NORWAY'S OIL GAS INVESTMENT WILL UP BY 6.2%

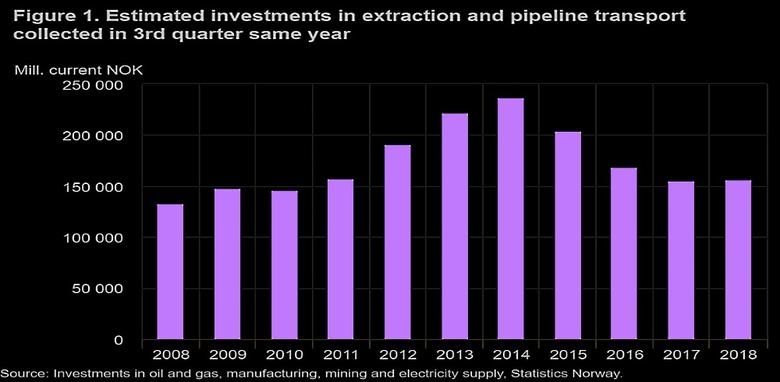

STATISTICS NORWAY - Total investments in oil and gas activity in 2019, including pipeline transportation, are estimated at NOK 165.1 billion, which is 6.2 per cent higher than estimated in the previous quarter. The estimate for 2018 is NOK 156 billion, which equals the estimate given in the previous quarter.

The estimate for 2018 is 0.4 per cent higher than the corresponding figure for 2017 given in the 3rd quarter of 2017.

The estimate for 2019 is 16.5 per cent higher than the corresponding estimate for 2018 given in the 3rd quarter of 2017.The strong growth indicated for 2019 should be interpreted with caution. The estimate for 2018, given in the 3rd quarter of 2017, which we now compare the 2019 estimate with, was NOK 141.7 billion. Two quarters later, in the survey in the 1st quarter 2018, the estimate for 2018 had increased by 13 per cent to NOK 160 billion, mainly due to the submission of 7 plans for development and operations (PDOs), see the figure 2 below. Although the PDO for Johan Sverdrup phase 2 very likely will be submitted in late August, which will increase the 2019- estimate in the next survey, it is reason to believe that comparable estimates for 2018 and 2019 will converge in the survey in the 1st quarter of 2019 and with that indicate a lower growth for 2019 than indicated in the present survey.

Strong increase in the field estimates for 2019

The investments in fields on stream for 2019 are estimated at NOK 59.1 billion. This is 10 per cent higher than the estimate given in the previous survey. Since the previous survey the operators on the Norwegian Shelf have submitted their preliminary budgets for the next year. This updating has in sum resulted in higher estimates in fields on stream. The estimate for field development is now NOK 66.6 billion, which is 8.7 per cent higher than the estimate given in the previous quarter. The higher estimate is partly due to the submission of a PDO on another development project. This project is now included in this survey.

The increase in 2019 compared to the estimate for 2018, given in the 3rd quarter of 2017 is due to higher investments within the categories field development and exploration, while the estimates indicate a decrease in the investment categories fields on stream and pipeline transportation.

1 The contribution by cost category is calculated by multiplying the percentage change of the category with the category's share of investments in extraction and pipeline transport

The investments in onshore activity and pipeline transportation for 2019 are estimated at NOK 1.5 and 0.6 billion, respectively. The estimates are 17 and 70 per cent lower than the corresponding estimates for 2018, given in the 3rd quarter of 2017. The investments in these categories have showed a sharp decline in the last years. In 2015, the investments in onshore activity and pipeline transportation came to NOK 10.9 and 4.4 billion, respectively.

Estimates for 2018 indicate zero growth

The investments in oil and gas extraction and pipeline transport for 2018 are estimated at NOK 156.3 billion. This is about the same estimate as given in the previous quarter.

