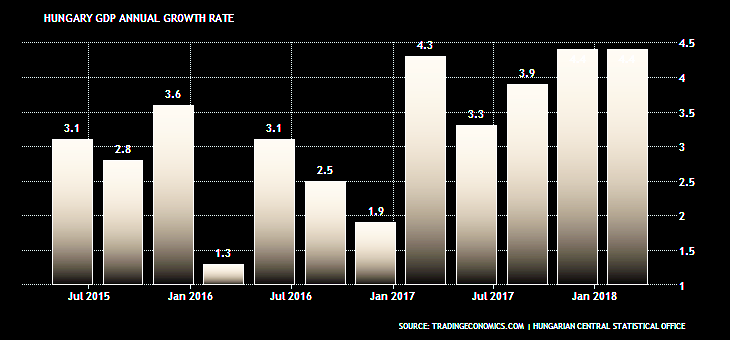

HUNGARY'S GROWTH 4%

IMF - On August 1, 2018 the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Hungary, and considered and endorsed the staff appraisal without a meeting.

Hungary has achieved several years of strong growth. This expansion has been largely supported by accelerated absorption of EU funds and strong disposable income. External debt declined substantially over the past few years and so did public debt, albeit at a much slower pace. The increase in domestic demand has been reflected in a moderation in the external current account surplus from its 2016 record level, and the exchange rate has recently depreciated. Headline inflation has started to pick up, mainly due to higher energy prices, while core inflation has been running sideways over the past six months, despite emerging capacity constraints. Unemployment remains on a decreasing trend and labor shortages are intensifying despite the improvement in participation rates.

The 2017 general government fiscal deficit narrowed to 2 percent of GDP, compared to the budgeted 2.4 percent. This outcome was mostly driven by strong GDP growth and reduced interest payments. The structural primary balance, on the other hand, deteriorated by about 1.2 percent of potential GDP. Staff projects the 2018 overall fiscal deficit at about 2.4 percent of GDP, in line with the budget's target. In view of the strong cyclical position, the structural primary balance is expected to deteriorate by close to one percent of potential GDP.

The Magyar Nemzeti Bank (MNB) further relaxed its monetary stance during 2017 and in early 2018, mostly with the help of unconventional tools. Imported inflation has been low and large wage increases have thus far been mitigated by lowering social security contributions. The MNB intends to let the Market-Based Lending Scheme expire by end-2018, as originally scheduled.

GDP growth is expected to be around 4 percent in 2018, similar to last year. In 2019, growth will start to decelerate, as the absorption of EU funds tapers off and capacity constraints tighten further, while inflation is projected to slightly exceed the MNB's 3 percent inflation target. Improving productivity through structural reforms is key to achieving convergence and higher living standards.

Executive Board Assessment

Hungary has achieved several years of strong growth and substantially reduced its external debt. Growth is expected to be around 4 percent in 2018, similar to last year. This strong expansion has been supported by private consumption and EU funds-related investments. However, although fiscal outcomes have overperformed the budget targets in recent years, the public debt ratio has come down only to a limited extent. With economic expansion well entrenched, now is the time to do more to reduce fiscal vulnerabilities and create space for policy to be able to react again when new shocks hit. Rebalancing the policy mix and advancing structural reforms would also help moderate the reduction of the external current account surplus that is being driven by the strong domestic demand.

In view of the increased risks, it would be desirable to expedite the reversal in the pro-cyclical fiscal stance and the reduction in public debt. A set of growth-friendly fiscal measures to achieve smaller deficits starting in the second half of 2018 and over the medium term would be advisable. Such a rebalancing of the policy mix would also alleviate the burden on monetary policy. Specifically, phasing out the remaining sectoral taxes, broadening the tax base, and further enhancing tax administration would reduce distortions while boosting revenue collection. Furthermore, transforming the existing property taxes into a modern real estate tax would help local governments raise additional revenue to finance spending on healthcare, education, and infrastructure, while protecting the vulnerable. On the expenditure side, reforming public administration would help reduce the wage bill while facilitating a competitive public salaries scale and an improvement of the provision and quality of public services. There is also room to further reduce spending on goods and services. In addition, eliminating generalized subsidies, while protecting the poor by targeted measures, would enhance efficiency and save resources.

