OIL PRICES 2018 - 19: $72 - $71

EIA - SHORT-TERM ENERGY OUTLOOK

Global liquid fuels

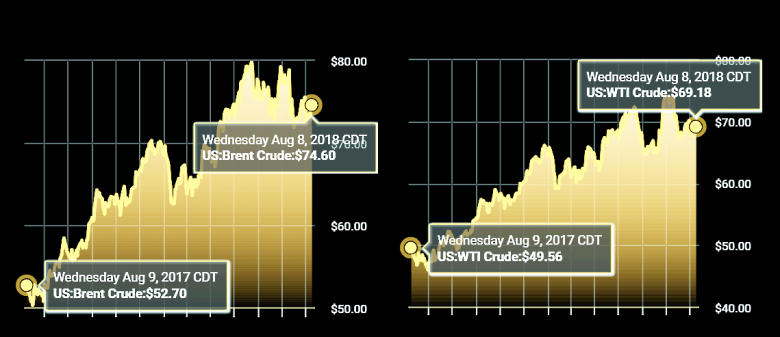

Brent crude oil spot prices averaged $74 per barrel (b) in July, largely unchanged from the average in June. EIA expects Brent spot prices will average $72/b in 2018 and $71/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average about $6/b lower than Brent prices in 2018 and in 2019. NYMEX WTI futures and options contract values for November 2018 delivery that traded during the five-day period ending August 2, 2018, suggest a range of $54/b to $84/b encompasses the market expectation for November WTI prices at the 95% confidence level.

U.S. regular gasoline retail prices averaged $2.85 gallon (gal) in July, down 4 cents/gal from the average in June. EIA expects that 2018 monthly average gasoline prices peaked in May and forecasts prices will remain relatively flat in the coming months, averaging $2.83/gal in September. EIA expects regular gasoline retail prices to average $2.76/gal in 2018 and in 2019.

EIA estimates that U.S. crude oil production averaged 10.8 million barrels per day (b/d) in July, up 47,000 b/d from June. EIA forecasts that U.S. crude oil production will average 10.7 million b/d in 2018, up from 9.4 million b/d in 2017, and will average 11.7 million b/d in 2019.

EIA forecasts total global liquid fuels inventories to decrease by 0.3 million b/d in 2018 compared with 2017, followed by an increase of 0.3 million b/d in 2019. This outlook of relatively stable inventory levels over the forecast period contributes to a forecast of monthly average Brent crude oil prices remaining relatively stable between $70/b and $73/b, from August 2018 through the end of 2019.

Natural Gas

EIA estimates dry natural gas production was 81.8 billion cubic feet per day (Bcf/d) in July, up 0.4 Bcf/d from June. EIA forecasts dry natural gas production will average 81.1 Bcf/d in 2018, up by 7.5 Bcf/d from 2017 and establishing a new record high. EIA expects natural gas production will rise again in 2019 to 84.1 Bcf/d.

EIA forecasts that pipeline exports of natural gas, which averaged 6.7 Bcf/d in 2017, will average 7.0 Bcf/d in 2018 and 8.5 Bcf/d in 2019. Increasing natural gas production in the United States and the completion of new pipelines that carry U.S. natural gas to demand centers in Mexico contribute to the expected increase. In June, two new pipelines in Mexico were placed in service that will distribute natural gas from the United States to destinations in Mexico. In addition, EIA forecasts exports of liquefied natural gas (LNG) rise from 1.9 Bcf/d in 2017 to 3.0 Bcf/d in 2018 and to 5.1 Bcf/d in 2019. This growth contributes to U.S. net exports of natural gas averaging 2.0 Bcf/d in 2018 and 5.4 Bcf/d in 2019, compared with 0.3 Bcf/d in 2017.

EIA expects Henry Hub natural gas spot prices to average $2.96/million British thermal units (MMBtu) in 2018 and $3.10/MMBtu in 2019. NYMEX futures and options contract values for November 2018 delivery that traded during the five-day period ending August 2, 2018, suggest a range of $2.33/MMBtu to $3.48/MMBtu encompasses the market expectation for November Henry Hub natural gas prices at the 95% confidence level.

