SAUDIS OIL PRICES DOWN

ЦЕНТРАЛЬНЫЙ БАНК РОССИИ - Банк России принял решение сохранить ключевую ставку на уровне 7,25% годовых

Совет директоров Банка России 27 июля 2018 года принял решение сохранить ключевую ставку на уровне 7,25% годовых. Хотя годовая инфляция остается ниже цели, формируется тенденция ее возвращения к 4%. Банк России прогнозирует годовые темпы роста потребительских цен в 3,5–4% в конце 2018 года и временное превышение годовой инфляцией 4% в 2019 году в связи с запланированным увеличением налога на добавленную стоимость. Годовые темпы роста потребительских цен вернутся к 4% в начале 2020 года.

Баланс рисков смещен в сторону проинфляционных рисков. Сохраняется неопределенность относительно степени влияния налоговых мер на инфляционные ожидания, а также неопределенность развития внешних условий. Банк России будет принимать решения по ключевой ставке, оценивая инфляционные риски, динамику инфляции и развитие экономики относительно прогноза. Банк России считает наиболее вероятным переход к нейтральной денежно-кредитной политике в 2019 году.

Динамика инфляции. Годовая инфляция сохраняется на низком уровне. В июне она составила 2,3%, в июле — ожидается в интервале 2,5–2,6%, что соответствует прогнозу Банка России. Большинство показателей годовой инфляции, характеризующих наиболее устойчивые процессы ценовой динамики, по оценке Банка России, отражают постепенное возвращение инфляции к цели.

Динамика инфляции по основным товарным группам потребительской корзины в июне оставалась неоднородной. Годовой темп прироста цен на продовольственном рынке сложился вблизи нуля. Цены на овощи и фрукты снизились, в том числе из-за эффекта высокой базы прошлого года. При этом годовая инфляция по другим видам продовольственных товаров возросла (с 0,8% в мае до 1,1% в июне). Годовой темп прироста цен на непродовольственном рынке увеличился до 3,7% (после 3,4% в мае). Основной вклад внес рост цен на нефтепродукты. Динамика цен на бензин, в свою очередь, отразилась на инфляционных ожиданиях, увеличение которых продолжилось в июне. Оперативные данные в июле отражают прекращение роста цен на бензин, чему способствовало принятое решение о снижении акцизов на нефтепродукты. В этих условиях инфляционные ожидания населения в июле стабилизировались. Годовой темп прироста цен на услуги оставался в июне вблизи 4%.

Банк России прогнозирует годовую инфляцию в 3,5–4% в конце 2018 года и временное превышение инфляцией 4% в 2019 году в связи с запланированным увеличением налога на добавленную стоимость. Это повышение будет иметь разовый эффект на цены, поэтому годовые темпы роста потребительских цен вернутся к 4% в начале 2020 года.

Денежно-кредитные условия близки к нейтральным. По оценкам Банка России, они уже практически не оказывают сдерживающего влияния на динамику кредита, спроса и инфляции. Денежно-кредитные условия формируются в том числе под воздействием ранее принятых решений о снижении ключевой ставки. Депозиты остаются привлекательными для населения при текущем уровне процентных ставок. Консервативный подход банков к отбору заемщиков, а также изменение с 1 сентября 2018 года коэффициентов риска по необеспеченным потребительским кредитам формируют условия для роста кредита, не создающего риски для ценовой и финансовой стабильности.

С учетом влияния запланированных налогово-бюджетных мер на инфляцию и инфляционные ожидания потребуется некоторая степень жесткости денежно-кредитных условий, чтобы ограничить масштаб вторичных эффектов и стабилизировать годовую инфляцию вблизи 4% на прогнозном горизонте.

Экономическая активность. Обновленные данные Росстата отражают более уверенный рост экономики в 2017 — начале 2018 года, чем оценивалось ранее. Это существенно не меняет взгляд Банка России на влияние деловой активности на динамику инфляции, учитывая, что пересмотр данных в основном касается производства инвестиционных товаров. Проведение чемпионата мира по футболу внесло положительный вклад (0,1–0,2 п.п.) в годовой темп прироста ВВП в II квартале.

Банк России прогнозирует темп экономического роста в 2018 году в интервале 1,5–2%, что соответствует потенциальному росту российской экономики в условиях сохраняющихся структурных ограничений.

Инфляционные риски. Баланс рисков смещен в сторону проинфляционных рисков. Основные риски связаны с высокой неопределенностью относительно масштаба вторичных эффектов принятых налоговых решений (в первую очередь со стороны реакции инфляционных ожиданий), а также с внешними факторами.

В части внешних условий ускоренный рост доходностей на развитых рынках и геополитические факторы могут приводить к всплескам волатильности на финансовых рынках и оказывать влияние на курсовые и инфляционные ожидания.

