СПГ в год - намечен на конец 2019 г. К настоящему моменту с проекта уже отгружено около трёх миллионов тонн продукции», - сообщил Александр Новак.

|

2018, July, 23, 13:30:00

NOVATEK - PAO NOVATEK (“NOVATEK” and/or the “Company”) has shipped its first cargos of liquefied natural gas (LNG) from the Yamal LNG project to China via the Northern Sea Route.

|

2018, July, 11, 09:05:00

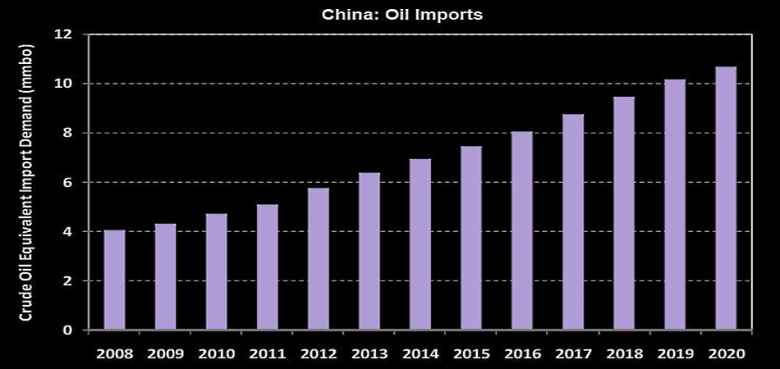

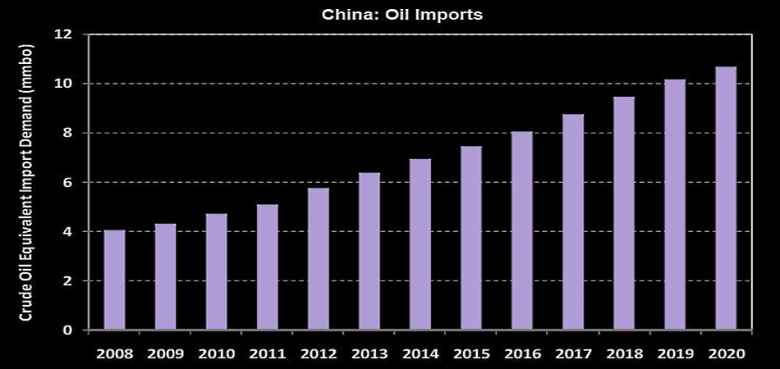

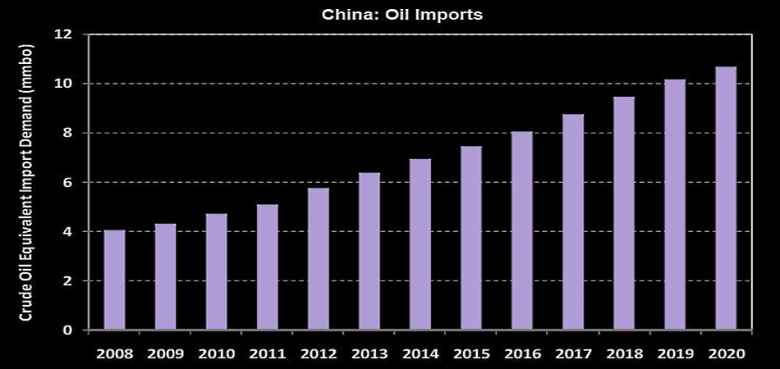

EIA - In recent years, as its domestic energy consumption has grown, China has become a more significant destination for U.S. energy exports. In particular, China has been among the largest importers of U.S. exports of crude oil, propane, and liquefied natural gas.

|

2018, June, 20, 12:55:00

PLATTS - Since the US dropped all limits on crude exports in 2015, China has competed with Canada as the top buyer of US crude. US crude exports to China averaged over 358,000 b/d in the first quarter, up from nearly 175,000 b/d in Q1 2017. US crude's market share in China rose to 3.5% from 0.4% over the same period.

|

2018, June, 13, 13:35:00

МИНЭНЕРГО РОССИИ - Было отмечено, что отношения России и Китая носят дружественный, добрососедский характер, поступательно развиваются в духе всеобъемлющего стратегического партнёрства: стабильно растет товарооборот, увеличиваются инвестиции.

|

Tags:

USA,

CHINA,

OIL