IRANIAN OIL TO S.KOREA DOWN TO 46%

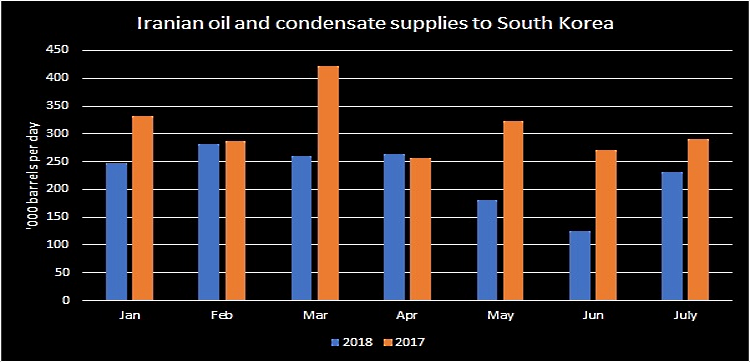

PLATTS - South Korea's crude oil imports from Iran dropped 45.8% year on year in July in the wake of the re-imposition of US sanctions, while intakes from Kazakhstan, the US and Mexico jumped as alternative sources.

S.Korea imported 6.2 million barrels of crude from Iran last month, compared with 11.44 million barrels a year ago, data released late Thursday by the Korea National Oil Corp. showed. This marks the ninth consecutive decline since November last year when imports from Iran fell 26.8% year on year to 10.37 million barrels.

The July imports, however, were up 12.8% from 5.49 million barrels in June. For the first seven months of this year, Iranian imports fell 36% year on year to 56.2 million barrels, compared with 87.81 million barrels in the year-ago period.

In 2017, Iranian crude oil imports increased 32.1% to 147.87 million barrels. The country's monthly imports of Iranian crude had increased since January 2016 when the US and EU lifted sanctions on Iran.

The sharp decline in crude imports from Iran was largely attributable to fewer condensate purchases following the startup of new condensate splitters in the Persian Gulf nation.

The decline is also due to South Korea trying to pare back crude shipments from Iran in a bid to secure an exemption from the US' decision to re-impose sanctions on Tehran over its nuclear program, according to a KNOC official.

South Korea has called for a US sanctions waiver to keep buying Iranian condensate saying it is hard to find alternative sources of condensate due to limited suppliers. About 70% of Iranian crude brought into South Korea is condensate, and more than half of the condensate which South Korea imports are from Iran.

South Korea has held two rounds of consultations with the US in June and July, and the two sides would meet for a third meeting sooner or later, according to an official at the Ministry of Trade, Industry and Energy.

In order to fill the loss of Iranian barrels, South Korean importers have increased intakes from Kazakhstan, the US, Mexico and other non-OPEC suppliers.

The country's imports of Kazakhstan's light CPC Blend soared more than seven times to 7.68 million barrels in July, from 1.07 million barrels a year ago. This made Kazakhstan the fourth-biggest crude supplier to South Korea in July, overtaking traditional Middle East suppliers such as the UAE, Iran and Qatar.

Over January-July, intakes from Kazakhstan jumped nearly four times to 31.15 million barrels, from 7.32 million barrels a year ago. South Korea imported 5.37 million barrels of crude from the US, compared with no purchases a year ago. For the first seven months, South Korea's intakes of US crude jumped more than six times to 19.7 million barrels, from 3.08 million barrels a year earlier.

South Korea's imports of Mexican crude also doubled to 3.98 million barrels in July, from 1.95 million barrels a year earlier. The country's imports of Mexican crude are expected to further increase as Hyundai Oilbank said it would purchase more Mexican Maya, and other sour and heavy grades thanks to its expanded refining capacity and improved heavy oil upgraders.

Meanwhile, South Korea's crude imports from its biggest supplier Saudi Arabia fell 10.6% year on year to 24.38 million barrels in July. South Korea's crude imports from Middle Eastern suppliers dropped 14.5% year on year to 68.47 million barrels last month. South Korea's intakes of Middle East crude increased in June after sliding for nine months in a row, but fell again in July. Over January-July, imports from the Middle East dipped 8.3% year on year to 495.72 million barrels, compared with 540.79 million barrels in the same period last year, as a result of OPEC-led drive to limit their production in order to balance an oversupplied market.

In total, South Korea imported 96.67 million barrels, or 3.12 million b/d, of crude oil in July, up 3.3% from 93.58 million barrels a year earlier. This marked the fourth consecutive increase in the country's crude imports since April, but the July imports were down 1.4% from 97.99 million barrels in June. For the first seven months, the country's crude imports climbed 2.8% year on year to 654.1 million barrels.

As a result of the increased crude imports for the past months, South Korea's crude stockpiles climbed 28.3% year on year to 51.18 million barrels in July, compared with 39.89 million barrels a year ago, according to the KNOC data. The country's crude stockpiles have climbed steadily on a yearly basis since November 2015 on the back of increased crude oil imports for the past months.

South Korean stockpiles of overall oil products also rose 13.6% year on year to 71.15 million barrels in July.

South Korean refiners and condensate splitters, processed 97.09 million barrels of crude in July, or 3.13 million b/d, up 0.2% from 96.88 million barrels a year ago.

-----

Earlier:

2018, August, 24, 11:05:00

S.KOREA'S LPG UP 4.2%PLATTS - South Korean LPG providers' sales to the domestic market in the first six month rose 4.2% on the year despite higher retail prices, driven by solid demand for petrochemical production, company officials said Thursday.

|

2018, August, 17, 11:35:00

IRAN'S OIL EXPORTS DOWNPLATTS - South Korea's crude oil imports from Iran halved in July from a year earlier in the wake of the reimposition of US sanctions, according to preliminary data released by the Korea Customs Service Thursday.

|

2018, June, 20, 12:10:00

GAZPROM'S GAS FOR KOREAPLATTS - "Today, the political situation is somewhat different. The South Korean side approached Gazprom about the revival of this project. A series of talks took place on this. These talks are continuing. We can't say anything further, but we are renewing such talks with the Korean side," Markelov said.

|

2018, April, 25, 09:55:00

ASIA'S LNG DEMANDREUTERS - global liquefied natural gas (LNG) imports have risen 40 percent since 2015, to almost 40 billion cubic meters (bcm) a month. Growth accelerated in 2017, with imports up by a fifth, largely because of rising demand in China, but also in South Korea and Japan.

|

2018, January, 19, 12:15:00

S.KOREA'S DIVERSIFICATIONPLATTS - For full-year 2017, South Korea's crude imports from its biggest supplier Saudi Arabia fell 1.7% to 319.02 million barrels, compared with 324.45 million barrels in the previous year, customs data showed. On the contrary, South Korea has imported 1.77 million mt, or around 13 million barrels, of crude from the US in 2017, about four times higher than in 2016. Shipments from Russia grew to 140,000 b/d last year from 112,000 b/d in 2016.

|

2017, November, 24, 09:05:00

S.KOREA'S SOLAR UPFT - OCI — the world’s third-largest polysilicon maker by capacity and South Korea’s biggest — this month reported a 3,373 per cent increase in operating profit to Won78.7bn ($72m) for the July-September quarter, its best performance in five years. Rival Hanwha Chemical saw third-quarter net profit jump 25 per cent to a record Won252bn.

|

2017, June, 30, 08:30:00

U.S. - S.KOREA BUSINESSSouth Korean companies announced plans to import more American shale gas and build new factories in the U.S. as the two countries' leaders prepare to hold summit talks in Washington where trade is expected to be a key issue. |