БАНК РОССИИ: КЛЮЧЕВАЯ СТАВКА 7,25%

ЦЕНТРАЛЬНЫЙ БАНК РОССИИ - Банк России принял решение сохранить ключевую ставку на уровне 7,25% годовых

Совет директоров Банка России 27 июля 2018 года принял решение сохранить ключевую ставку на уровне 7,25% годовых. Хотя годовая инфляция остается ниже цели, формируется тенденция ее возвращения к 4%. Банк России прогнозирует годовые темпы роста потребительских цен в 3,5–4% в конце 2018 года и временное превышение годовой инфляцией 4% в 2019 году в связи с запланированным увеличением налога на добавленную стоимость. Годовые темпы роста потребительских цен вернутся к 4% в начале 2020 года.

Баланс рисков смещен в сторону проинфляционных рисков. Сохраняется неопределенность относительно степени влияния налоговых мер на инфляционные ожидания, а также неопределенность развития внешних условий. Банк России будет принимать решения по ключевой ставке, оценивая инфляционные риски, динамику инфляции и развитие экономики относительно прогноза. Банк России считает наиболее вероятным переход к нейтральной денежно-кредитной политике в 2019 году.

Динамика инфляции. Годовая инфляция сохраняется на низком уровне. В июне она составила 2,3%, в июле — ожидается в интервале 2,5–2,6%, что соответствует прогнозу Банка России. Большинство показателей годовой инфляции, характеризующих наиболее устойчивые процессы ценовой динамики, по оценке Банка России, отражают постепенное возвращение инфляции к цели.

Динамика инфляции по основным товарным группам потребительской корзины в июне оставалась неоднородной. Годовой темп прироста цен на продовольственном рынке сложился вблизи нуля. Цены на овощи и фрукты снизились, в том числе из-за эффекта высокой базы прошлого года. При этом годовая инфляция по другим видам продовольственных товаров возросла (с 0,8% в мае до 1,1% в июне). Годовой темп прироста цен на непродовольственном рынке увеличился до 3,7% (после 3,4% в мае). Основной вклад внес рост цен на нефтепродукты. Динамика цен на бензин, в свою очередь, отразилась на инфляционных ожиданиях, увеличение которых продолжилось в июне. Оперативные данные в июле отражают прекращение роста цен на бензин, чему способствовало принятое решение о снижении акцизов на нефтепродукты. В этих условиях инфляционные ожидания населения в июле стабилизировались. Годовой темп прироста цен на услуги оставался в июне вблизи 4%.

Банк России прогнозирует годовую инфляцию в 3,5–4% в конце 2018 года и временное превышение инфляцией 4% в 2019 году в связи с запланированным увеличением налога на добавленную стоимость. Это повышение будет иметь разовый эффект на цены, поэтому годовые темпы роста потребительских цен вернутся к 4% в начале 2020 года.

Денежно-кредитные условия близки к нейтральным. По оценкам Банка России, они уже практически не оказывают сдерживающего влияния на динамику кредита, спроса и инфляции. Денежно-кредитные условия формируются в том числе под воздействием ранее принятых решений о снижении ключевой ставки. Депозиты остаются привлекательными для населения при текущем уровне процентных ставок. Консервативный подход банков к отбору заемщиков, а также изменение с 1 сентября 2018 года коэффициентов риска по необеспеченным потребительским кредитам формируют условия для роста кредита, не создающего риски для ценовой и финансовой стабильности.

С учетом влияния запланированных налогово-бюджетных мер на инфляцию и инфляционные ожидания потребуется некоторая степень жесткости денежно-кредитных условий, чтобы ограничить масштаб вторичных эффектов и стабилизировать годовую инфляцию вблизи 4% на прогнозном горизонте.

Экономическая активность. Обновленные данные Росстата отражают более уверенный рост экономики в 2017 — начале 2018 года, чем оценивалось ранее. Это существенно не меняет взгляд Банка России на влияние деловой активности на динамику инфляции, учитывая, что пересмотр данных в основном касается производства инвестиционных товаров. Проведение чемпионата мира по футболу внесло положительный вклад (0,1–0,2 п.п.) в годовой темп прироста ВВП в II квартале.

Банк России прогнозирует темп экономического роста в 2018 году в интервале 1,5–2%, что соответствует потенциальному росту российской экономики в условиях сохраняющихся структурных ограничений.

Инфляционные риски. Баланс рисков смещен в сторону проинфляционных рисков. Основные риски связаны с высокой неопределенностью относительно масштаба вторичных эффектов принятых налоговых решений (в первую очередь со стороны реакции инфляционных ожиданий), а также с внешними факторами.

В части внешних условий ускоренный рост доходностей на развитых рынках и геополитические факторы могут приводить к всплескам волатильности на финансовых рынках и оказывать влияние на курсовые и инфляционные ожидания.

Оценка Банком России рисков, связанных с волатильностью продовольственных и нефтяных цен, динамикой заработных плат, возможными изменениями в потребительском поведении, существенно не изменилась. Эти риски остаются умеренными.

