PEMEX NET LOSS MXN 163 BLN

PEMEX - Petróleos Mexicanos announced its financial and operating results for the second quarter of 2018, which show a total increase in sales of 36 per cent, compared to the same quarter of the previous year.

Concerning exploration and production activities during the second quarter of 2018, Pemex achieved success in the Manik-101A well, which is part of the Chalabil Project, located in shallow waters off the coast of Tabasco. This discovery is expected to contribute 1,300 barrels of crude oil and 1.3 million cubic feet of gas per day. As of the closing of the second quarter, the company has 37 drills, which translates into a 37 per cent increase compared to the second quarter of the previous year. Crude oil production averaged 1,866 thousand barrels a day during this quarter.

On the 7th of May, through Pemex Exploración y Producción (Pemex Exploration and Production), Pemex signed the four deep-water contracts that were awarded in Round 2.4 (2 as part of a consortium and 2 individually); later, on the 27th of June, the company signed an additional 7 shallow-water contracts awarded in Round 3.1 (6 in a consortium and one individually).

It is important to point out that during this quarter, the efficiency of natural gas use increased from 95.9 to 96.7 %, compared with the same quarter of the previous year. This marks a reduction in gas flares, which is aligned with Pemex's commitment towards environmental sustainability.

Regarding Transformación Industrial (Pemex Industrial Transformation), on the 3rd of May, Pemex signed a marketing contract for diesel and gasoline with one of its largest clients, who holds over 200 service stations throughout central Mexico. As of the month of June 2018, Pemex has undersigned 172 new marketing contracts with its gasoline and diesel clients, including independent service stations and large commercial corporations, which number over 2,200 service stations throughout the country. Petróleos Mexicanos reaffirms the trust and commitment it has placed in its commercial partners and continues to assure the supply of Pemex brand fuel in these service stations.

In connection with the adherence to its Occupational Health and Safety and Environmental Protection Program (initials in Spanish, SSPA), the accident frequency index fell to 0.33 injuries per million man-hours during the second quarter, so the company achieved the goal of zero accidents during this period. On the other hand, the Pemex severity index was reduced by 11 workdays lost per million man-hours, i.e., the days of work lost because of occupational accidents were reduced by 10 days compared to the second quarter of 2017. Furthermore, sulfur oxide emissions were 20% lower than during the second quarter of the previous year.

As a result from these operations, Pemex achieved total sales for 254 billion pesos in the second quarter of 2018, a figure 36% higher than the result obtained during the same quarter of the previous year. Operating yields were 120 billion pesos, a growth almost 37% greater than the second quarter of 2017. Operation, management, distribution and sales costs remained stable and aligned with the current austerity and expenditure policies.

Considering the depreciation of the peso against the dollar during the second quarter of 2018, the currency exchange losses and net financial costs increased, the impact of which was largely limited to accounting and did not carry any large cash operations, and led to a negative net result of 163 billion pesos. This result may be reversed if the appreciation of the peso against the dollar that was observed in July remains over the following months.

During the first quarter of 2018, Pemex maintained an adequate capacity for the generation of cash flow with an EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) of 288 billion pesos, 14% greater than the EBITDA obtained during the first semester of 2017. The EBITDA of the first semester of 2018 is 35%.

Pemex continues implementing its Business Plan for 2017-2021, continually seeking to improve its competitiveness and value generation.

-----

Earlier:

2017, October, 30, 11:10:00

PEMEX PRODUCTION DOWN 18%Reuters - Mexican national oil company Pemex reported on Friday that September crude production fell 18 percent from the same month last year, marking three consecutive months with oil output coming in below 2 million barrels per day.

|

2016, November, 23, 18:35:00

IMF WANTS PEMEXA particularly important aspect of this consolidation pertains to reforms in PEMEX, the state-owned oil company. Earlier this month, PEMEX released a five-year business plan that aims at turning the company profitable by 2020, through efficiency improvements and a focus on high-return activities.

|

2016, November, 7, 18:40:00

MEXICO'S POTENTIAL: $415 BLNAfter a decade of volatile GDP growth and steadily increasing gas and power demand, Mexico continues to progress toward an unbundling of the monopolies Pemex and CFE once held over its gas and power sectors. According to a recent study by Wood Mackenzie, these reforms have created the potential for approximately US$415 billion in investment over the next two decades as the country builds pipelines, develops a renewables market to meet clean energy targets, and sets the stage for M&A.

|

2016, October, 4, 18:30:00

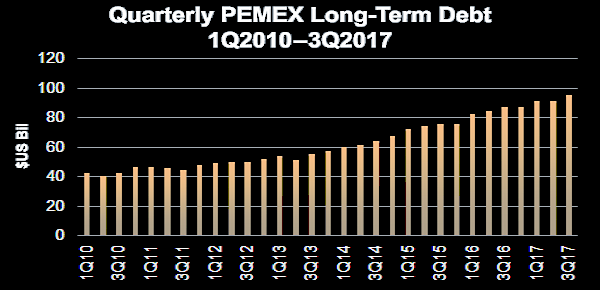

PEMEX DEBT UPThe two bonds, valued at USD 2 billion each and issued in a financial operation that started early in September, will carry maturities of seven and close to 31 years. They pay yields of 4.62% and 6.75%, respectively, according to Pemex CFO Juan Pablo Newman. Now with greater maturity, Pemex’s repurchased debt, which was due to mature in 2018 and 2019, has reduced the risks of the company’s debt portfolio.

|

2016, July, 29, 18:30:00

PEMEX NET LOSS $7.7 BLNMexican state oil company Petróleos Mexicanos on Thursday said it recorded an after-tax loss of $4.4 billion in the second quarter, as lower oil prices and output hit sales and hefty exchange losses boosted its financial costs. |

2016, April, 5, 18:25:00

MEXICO'S RESERVES DOWN 21%Mexico's proven oil and gas reserves dropped 21.3 percent in 2015, the oil regulator said on Thursday, as the state-run oil company, Pemex, cut back on investment because of plunging crude prices.

|

2015, December, 11, 19:30:00

PEMEX WILL SPEND $23 BLNThe $23 billion in downstream projects would enable a 7 million-tonne/year reduction in the Mexico’s carbon dioxide emissions. |