OIL DEMAND - 2019: 100 MBD

OPEC - Monthly Oil Market Report

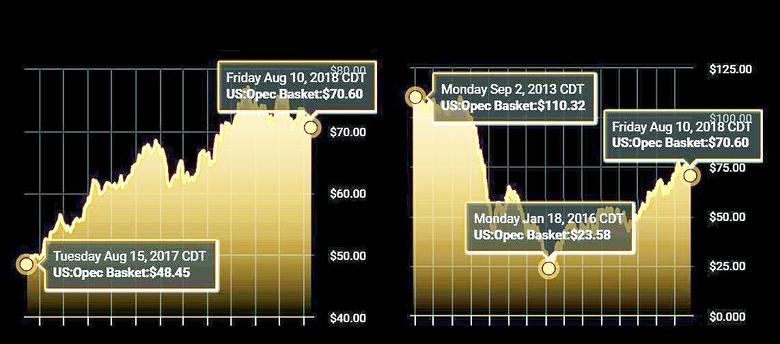

Crude Oil Price Movements

In July, the OPEC Reference Basket increased marginally by 5¢ m-o-m to settle at $73.27/b. Oil futures saw mixed movement over the month, while US oil inventories continued to drain, particularly in Cushing, Oklahoma. ICE Brent averaged 99¢ m-o-m lower at $74.95/b, while NYMEX WTI rose $3.26 m-o-m to $70.58/b. Year-to-date (y-t-d), ICE Brent is $19.53 higher at $71.72/b compared to the same period a year earlier, while NYMEX WTI climbed $16.70 to $66.20/b. The ICE Brent/NYMEX WTI spread narrowed by $4.25/b to $4.37/b in July. Speculative net long positions ended the month lower, particularly for ICE Brent.

The Dubai market backwardated structure eased again, while Brent flipped into contango for the remainder of the year. In the US, WTI backwardation increased significantly for the second successive month. Apart from the USGC costal grades, the global sour discount to sweet crudes increased due to a surplus of sour crudes.

World Economy

The global GDP growth forecast remains at 3.8% for 2018 and 3.6% for 2019, unchanged from the previous assessment. After a strong 2Q18, US growth was revised up by 0.1 pp in both 2018 and 2019, reaching 2.9% and 2.5%, respectively. Euro-zone growth slowed and the forecasts were revised down by 0.2 pp to 2% for 2018 and by 0.1 pp to 1.9% in 2019. Growth in Japan remains at 1.2% in 2018, and the same level is projected for 2019. India's forecasts are unchanged at 7.3% for 2018 and 7.4% for 2019. After solid growth in 1H18, China's growth forecast was revised up by 0.1 pp to now stand at 6.6% for 2018 and remains at 6.2% for 2019. Growth in Brazil was revised down by 0.1 pp, reaching 1.6% in 2018, but a mild rebound to 2.1% is anticipated in 2019. Russia's GDP growth forecast remains unchanged at 1.8% in both 2018 and 2019.

World Oil Demand

In 2018, oil demand growth is anticipated to increase by 1.64 mb/d, 20 tb/d lower than last month's projections, mainly due to weaker-than-expected oil demand data from Latin America and the Middle East in 2Q18. Total oil demand is anticipated to reach 98.83 mb/d. For 2019, world oil demand is forecast to grow by 1.43 mb/d, also some 20 tb/d lower than last month's assessment. Total world consumption is anticipated to reach 100.26 mb/d. The OECD region will contribute positively to oil demand growth, rising by 0.27 mb/d y-oy, yet with growth of 1.16 mb/d, non-OECD nations will account for the majority of growth expected.

World Oil Supply Non-OPEC oil supply in 2018 was revised up by 73 tb/d from the previous MOMR to average 59.62 mb/d, representing an increase of 2.08 mb/d y-o-y. The main reason for this upward revision was an adjustment for the Chinese supply forecast due to the higher-than-expected oil output in 1H18. Non-OPEC oil supply in 2019 is projected to reach an average of 61.75 mb/d, indicating an upward revision by 106 tb/d, mostly due to a re-assessment of the Chinese supply forecast for the next year. However, y-o-y growth was revised up by only 34 tb/d, to average 2.13 mb/d, owing to downward revisions in the US and Australian supply forecasts. The US, Brazil, Canada, the UK, Kazakhstan, Australia and Malaysia are the main growth drivers; while Mexico and Norway are expected to see the largest declines. The 2019 forecast remains subject to many uncertainties. OPEC NGL production in 2018 and 2019 is expected to grow by 0.12 mb/d and 0.11 mb/d to average 6.36 mb/d and 6.47 mb/d, respectively. In July, OPEC production increased by 41 tb/d to average 32.32 mb/d, according to secondary sources.