Банк России будет принимать решения по ключевой ставке, оценивая инфляционные риски, динамику инфляции и развитие экономики относительно прогноза. Банк России считает наиболее вероятным переход к нейтральной денежно-кредитной политике в 2019 году.

Следующее заседание Совета директоров Банка России, на котором будет рассматриваться вопрос об уровне ключевой ставки, запланировано на 14 сентября 2018 года. Время публикации пресс-релиза о решении Совета директоров Банка России — 13:30 по московскому времени.

-----

Раньше:

2018, March, 28, 10:45:00

ЦБРФ - Совет директоров Банка России 23 марта 2018 года принял решение снизить ключевую ставку на 25 б.п., до 7,25% годовых. Годовая инфляция остается на устойчиво низком уровне. Инфляционные ожидания постепенно снижаются. По прогнозу Банка России, годовая инфляция составит 3–4% в конце 2018 года и будет находиться вблизи 4% в 2019 году. В этих условиях Банк России продолжит снижение ключевой ставки и завершит переход к нейтральной денежно-кредитной политике в 2018 году.

|

2017, August, 3, 12:45:00

Годовой темп прироста инвестиций в основной капитал во II квартале 2017 года, по оценке Банка России, ускорился до 3,5–4,5%. В III квартале прирост инвестиций сохранится на достаточно высоком уровне – 2,5–4%.

|

2017, August, 3, 12:40:00

Банк России принял решение сохранить ключевую ставку на уровне 9,00% годовых.

|

2016, November, 30, 18:50:00

Ожидаемая бюджетная консолидация и сдержанный характер восстановления экономики создают условия для возобновления в должное время центральным банком более мягкой денежно-кредитной политики, которая согласуется с целевым показателем инфляции в размере 4 процента. Однако темпы смягчения политики должны учитывать наличие внешних рисков и необходимость укрепления доверия в условиях недавно введенного режима таргетирования инфляции.

|

| |

| |

| |

THE BANK OF RUSSIA KEY RATE 7.25%

BANK OF RUSSIA - The Bank of Russia keeps the key rate at 7.25% p.a.

On 27 July 2018, the Bank of Russia Board of Directors decided to keep the key rate at 7.25% per annum. Though annual inflation remains below the target, it is tending to return to 4%. The Bank of Russia forecasts that consumer prices will grow by 3.5–4% year-on-year at the end of 2018 and annual inflation will temporarily overshoot 4% in 2019 due to the planned increase of the value added tax. The annual consumer price growth rate will return to 4% in early 2020.

The balance of risks is shifted towards proinflationary risks. Uncertainty persists over how strongly the tax measures may affect inflation expectations and how the external conditions will develop. In making its key rate decisions the Bank of Russia will assess inflation risks, inflation dynamics and economic developments against the forecast. The Bank of Russia considers that monetary policy is highly likely to shift to a neutral stance in 2019.

Inflation dynamics. Annual inflation remains low. It stood at 2.3% in June and is expected to hold within the 2.5–2.6% range in July in line with the Bank of Russia's forecast. According to Bank of Russia estimates, a majority of annual inflation indicators reflecting the most sustainable price movements suggests that inflation is gradually returning to the target.

Inflation for main consumer basket product groups continued to show mixed dynamics in June. The annual price growth rate in the food market was near zero. Fruit and vegetable prices went down on the back of the last year's high base effect, among other reasons. That said, annual inflation in other food product categories rose from 0.8% in May to 1.1% in June. The annual price growth rate in the non-food market jumped to 3.7% (vs 3.4% seen in May), driven mainly by rising petrochemical prices. Petrol price movements affected inflation expectations which continued to rise in June. Real-time July data show that petrol prices ceased to increase as a result of the decision to cut petrochemical excise taxes. In these circumstances, household inflation expectations stabilised in July. The annual services price growth rate held close to 4% in June.

The Bank of Russia forecasts that annual inflation will stand at 3.5–4% at the end of 2018 and temporarily overshoot 4% in 2019 due to the planned increase of the value added tax. This increase will have a one-off effect on price dynamics. As a result annual consumer price growth rate will return to 4% in early 2020.