Once inflation sustainably approaches the upper half of the tolerance band (3±1 percent), the monetary policy stimulus would need to be gradually scaled back. During 2017 and in early 2018, the MNB further relaxed its monetary stance, mostly with the help of unconventional tools. Imported inflation has been low and large wage increases have thus far been mitigated by lowering social security contributions. However, the output gap has closed and labor shortages are intensifying and thus the risks related to premature tightening have declined. Rising inflationary pressure and falling current account surpluses point to accelerating domestic demand. All in all, this calls for some removal of the monetary accommodation, starting with unconventional measures. In this connection, the recent MNB communication, which emphasizes the commitment to its inflation target and keeps the options open to take any action to achieve it, is welcome. Staff also welcome the commitment to let the Market-Based Lending Scheme expire as scheduled by end-2018.

Hungary's external position is broadly in line with medium-term fundamentals and desirable policies. However, non-price indicators point to the need to improve productivity and competitiveness. Hungary's IIP has improved in the recent years and its international reserves are adequate according to the Fund's metric.

Improving productivity through structural reforms is key to achieving convergence and higher living standards. In this regard, we welcome the establishment of the Competitiveness Council and the implementation of some of its recommendations to improve the business environment. It is also important to make further progress in addressing the challenges in the areas of obtaining construction permits and electricity connection, ease of paying taxes, and perceived corruption. In addition, levelling the playing field for all investors, including SMEs and FDI, by reducing red tape and simplifying the regulatory environment would help broaden the growth and export base. Furthermore, there is an urgent need to improve education and vocational training to address skills mismatches, and to continue to reduce the number of participants in the public works schemes to release them to the primary labor market. Increasing the availability of child-care facilities would also improve labor market participation, especially among women.

