BP PROFIT $2.8 BLN

BP - Group results Second quarter and half year 2018

Highlights

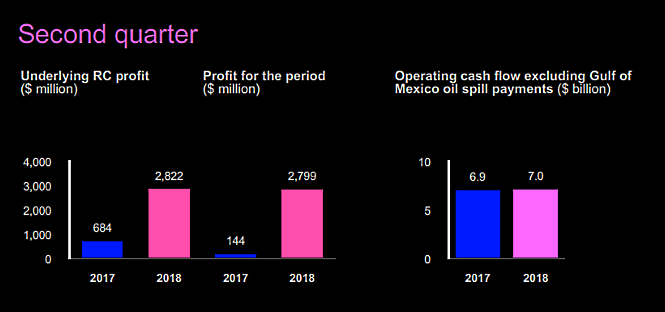

- Underlying replacement cost profit* for the second quarter of 2018 was $2.8 billion – four times that reported for the same period in 2017 – including significantly higher earnings from the Upstream and Rosneft.

- Operating cash flow excluding Gulf of Mexico oil spill payments* was $7.0 billion in the second quarter – which included a $1.3 billion working capital* release (after adjusting for inventory holding gains*) – and $12.4 billion in the first half, including a $0.4 billion working capital build.

- Dividend was increased 2.5% to 10.25 cents a share, the first rise since the third quarter of 2014.

- Upstream reported the strongest quarter since the third quarter of 2014 on both a replacement cost and underlying basis.

- Oil and gas production: reported production in the quarter was 3.6 million barrels of oil equivalent a day. Upstream production, excluding Rosneft, was 1.4% higher than a year earlier and up 9.6% when adjusted for portfolio changes and pricing effects, driven by rising output from new major projects* and strong plant reliability*.

- Major projects: with start-ups in Azerbaijan, Russia and Egypt, three of the six new projects expected to start in 2018 are now online.

- Strategic portfolio management: agreed to buy world-class US onshore oil and gas assets from BHP, a $10.5 billion acquisition that will transform BP's US Lower 48 business. BP also agreed to increase its stake in the Clair oilfield in the UK while exiting the Greater Kuparuk Area in Alaska.

- Downstream reported strong first half refining performance, with record levels of crude processed at Whiting refinery in US; further expansion in fuels marketing, with more than 1,200 convenience partnership sites now across our retail network.

- Advancing the energy transition: acquisition of UK's largest electric vehicle charging company Chargemaster and investment in innovative battery technology firm StoreDot move forward BP's approach to advanced mobility.

- Gulf of Mexico oil spill payments in the quarter were $0.7 billion on a post-tax basis.

- Net debt* reduced in the quarter by $0.7 billion to $39.3 billion.

- BP's share buyback programme continued with 29 million ordinary shares bought back in the first half at a cost of $200 million.

Bob Dudley – Group chief executive: "We continue to make steady progress against our strategy and plans, delivering another quarter of strong operational and financial performance. We brought two more major projects online, high-graded our portfolio through acquisitions such as BHP's US onshore assets and invested in a low-carbon future with the creation of BP Chargemaster. Given this momentum and the strength of our financial frame, we are increasing our dividend for the first time in almost four years. This reflects not just our commitment to growing distributions to shareholders but our confidence in the future".

-----

Earlier:

2018, July, 27, 12:25:00

BP GAS INVESTMENT $10.5 BLNBP - “This is a transformational acquisition for our Lower 48 business, a major step in delivering our Upstream strategy and a world-class addition to BP’s distinctive portfolio. Given our confidence in BP’s future – further bolstered by additional earnings and cash flow from this deal – we are increasing the dividend, reflecting our long-standing commitment to growing distributions to shareholders.” |

2018, July, 11, 08:45:00

BP INVESTS IN DIGITAL £1.5 MLNBP - BP Ventures, in support of BP Alternative Energy’s strategy in low-carbon power, storage and digital energy, has invested £1.5 million in Voltaware, whose innovative energy monitor offers businesses the ability to track their energy demand in detail, down to individual appliances. |

2018, June, 15, 11:10:00

BP: GROWTH IN ENERGY DEMAND UPBP - In 2017 global energy demand grew by 2.2%, above its 10-year average of 1.7%. This above-trend growth was driven by stronger economic growth in the developed world and a slight slowing in the pace of improvement in energy intensity. |

2018, May, 2, 13:05:00

BP PROFIT $2.5 BLNBP - “We have delivered another strong set of results. Our safe and reliable operations and strong financial delivery have continued into 2018. Underlying profit was up 23% on the previous quarter and was our best quarterly result in three years. With rising output from our new major projects and excellent reliability, Upstream production was 9% higher than a year earlier. |

2018, April, 25, 09:40:00

BP - ROSNEFT STRONG PARTNERSHIPREUTERS - BP (BP.L) has a “very strong” partnership with Russian oil giant Rosneft (ROSN.MM) but will steer away from politics, Chief Executive Officer Bob Dudley said on Tuesday, as Moscow could face new western sanctions. |

2018, February, 14, 09:40:00

BP STARTS IN EGYPTBP announced the start of gas production from the Atoll Phase One project, offshore Egypt. The project, in the North Damietta concession in the East Nile Delta, was delivered seven months ahead of schedule and 33% below the initial cost estimate. |

2018, February, 7, 07:30:00

BP PROFIT $3.4 BLNBP - “2017 was one of the strongest years in BP’s recent history. We delivered operationally and financially, with very strong earnings in the Downstream, Upstream production up 12%, and our finances rebalanced. And we did all this while maintaining safe and reliable operations. “We enter the second year of our five-year plan with real momentum, increasingly confident that we can continue to deliver growth across our business, improving cash flows and returns for shareholders out to 2021 and beyond. “At the same time, we are embracing the energy transition, seeking new opportunities in a changing, lower-carbon world.” |