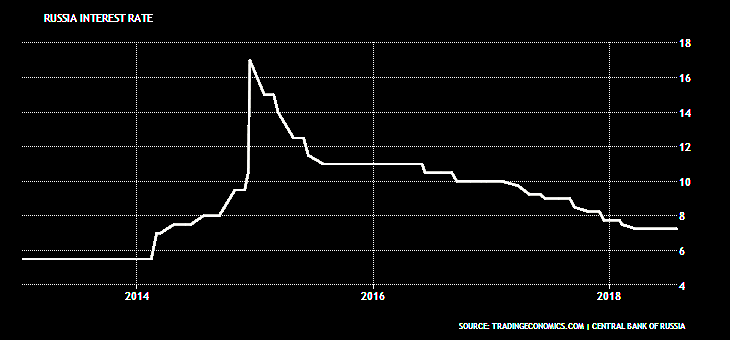

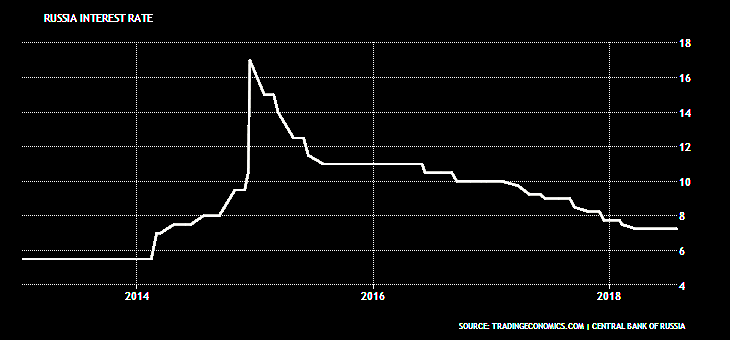

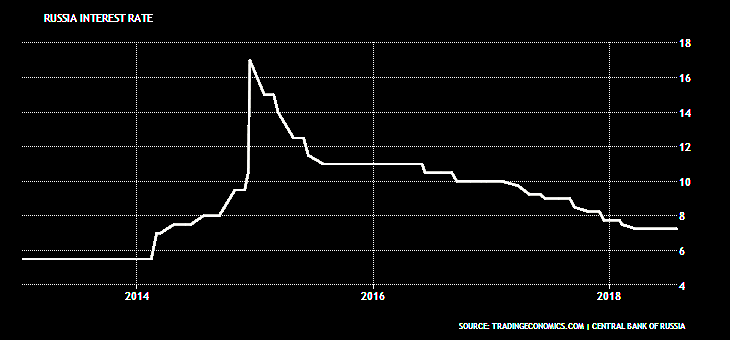

Monetary conditions are close to neutral. The Bank of Russia estimates that they are already causing almost no constraining impact on credit, demand and inflation dynamics. Monetary conditions evolve, among other things, under the influence of earlier decisions to cut the key rate. Deposits remain attractive for households at the current interest rate levels. The conservative approach of banks to screening borrowers and the revision of risk ratios on unsecured consumer loans (effective from 1 September 2018) create conditions for lending growth that would pose no risks to price and financial stability.

Given the effect of the planned fiscal measures on inflation and inflation expectations, monetary conditions should remain to some extent tight to limit the scale of secondary effects and stabilise annual inflation close to 4% over the forecast horizon.

Economic activity. The updated Rosstat statistics reflect steadier economic growth in 2017 — early 2018 than previous estimates. It does not materially change the Bank of Russia's view regarding the influence of business activity on inflation, considering that the reviewed data mostly concern investment goods production. The FIFA World Cup made a positive contribution to the annual GDP growth rate in Q2 (0.1–0.2 pps).

The Bank of Russia forecasts that in 2018 the Russian economy will post a 1.5–2% growth rate, which corresponds to its potential amid the remaining structural limitations.

Inflation risks. The balance of risks is shifted towards proinflationary risks. Main risks are related to a high uncertainty over the scale of secondary effects of the adopted tax decisions (primarily, the response of inflation expectations) and the external factors.

With regard to external conditions, accelerated yield growth in advanced economies and geopolitical factors may cause surges in volatility in financial markets and affect expectations for the exchange rate and inflation.

The Bank of Russia leaves mostly unchanged its estimates of risks associated with consumer and oil price volatility, wage movements and possible changes in consumer behaviour. These risks remain moderate.

In making its key rate decisions the Bank of Russia will assess inflation risks, inflation dynamics and economic developments against the forecast. The Bank of Russia considers that monetary policy is highly likely to shift to a neutral stance in 2019.

The Bank of Russia Board of Directors will hold its next key rate review meeting on 14 September 2018. The Board decision press release is to be published at 13:30 Moscow time.

-----

Earlier:

2018, March, 28, 10:45:00

CBRF - On 23 March 2018, the Bank of Russia Board of Directors decided to cut the key rate by 25 bp to 7.25% per annum. Annual inflation remains sustainably low. Inflation expectations are diminishing progressively. The Bank of Russia forecasts annual inflation to be 3-4% in late 2018 and remain close to 4% in 2019. In this environment the Bank of Russia will continue to reduce the key rate and will complete the transition to neutral monetary policy in 2018.

|

2017, August, 3, 12:45:00

Годовой темп прироста инвестиций в основной капитал во II квартале 2017 года, по оценке Банка России, ускорился до 3,5–4,5%. В III квартале прирост инвестиций сохранится на достаточно высоком уровне – 2,5–4%.

|

2017, August, 3, 12:40:00

Банк России принял решение сохранить ключевую ставку на уровне 9,00% годовых.

|

2016, November, 30, 18:50:00

The expected fiscal consolidation and the subdued nature of the recovery are putting in place the conditions for the central bank to resume, in due course, monetary policy easing in a manner consistent with the 4 percent inflation target. However, the pace of easing should take into account the presence of external risks and the need to build credibility under the newly introduced inflation targeting regime.

|

| |

| |

| |

Tags:

РОССИЯ,

БАНК,

СТАВКА,

RUSSIA,

BANK,

RATE