SAUDI ARAMCO NEW CONTRACT

FT - Saudi Arabia has cut the length of time that its state energy company has exclusive rights to the kingdom’s vast oil and gasfields, raising questions about Saudi Aramco’s long-term production and revealing a power struggle between the company and the government.

Saudi Aramco's concession agreement with the state has limited the amount of time in which the group can explore and develop resources to 40 years — from a previous contract that gave it access in perpetuity. There will be an option to renew the contract.

The move, three people briefed on the matter said, came as part of the kingdom's preparations for a stock market flotation of Saudi Aramco, which has been indefinitely delayed.

Energy minister Khalid al Falih, chairman of Saudi Aramco and former chief executive of the company, has insisted the kingdom is committed to a listing, despite mounting signs that the country is unable or unwilling to execute the flotation.

Mr Falih said last week that a new concession contract had been agreed as part of the initial public offering process, which also included overhauling Saudi Aramco's financial reporting and undertaking an independent audit of its energy reserves, without disclosing terms.

The Saudi energy ministry told the FT that the new contract was "one of several important steps undertaken to prepare Saudi Aramco for being listed", adding that the government was committed to "proceeding with the IPO, when conditions are optimum, at a time of its choosing".

The legal change sought to formalise the relationship between Saudi Aramco and the state, ahead of opening up the company to potential foreign investors, the three people said. It also suggested that the ambitions for a listing were for a sale of more than 5 per cent of the company.

With the listing halted, those close to the company said it had been a pointless exercise that had only served to exert ministerial control over Saudi Aramco, which had fought to keep its rare evergreen contract.

The government initially pushed for an even shorter contract — more in line with international oil companies that have 20-year agreements. But this would have had ramifications for what the company could declare as its reserves, long-term development plans and its valuation.

Some energy sector experts have asked if the concession agreement could prompt Saudi Aramco to produce oil at a faster rate. Others have suggested it could signal a move by the government to alter its output policy, with the industry expecting demand for crude to peak in the coming decades.

"Often for oil companies, the shorter the concession, the sooner you must produce the resources," said John Lee, professor at Texas A&M University. "It has always been a huge advantage to have a concession without any expiry."

However, a 40-year concession is still longer than most energy sector contracts and, with Saudi Aramco the country's main revenue generator, there is no sign yet it would not be renewed.

People close to Saudi Arabia's energy minister said that output policy should remain unaffected. They added that the kingdom, as the ultimate shareholder, already had the power to dictate big changes in energy strategy without the legal change, which they said was a procedural matter.

-----

Earlier:

2018, August, 24, 11:25:00

SAUDI ARAMCO IPOARAB NEWS - The Government remains committed to the IPO of Saudi Aramco at a time of its own choosing when conditions are optimum. This timing will depend on multiple factors, including favorable market conditions, and a downstream acquisition which the Company will pursue in the next few months, as directed by its Board of Directors. |

2018, August, 20, 14:15:00

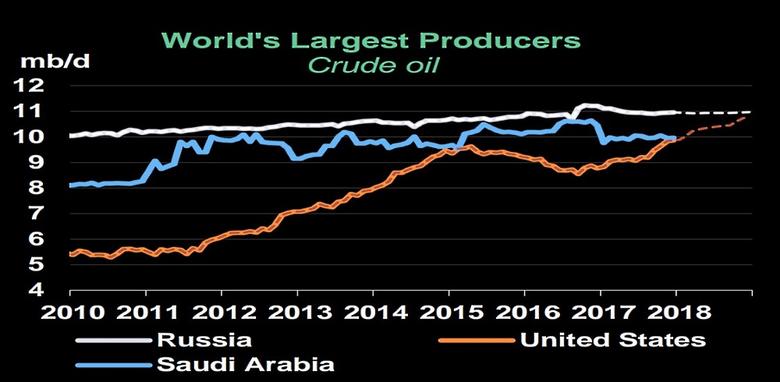

SAUDI ARAMCO: THE GLOBAL LEADERSAUDI ARAMCO - 2017 highlights: Produced an average of 10.2 million barrels per day of crude oil including condensate Increased amount of natural gas supplied for fourth straight year, to an average of 8.7 billion standard cubic feet per day Crude oil exports averaged 6.9 million barrels per day |

2018, July, 25, 09:20:00

SAUDI ARABIA'S PROGRESSIMF - Real GDP growth is expected to increase to 1.9 percent in 2018, with non-oil growth strengthening to 2.3 percent. Growth is expected to pick-up further over the medium-term as the reforms take hold and oil output increases. Risks are balanced in the near-term. The employment of Saudi nationals has increased, especially for women, but the unemployment rate among Saudi nationals rose to 12.8 percent in 2017. |

2018, June, 29, 10:00:00

NOV - ARAMCO COOPERATIONNOV - National Oilwell Varco, Inc. (NYSE: NOV) today announced the signing of an agreement with Saudi Aramco to form a joint venture in the Kingdom of Saudi Arabia. Through its state-of-the-art manufacturing and fabrication facilities in the Kingdom and NOV’s market-leading drilling technologies, the joint venture will provide high-specification land rigs, rig and drilling equipment and offer certain aftermarket services. |

2018, June, 22, 13:25:00

RUSSIA - SAUDIS SUPER OPECBLOOMBERG - Russian Oil Minister Alexander Novak said in a speech yesterday that “we need to build upon our successful cooperation model and institutionalize its success through a broader and more permanent strategically focused framework.” His Saudi counterpart Khalid Al-Falih echoed those comments. |

2018, June, 15, 11:00:00

SAUDI ARAMCO INVESTMENTS WILL UPREUTERS - Saudi Aramco plans to boost investments in refining and petrochemicals to secure new markets for its crude, and sees growth in chemicals as central to its downstream strategy to lessen the risk of a slowdown in oil demand. |

2018, May, 8, 10:45:00

SAUDIS DEFICIT $9.15 BLNREUTERS - Saudi Arabia’s first quarter budget deficit stood at 34.3 billion Saudi riyals ($9.15 billion), around 18 percent of the total gap forecast for 2018, the finance ministry said |