Elecriticty, coal, renewables, and emissions

EIA expects the share of U.S. total utility-scale electricity generation from natural gas-fired power plants to rise from 32% in 2017 to 34% in 2018 and to 35% in 2019. EIA's forecast electricity generation share from coal averages 28% in 2018 and 27% in 2019, down from 30% in 2017. The nuclear share of generation was 20% in 2017 and is forecast to be 20% in 2018 and then fall to 19% in 2019. Nonhydropower renewables provided slightly less than 10% of electricity generation in 2017 and EIA expects it to provide more than 10% in 2018 and nearly 11% in 2019. The generation share of hydropower was 7% in 2017 and is forecast to be about the same in 2018 and 2019.

In 2017, EIA estimates that wind generation averaged 697,000 megawatthours per day (MWh/d). EIA forecasts that wind generation will rise by 7% to 746,000 MWh/d in 2018 and by 5% in to 782,000 MWh/d in 2019.

Although solar power generates less electricity in the United States than wind power, solar power continues to grow. EIA expects solar generation will rise from 211,000 MWh/d in 2017 to 260,000 MWh/d in 2018 (an increase of 23%) and to 290,000 MWh/d in 2019 (an increase of 12%).

EIA forecasts coal production will decline by 1.1% to 766 million short tons (MMst) in 2018 despite a 5.7% (6 MMst) increase in coal exports. The production decrease is largely attributable to a forecast decline of 2.1% (15 MMst) in domestic coal consumption in 2018. EIA expects coal production to decline by 1.8% (14 MMst) in 2019 because coal exports and coal consumption are both forecast to decrease

After declining by 0.9% in 2017, EIA forecasts that energy-related carbon dioxide (CO2) emissions will rise by 2.0% in 2018. The increase largely reflects higher natural gas consumption because of a colder winter and warmer summer than in 2017. Emissions are forecast to decline by 0.8% in 2019. Energy-related CO2 emissions are sensitive to changes in weather, economic growth, energy prices, and fuel mix.

-----

Earlier:

2018, August, 6, 13:40:00

OIL PRICE: NEAR $74 AGAINREUTERS - Brent crude oil futures were up 31 cents on the day at $73.52 a barrel by 0903 GMT, while U.S. futures rose 35 cents to $68.84 barrel.

|

2018, August, 3, 10:10:00

ЦЕНА URALS: $ 69,43МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – июля 2018 года составила $ 69,43 за баррель. В 2017 году средняя цена на Urals в январе – июле составила $ 49,94 за баррель. Средняя цена на нефть марки Urals в июле 2018 года сложилась в размере $ 72,87 за баррель, что в 1,52 раза выше, чем в июле 2017 года ($ 47,85 за баррель). |

2018, August, 3, 09:55:00

SAUDIS OIL PRICES DOWNBLOOMBERG - Saudi Aramco, as the state-owned company is known, cut pricing for September shipments of all grades to Asia, its largest market. Aramco set the premium for Arab Light crude to Asia at $1.20 a barrel above the Middle East benchmark, it said Thursday in an emailed price list. The reduction of 70 cents for Arab Light was the second consecutive monthly cut for the grade and was 10 cents deeper than the median estimate of five traders in a Bloomberg survey. |

2018, July, 16, 11:00:00

IEA: OIL SUPPLY ISSUESIEA - The re-emergence of Libya as a risk factor in global supply follows a series of attacks on key infrastructure that saw production plummet to around 500 kb/d in July from close to the 1 mb/d level seen for about a year. |

2018, July, 12, 10:45:00

OPEC: OIL DEMAND UP BY 1.65 MBDOPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East. |

2018, July, 11, 09:25:00

OIL PRICES 2018 - 19: $73 - $69EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level. |

2018, June, 15, 11:10:00

BP: GROWTH IN ENERGY DEMAND UPBP - In 2017 global energy demand grew by 2.2%, above its 10-year average of 1.7%. This above-trend growth was driven by stronger economic growth in the developed world and a slight slowing in the pace of improvement in energy intensity. |