The estimate for 2018 is 0.4 per cent higher than the corresponding estimate for 2017 given in the 3rd quarter of 2017. The estimated increase from 2017 to 2018 is due to higher investments within the categories field development and exploration. The estimates for fields on stream, onshore activity, pipeline transportation and shutdown and removal have the opposite path, and show a decrease compared to the corresponding estimates for 2017, given in the 3rd quarter of 2017.

1 The contribution by cost category is calculated by multiplying the percentage change of the category with the category's share of investments in extraction and pipeline transport.

Increasing investment activity in the 2nd quarter

The accrued investments from the 1st quarter to the 2nd quarter increased by 21 per cent, from NOK 31.4 billion to NOK 38.1 billion. The seasonally adjusted growth from the 1st quarter to the 2nd quarter came to 3.5 per cent. The investments in the first half of 2018 are 7.4 per cent lower than the investments in the first half of 2017.

High estimates for the second half of 2018

While the accrued investments in the first half of 2018 are accumulated to NOK 69.5 billion, the investments in the second half of 2018 are estimated to increase by 25 per cent, to NOK 86.8 billion. Figures from the last 17 years show that investments on average have been 9 per cent higher in in the second half of the year than the first half, In the last three years the investments in the second half of the year have been lower than in the first half. This is due to the decline in the investments from 2014 to 2017.

In the last 17 years the estimates given in the 3rd quarter have been on average 4.1 per cent higher than the final investments. When, in addition, the estimate for 2018 assumes as much as a 25 per cent increase from the first half to the second half of the year, it is likely that the final investments will be lower than the estimate for 2018, given in this survey.

-----

Earlier:

2018, August, 22, 13:05:00

NORWAY'S FUND: $1 TLN + $20 BLNNORWAY'S FUND - The Government Pension Fund Global returned 1.8 percent, or 167 billion kroner, in the second quarter of 2018.

|

2018, August, 17, 11:25:00

NORWAY'S PETROLEUM PRODUCTION: 1.911 MBDNPD - Preliminary production figures for July 2018 show an average daily production of 1 911 000 barrels of oil, NGL and condensate, which is an increase of 64 000 barrels per day compared to June.

|

2018, August, 15, 10:35:00

NORWAY'S KEY PRIORITYBLOOMBERG - The Norwegian government in June made its first deposit into its wealth fund since the end of 2015. Now that the economy is in full recovery and the labor market is tightening, winding down fiscal stimulus is a key priority in next year’s budget, the prime minister said in an interview in Arendal, on Norway’s southern coast. |

2018, June, 27, 10:35:00

U.S. WANT NORWAY'S MONEYREUTERS - Norway, which shares an Arctic border with Russia, lacks a “credible plan” how to meet NATO’s spending target, U.S. President Donald Trump said in a letter to the country’s prime minister, the Norwegian daily VG reported on Tuesday. |

2018, May, 23, 10:00:00

NORWAY'S OIL EXITBLOOMBERG - The fund shocked markets around the world in November when it asked for permission to divest oil and gas companies to reduce financial risk, arguing Norway as a whole is already heavily exposed to oil as western Europe’s biggest petroleum producer. At the time of the proposal, the fund held about $40 billion of shares in oil giants such as Exxon Mobil Corp. and Royal Dutch Shell Plc. |

2018, March, 28, 10:50:00

NORWAY'S OIL THREATBLOOMBERG - The government has paid out 109 billion kroner ($14 billion) since 2005 to explorers such as Lundin Petroleum AB and Repsol SA. It helped attract more companies to Norway, nearly doubling the pace of exploration and leading to key discoveries such as the multi-billion-barrel Johan Sverdrup field. |

2018, February, 12, 07:10:00

NORWAY DEFENDS OILREUTERS - “The Ministry maintains that the Norwegian rules on reimbursement of exploration costs and interest on carry forward of losses ... do not constitute state aid under Article 61 of the EEA Agreement, and are therefore in compliance with the EEA (European Economic Area) law,” the ministry said in a letter. |