| Hungary: Selected Economic Indicators, 2013–19 | |||||||

|

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

|

Prelim. |

Proj. |

||||||

|

Real economy |

|||||||

|

Real GDP (percentage change) |

2.1 |

4.2 |

3.4 |

2.2 |

4.0 |

4.0 |

3.3 |

|

Total domestic demand (contribution to growth) |

2.1 |

5.1 |

1.1 |

1.5 |

5.4 |

3.3 |

3.2 |

|

Private consumption |

0.3 |

1.5 |

2.0 |

2.3 |

2.5 |

2.4 |

2.0 |

|

Government consumption |

0.6 |

1.0 |

0.0 |

0.1 |

0.0 |

0.4 |

0.2 |

|

Gross fixed investment |

1.9 |

2.6 |

0.4 |

-2.3 |

3.2 |

2.6 |

1.2 |

|

Foreign balance (contribution to growth) |

0.0 |

-0.8 |

2.2 |

0.7 |

-1.4 |

0.7 |

0.1 |

|

CPI inflation (average) |

1.7 |

-0.2 |

-0.1 |

0.4 |

2.4 |

2.8 |

3.3 |

|

CPI inflation (end year) |

0.4 |

-0.9 |

0.9 |

1.8 |

2.1 |

3.1 |

3.1 |

|

Unemployment rate (average, ages 15-64) |

10.2 |

7.8 |

6.8 |

5.1 |

4.2 |

... |

... |

|

Gross fixed capital formation (percent of GDP) |

20.9 |

22.2 |

21.9 |

19.2 |

21.5 |

23.1 |

23.3 |

|

Gross national saving (percent of GDP, from BOP) |

24.7 |

23.7 |

25.4 |

25.3 |

24.7 |

25.4 |

25.2 |

|

General government 1/ |

|||||||

|

Overall balance |

-2.6 |

-2.6 |

-1.9 |

-1.7 |

-2.0 |

-2.4 |

-2.0 |

|

Primary balance |

1.6 |

1.2 |

1.5 |

1.5 |

0.8 |

0.1 |

0.2 |

|

Primary structural balance (percent of potential GDP) |

3.6 |

2.0 |

2.2 |

1.8 |

0.6 |

-0.3 |

-0.5 |

|

Public debt |

77.1 |

76.6 |

76.7 |

76.0 |

73.6 |

71.3 |

69.1 |

|

Money and credit (end-of-period) |

|||||||

|

Broad money |

5.5 |

5.1 |

6.3 |

7.0 |

7.8 |

7.0 |

6.2 |

|

Lending to the private sector, flow-based 2/ |

-3.3 |

-0.9 |

-11.0 |

2.0 |

6.4 |

7.2 |

6.5 |

|

Interest rates 3/ |

|||||||

|

T-bill (90-day, average) |

4.1 |

2.1 |

1.1 |

0.7 |

0.0 |

0.2 |

... |

|

Government bond yield (5-year, average) |

5.2 |

3.9 |

2.7 |

2.1 |

1.7 |

2.0 |

... |

|

Balance of payments |

|||||||

|

Current account |

3.8 |

1.5 |

3.5 |

6.0 |

3.1 |

2.3 |

1.9 |

|

Reserves (billions of Euros) |

33.8 |

34.6 |

30.3 |

24.4 |

23.4 |

26.9 |

30.1 |

|

Gross external debt 4/ |

117.8 |

114.7 |

107.7 |

97.2 |

84.6 |

76.2 |

70.7 |

|

Gross official reserves (percent of short-term debt at remaining maturity) |

119.4 |

160.6 |

139.5 |

131.1 |

139.9 |

165.3 |

174.0 |

|

Exchange rate 5/ |

|||||||

|

Exchange regime |

Floating |

||||||

|

Exchange rate, HUF per euro, period average |

297 |

309 |

310 |

311 |

309 |

329 |

... |

|

Nominal effective rate (2000=100, average) |

110.3 |

114.2 |

116.5 |

116.7 |

115.5 |

117.9 |

... |

|

Real effective rate, CPI basis (2000=100, average) |

74.3 |

77.7 |

79.5 |

79.6 |

78.2 |

78.7 |

... |

|

Quota at the Fund |

SDR 1,940 million |

||||||

|

Memorandum Items: |

|||||||

|

Nominal GDP (billions of Forints) |

30,247 |

32,592 |

34,324 |

35,420 |

38,183 |

40,823 |

43,435 |

|

Per capita GDP (EUR) |

10,277 |

10,691 |

11,238 |

11,568 |

12,600 |

13,449 |

14,286 |

|

Sources: Hungarian authorities; IMF, International Financial Statistics; Bloomberg; and Fund staff estimates and projections. 1/ Consists of the central government budget, social security funds, extrabudgetary funds, and local governments. 2/ 2015 reflects the effects of the Settlement Act on credit stock. 3/ Data for 2018 is at end-June. 4/ Excluding Special Purpose Entities. Including inter-company loans and nonresident holdings of forint-denominated assets. 5/ The exchange rates for 2018 are end of period figures; end-June for the nominal rate and end-May for the effective and real effective rates. |

|||||||

-----

Earlier:

2018, May, 18, 08:35:00

ROSATOM IS GLOBALWNN - Rosatom, the Russian state nuclear corporation, signed a series of agreements with overseas companies during the Atomexpo conference and exhibition being held this week in Sochi, Russia. The agreements, with Chile, China, Cuba, Finland, Hungary, Iran, Italy, Kazakhstan, Saudi Arabia, Serbia, Spain and Zambia, include the engineering and medical sectors, among others. |

2017, October, 6, 12:45:00

RUSSIAN GAS TO HUNGARY: +26.9%In the first nine months of 2017 Gazprom had supplied to Hungary 5.5 billion cubic meters of gas, an increase of 26.9 per cent, or 1.2 billion cubic meters, against the January-September period of 2016. |

2017, June, 5, 14:50:00

RUSSIAN GAS TO HUNGARY: + 37%over the past five months, Gazprom’s gas supplies to the country added 37.3 per cent compared to the January–May period of 2016. |

2015, June, 5, 18:50:00

THE NEXT GAS PIPELINESlovakian Prime Minister Robert Fico met with Russian Prime Minister Dmitry Medvedev in Moscow and proposed a plan that would transfer gas from the Turkish border through Bulgaria, Romania, Hungary and Slovakia, thereby bypassing Greece.

|

2015, May, 24, 19:50:00

EUROPE GAS NETWORKHungary, Romania, Bulgaria and Slovakia will sign an agreement to interconnect their natural gas networks whih to allow also the reverse transit, announced on Thursday night the Hungarian minister of Foreign Affairs and Trade Peter Szijjarto on the Hungarian public television station M1, MTI reports, according to Mediafax. |

2015, April, 9, 19:15:00

SOUTH STREAM FOREVERRepresentatives of five countries - Hungary, Serbia, Macedonia, Greece and Turkey - met in Budapest on Tuesday, announcing the formation of a working group to facilitate natural gas deliveries - specifically infrastructure development - to their markets from gas emanating from Turkey including possible participation in the Turkish Stream pipeline.

|

2014, September, 18, 18:20:00

SOUTH STREAM: GAS SECURITYEnergy ministers from Russia and several countries in Central & Eastern Europe (CEE), chamber of commerce heads and other high level speakers gathered in Budapest, Hungary on 16 September to grapple with energy security issues at the Gas Dialogues event Development and Use of Natural Gas in the Danube Region: Prospects and Opportunities. |