Оценка Банком России рисков, связанных с волатильностью продовольственных и нефтяных цен, динамикой заработных плат, возможными изменениями в потребительском поведении, существенно не изменилась. Эти риски остаются умеренными.

Банк России будет принимать решения по ключевой ставке, оценивая инфляционные риски, динамику инфляции и развитие экономики относительно прогноза. Банк России считает наиболее вероятным переход к нейтральной денежно-кредитной политике в 2019 году.

Следующее заседание Совета директоров Банка России, на котором будет рассматриваться вопрос об уровне ключевой ставки, запланировано на 14 сентября 2018 года. Время публикации пресс-релиза о решении Совета директоров Банка России — 13:30 по московскому времени.

-----

Раньше:

2018, March, 28, 10:45:00

ЦБРФ - Совет директоров Банка России 23 марта 2018 года принял решение снизить ключевую ставку на 25 б.п., до 7,25% годовых. Годовая инфляция остается на устойчиво низком уровне. Инфляционные ожидания постепенно снижаются. По прогнозу Банка России, годовая инфляция составит 3–4% в конце 2018 года и будет находиться вблизи 4% в 2019 году. В этих условиях Банк России продолжит снижение ключевой ставки и завершит переход к нейтральной денежно-кредитной политике в 2018 году.

|

2017, August, 3, 12:45:00

Годовой темп прироста инвестиций в основной капитал во II квартале 2017 года, по оценке Банка России, ускорился до 3,5–4,5%. В III квартале прирост инвестиций сохранится на достаточно высоком уровне – 2,5–4%.

|

2017, August, 3, 12:40:00

Банк России принял решение сохранить ключевую ставку на уровне 9,00% годовых.

|

2016, November, 30, 18:50:00

Ожидаемая бюджетная консолидация и сдержанный характер восстановления экономики создают условия для возобновления в должное время центральным банком более мягкой денежно-кредитной политики, которая согласуется с целевым показателем инфляции в размере 4 процента. Однако темпы смягчения политики должны учитывать наличие внешних рисков и необходимость укрепления доверия в условиях недавно введенного режима таргетирования инфляции.

|

| |

| |

| |

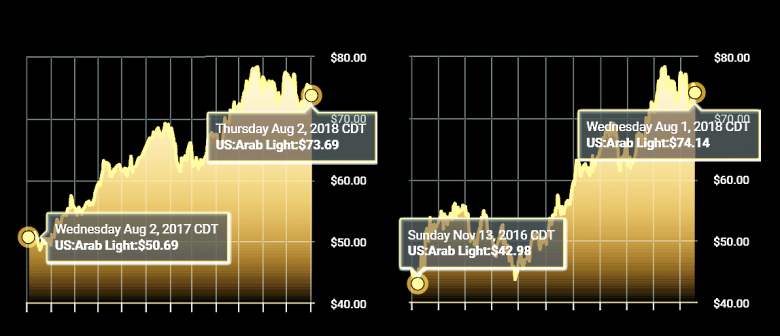

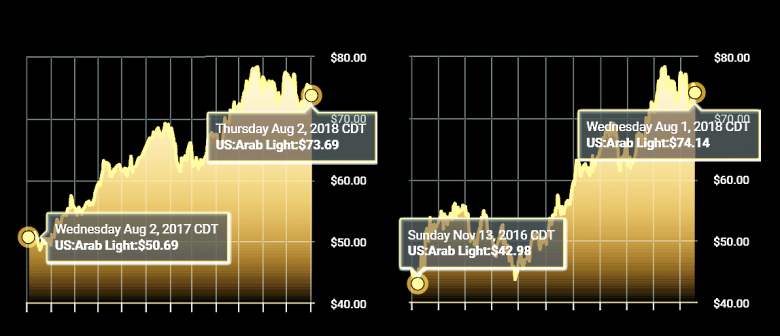

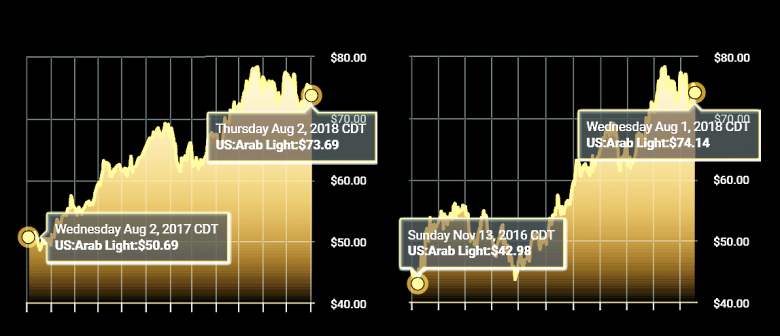

SAUDIS OIL PRICES DOWN

BLOOMBERG - Saudi Arabian Oil Co. reduced monthly pricing to most markets as the world's biggest oil exporter boosts supply to meet customer demand.

