U.S. INVESTMENT UP $427.3 BLN/ $260.4 BLN

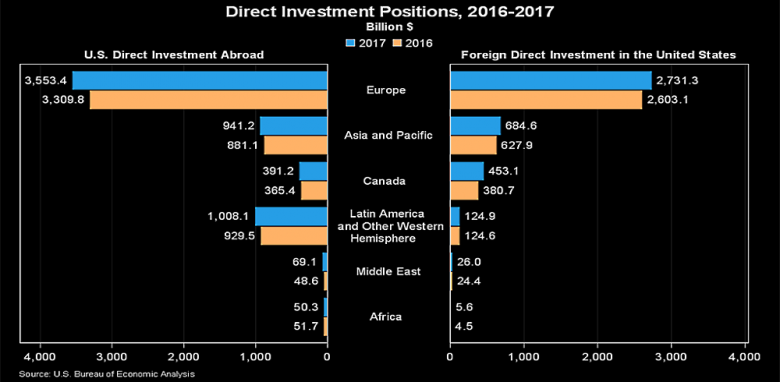

U.S. BEA - The U.S. direct investment abroad position, or cumulative level of investment, increased $427.3 billion to $6,013.3 billion at the end of 2017 from $5,586.0 billion at the end of 2016, according to statistics released by the Bureau of Economic Analysis (BEA). The increase mainly reflected a $243.6 billion increase in the position in Europe, primarily in Switzerland, the United Kingdom, Ireland, and the Netherlands. By industry, affiliates in manufacturing and holding companies accounted for the largest increases.

The foreign direct investment in the United States position increased $260.4 billion to $4,025.5 billion at the end of 2017 from $3,765.1 billion at the end of 2016. The increase mainly reflected a $128.2 billion increase in the position from Europe, primarily Ireland, Switzerland, and the Netherlands. By industry, affiliates in manufacturing and wholesale trade accounted for the largest increases.

The increase in the U.S. direct investment position abroad in 2017 mainly reflected financial transactions of $300.4 billion, primarily reinvestment of earnings. The increase in the foreign direct investment position in the United States in 2017 mainly reflected financial transactions of $277.3 billion, primarily equity investment other than reinvestment of earnings.

U.S. direct investment abroad

U.S. multinational enterprises (MNEs) invest in nearly every country, but their investment in foreign affiliates in five countries accounted for more than half of the total position at the end of 2017. The U.S. direct investment abroad position was largest in the Netherlands at $936.7 billion, followed by the United Kingdom ($747.6 billion), Luxembourg ($676.4 billion), Ireland ($446.4 billion), and Canada ($391.2 billion).

By industry of the immediate foreign affiliate, investment was highly concentrated in holding companies, which accounted for nearly half of the position in 2017. By industry of the U.S. parent, investment by manufacturing MNEs accounted for 55.6 percent of the position, followed by MNEs in finance and insurance (12.4 percent).

U.S. MNEs earned income of $470.9 billion on their investment abroad in 2017.

Foreign direct investment in the United States

By country of the immediate foreign parent, five countries accounted for more than half of the total position at the end of 2017. The United Kingdom was the top investing country with a position of $540.9 billion, followed by Japan ($469.0 billion), Canada ($453.1 billion), Luxembourg ($410.7 billion), and the Netherlands ($367.1 billion).

By country of the ultimate beneficial owner (UBO), the top five countries in terms of position were the United Kingdom ($614.9 billion), Canada ($523.8 billion), Japan ($476.9 billion), Germany ($405.6 billion), and Ireland ($328.7 billion). On this basis, investment from the Netherlands and Luxembourg was much lower than by country of foreign parent, indicating that much of the investment from these countries was ultimately owned by investors in other countries.

Foreign direct investment in the United States was concentrated in the U.S. manufacturing sector, which accounted for 39.9 percent of the position. There was also sizable investment in finance and insurance (13.4 percent).

Foreign MNEs earned income of $173.8 billion on their investment in the United States in 2017.

-----

Earlier:

2018, July, 30, 13:35:00

U.S. GDP UP 4.1%U.S. BEA - Real gross domestic product increased at an annual rate of 4.1 percent in the second quarter of 2018 , according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 2.2 percent. |

2018, July, 27, 12:50:00

U.S. OIL INVESTMENT UP, DEBT DOWNEIA - Capital expenditures for these 46 companies totaled almost $19 billion in the first quarter of 2018, a year-over-year increase of nearly $2 billion (10%). Most of these companies have announced that they expect to increase full-year 2018 capital expenditures from 2017 levels. |

2018, July, 23, 13:20:00

U.S. INDUSTRIAL PRODUCTION UP 0.6%U.S. FRB - Industrial production rose 0.6 percent in June after declining 0.5 percent in May. For the second quarter as a whole, industrial production advanced at an annual rate of 6.0 percent, its third consecutive quarterly increase. Manufacturing output moved up 0.8 percent in June. |

2018, July, 23, 13:15:00

U.S. INVESTMENT $69.9 BLNU.S. DT - The sum total in May of all net foreign acquisitions of long-term securities, short-term U.S. securities, and banking flows was a net TIC inflow of $69.9 billion. Of this, net foreign private inflows were $58.8 billion, and net foreign official inflows were $11.1 billion. |

2018, July, 12, 10:30:00

U.S. FOREIGN DIRECT INVESTMENT: $259.6 BLNU.S. BEA - Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $259.6 billion (preliminary) in 2017. Expenditures were down 32 percent from $379.7 billion (revised) in 2016 and were below the annual average of $359.9 billion for 2014-2016. As in previous years, acquisitions of existing businesses accounted for a large majority of total expenditures. |

2018, July, 9, 15:10:00

U.S. DEFICIT DOWN $3 BLN TO $43.1 BLNU.S. BEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $43.1 billion in May, down $3.0 billion from $46.1 billion in April,

|

2018, July, 4, 12:10:00

U.S. ECONOMY UP AGAINIMF - The near-term outlook for the U.S. economy is one of strong growth and job creation. Unemployment is near levels not seen in 50 years, and growth is set to accelerate, aided by a fiscal stimulus, a recovery of private investment, and supportive financial conditions. These positive outturns have supported, and been reinforced by, a favorable external environment. The balance of evidence suggests that the U.S. economy is beyond full employment. |