Product Markets and Refining Operations

In July, US margins recorded solid losses as crack spreads for all products with the exception of fuel oil declined, due to weaker fundamentals and higher feedstock costs. Strong middle distillate stock builds and an all-time record breaking jet fuel output further pressured USGC refining margins. In Europe, product markets recorded moderate gains on the top and bottom of the barrel, supported by firm exports outweighing losses seen in the middle of the barrel. Meanwhile, product markets in Asia strengthened, supported by robust gasoline demand from India, lower fuel oil arrivals from Europe and lower crude prices, which led to reduced feedstock costs for refiners, while gasoil output in China hit new highs.

Tanker Market Dirty tanker spot freight rates declined on average in July. This was mainly on the back of the continued weak trend persisting in the market across all classes. VLCC spot freight rates declined on all reported routes, while Suexmax spot freight rates remained flat, suffering from limited activity in general. Aframax saw mixed freight rates; however, average rates went down, pressured by the drop seen in the Caribbean and despite a firmer market in the Mediterranean. Clean tanker average spot freight rates declined as a result of lower freights West of Suez. Generally, the market remained uneventful, with limited demand on tonnage.

Stock Movements

Preliminary data for June showed that total OECD commercial oil stocks fell by 12.8 mb m-o-m to stand at 2,822 mb. This was 197 mb lower than seen during the same time one year ago, and 33 mb below the latest five-year average. However, OECD commercial oil stocks remain 251 mb above the January 2014 level. In terms of days of forward cover, OECD commercial stocks fell in June to stand at 58.8 days, which is 2.1 days lower than the latest five-year average.

Balance of Supply and Demand

In 2018, demand for OPEC crude is expected at 32.9 mb/d, 0.6 mb/d lower than the 2017 level. In 2019, demand for OPEC crude is forecast at 32 mb/d, around 0.8 mb/d lower than the 2018 level.

-----

Earlier:

2018, August, 8, 12:05:00

OIL PRICES 2018 - 19: $72 - $71EIA - Brent crude oil spot prices averaged $74 per barrel (b) in July, largely unchanged from the average in June. EIA expects Brent spot prices will average $72/b in 2018 and $71/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. |

2018, July, 23, 13:25:00

GLOBAL ENERGY INVESTMENT DOWN 2%IEA - For the third consecutive year, global energy investment declined, to USD 1.8 trillion (United States dollars) in 2017 – a fall of 2% in real terms. The power generation sector accounted for most of this decline, due to fewer additions of coal, hydro and nuclear power capacity, which more than offset increased investment in solar photovoltaics. |

2018, July, 12, 10:45:00

OPEC: OIL DEMAND UP BY 1.65 MBDOPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East. |

2018, July, 11, 09:25:00

OIL PRICES 2018 - 19: $73 - $69EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level. |

2018, June, 13, 13:10:00

OIL PRICES: 2018 - $71, 2019 - $68EIA - Brent crude oil spot prices averaged $77 per barrel (b) in May, an increase of $5/b from the April level and the highest monthly average price since November 2014. EIA forecasts Brent spot prices will average $71/b in 2018 and $68/b in 2019. The 2019 forecast price is $2/b higher than in the May STEO. EIA expects West Texas Intermediate (WTI) crude oil prices will average almost $7/b lower than Brent prices in 2018 and $6/b lower than Brent prices in 2019 |

2018, June, 8, 13:20:00

OPEC: WORLD OIL DEMAND UP, PRODUCTION DOWNOPEC - World oil demand averaged 97.20 mb/d in 2017, up by 1.7 per cent y-o-y, with the largest increases taking place in Asia and Pacific region (particularly China and India), Europe and North America. The 2017 oil demand in Africa and the Middle East grew by around 100,000 b/d, as compared to 2016, while oil demand declined in Latin America for the third year in a row. |

2018, March, 16, 10:30:00

OIL DEMAND GROWTH - 2018: 1.5 MBDIEA - Looking at demand, our estimate for global growth in 2018 has increased by 90 kb/d taking it up to 1.5 mb/d. Although this is a modest revision, it is interesting that provisional data suggests very strong starts to the year in China and India, which, taken together, accounted for nearly 50% of global demand growth in 2017. Cold weather in some parts of the northern hemisphere in January-February saw an increase in heating demand. |