Saudi Aramco, as the state-owned company is known, cut pricing for September shipments of all grades to Asia, its largest market. Aramco set the premium for Arab Light crude to Asia at $1.20 a barrel above the Middle East benchmark, it said Thursday in an emailed price list. The reduction of 70 cents for Arab Light was the second consecutive monthly cut for the grade and was 10 cents deeper than the median estimate of five traders in a Bloomberg survey.

The Organization of Petroleum Exporting Countries boosted output in July, led by near-record production from Saudi Arabia, while Russia pumped at levels not seen since it joined the group's effort last year to make coordinated global cuts. OPEC and its partners agreed in June to increase production, with the Saudi and Russian energy ministers saying it would add about 1 million barrels a day to the market.

Aramco also cut September pricing for all grades to Northwest Europe and the Mediterranean. It raised all pricing to the U.S. Benchmark Brent crude fell 39 cents to $72 a barrel at 1:30 p.m. in London.

Middle Eastern producers compete with cargoes from Latin America, North Africa, Russia and increasingly the U.S. for buyers in Asia. Companies in the Persian Gulf region sell mostly under long-term contracts to refiners. Most of the Gulf's state oil producers price their crude at a premium or discount to a benchmark. For Asia, the benchmark is the average of Oman and Dubai oil grades.

By setting its official selling prices, or OSPs, either higher or lower from month to month, Aramco signals how strong or weak it views demand globally. Cutting prices can be seen as an indication that a country wants to supply more crude. The Saudi pricing is the first of the monthly releases by state oil companies in the region and most producers usually follow the kingdom's lead.

-----

Earlier:

2018, July, 25, 09:20:00

IMF - Real GDP growth is expected to increase to 1.9 percent in 2018, with non-oil growth strengthening to 2.3 percent. Growth is expected to pick-up further over the medium-term as the reforms take hold and oil output increases. Risks are balanced in the near-term. The employment of Saudi nationals has increased, especially for women, but the unemployment rate among Saudi nationals rose to 12.8 percent in 2017.

|

2018, July, 12, 10:45:00

OPEC - In 2018, oil demand is expected to grow by 1.65 mb/d, unchanged from the previous month’s assessment, with expectations for total world consumption at 98.85 mb/d. In 2019, the initial projection indicates a global increase of around 1.45 mb/d, with annual average global consumption anticipated to surpass the 100 mb/d threshold. The OECD is once again expected to remain in positive territory, registering a rise of 0.27 mb/d with the bulk of gains originating in OECD America. The non-OECD region is anticipated to lead oil demand growth in 2019 with initial projections indicating an increase of around 1.18 mb/d, most of which is attributed to China and India. Additionally, a steady acceleration in oil demand growth is projected in Latin America and the Middle East.

|

2018, July, 11, 09:25:00

EIA - Brent crude oil spot prices averaged $74 per barrel (b) in June, a decrease of almost $3/b from the May average. EIA forecasts Brent spot prices will average $73/b in the second half of 2018 and will average $69/b in 2019. EIA expects West Texas Intermediate (WTI) crude oil prices will average $6/b lower than Brent prices in the second half of 2018 and $7/b lower in 2019. NYMEX WTI futures and options contract values for October 2018 delivery that traded during the five-day period ending July 5, 2018, suggest a range of $56/b to $87/b encompasses the market expectation for October WTI prices at the 95% confidence level.

|

2018, July, 4, 12:20:00

BLOOMBERG - Saudi Arabia and Russia reaffirmed an agreement between OPEC and its allies, which they say will mean increasing oil production by 1 million barrels a day.

|

2018, June, 18, 14:25:00

МИНЭНЕРГО РОССИИ - Стороны также договорились работать совместно со всеми подписантами «декларации о кооперации» от декабря 2016 для создания долгосрочной структуры для взаимодействия на основе декларации, а также пригласить к взаимодействию прочих крупных производителей нефти.

|

2018, May, 28, 11:35:00

МИНЭНЕРГО - Глава Минэнерго России отметил, что цена на нефть сегодня близка к 80 долларам, а год назад она была 51,5 долларов. «Год назад мы наблюдали только начало балансировки рынка, сегодня мы вышли на позитивные изменения по сравнению с прошлым годом. Сделка ОПЕК+ показала положительный результат. Цели, которые ставились, достигаются», - сообщил Александр Новак.

|

2018, May, 10, 13:10:00

PLATTS - Saudi Arabia's energy minister Khalid al-Falih said Wednesday that the country would work closely with OPEC as well as non-OPEC producers to mitigate the impact of any shortages that might arise following the US' decision to withdraw from the Iran nuclear deal.

|

| |